Cocoa Elliott Wave Analysis - 1 March 24

Cocoa Elliott Wave Technical Analysis

Function - Trend

Mode - Impulsive

Structure - Impulse Wave

Position - Blue wave ‘iv’ unfolds

Direction - Blue wave ‘iv’ in progress

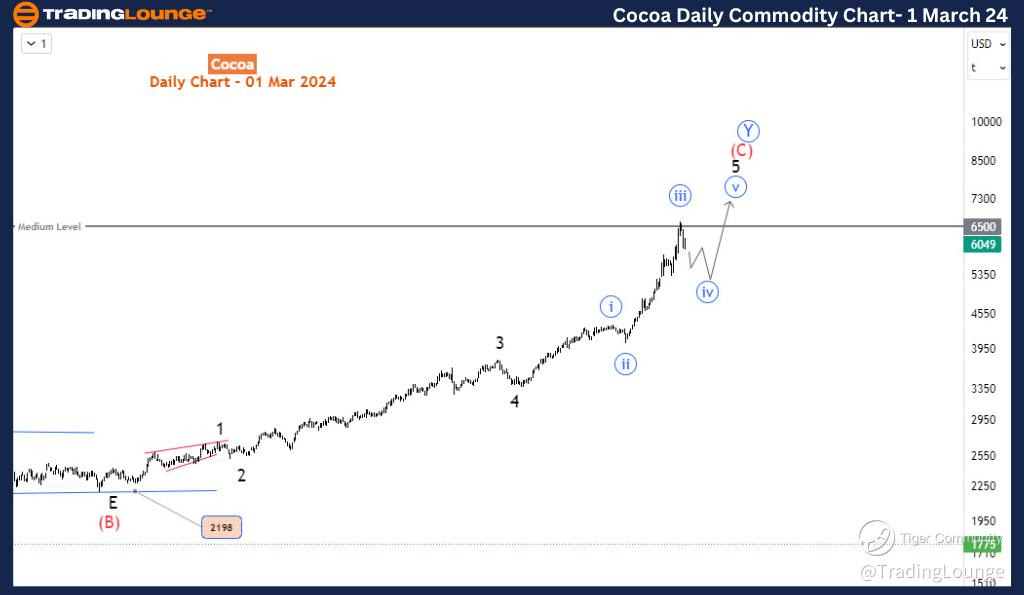

Cocoa has been a standout performer in the commodity market over the past two years, exhibiting a robust upward trend since September 2022. During this period, Cocoa prices have surged by an impressive 170%, following a discernible impulse wave pattern.

Cocoa Day Chart Analysis

Examining the daily chart, it is evident that the current rally, which commenced around the 2200 mark, is approaching its final stages. The completion of black wave 5 marked the conclusion of blue sub-wave iii at 6500. The recent downward movement indicates the emergence of blue sub-wave iv. Based on projections, blue sub-wave iv of 5 is anticipated to progress towards the significant level of 8000.

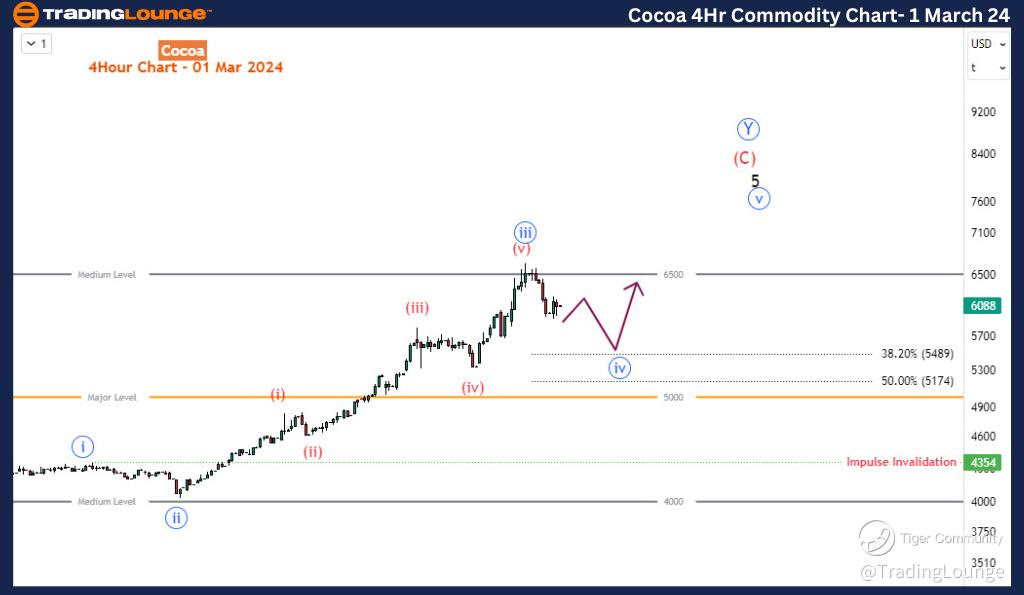

Cocoa 4-Hour Chart Analysis

A closer inspection of the sub-waves within blue wave iv reveals a potential three-wave decline, as depicted on the H4 chart. This decline from 6500 is forecasted to retrace towards the Fibonacci levels of 5489-5174. Additionally, the critical trading level of 5000 serves as another pivotal area to monitor for potential support should the ongoing dip breach the aforementioned Fibonacci zone. However, it's essential to note that the development of the wave 5 impulse pattern would be invalidated if prices were to fall below 4354.

In summary, adopting a strategy of buying into the dip appears to be the most prudent approach for traders interested in Cocoa. The focus will be on purchasing opportunities towards the end of blue wave iv of 5, particularly if there's a bullish reaction observed at the identified price support levels.

This analysis underscores the potential opportunities within Cocoa's current price movement and provides a framework for traders to navigate the market effectively. By incorporating Elliott Wave principles, traders can better understand the underlying market dynamics and make informed decisions to capitalize on future price movements in Cocoa.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Gold (XAUUSD)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.