BRAMBLES LIMITED - BXB Elliott Wave Technical Analysis TradingLounge

Greetings!

Today's Elliott Wave analysis focuses on BRAMBLES LIMITED (ASX:BXB), traded on the Australian Stock Exchange. Based on our assessment, ASX:BXB may be gearing up for a potential upward move with a ((3))-navy wave in progress.

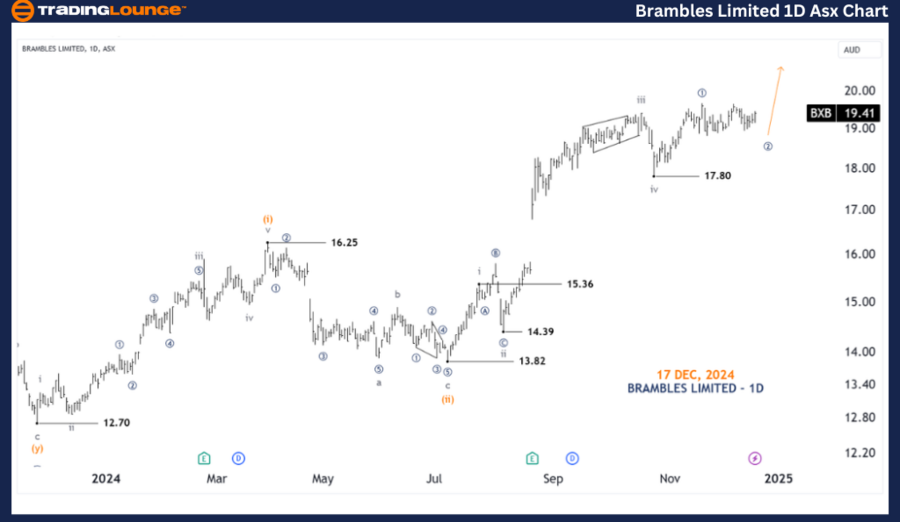

BRAMBLES LIMITED - BXB 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minuette Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((2))-navy of Wave v-grey

Details:

- The v-grey wave appears to be extending.

- It is currently near completion of the ((2))-navy wave.

- Once completed, the ((3))-navy wave could initiate a strong upward move.

Invalidation Point: 17.80

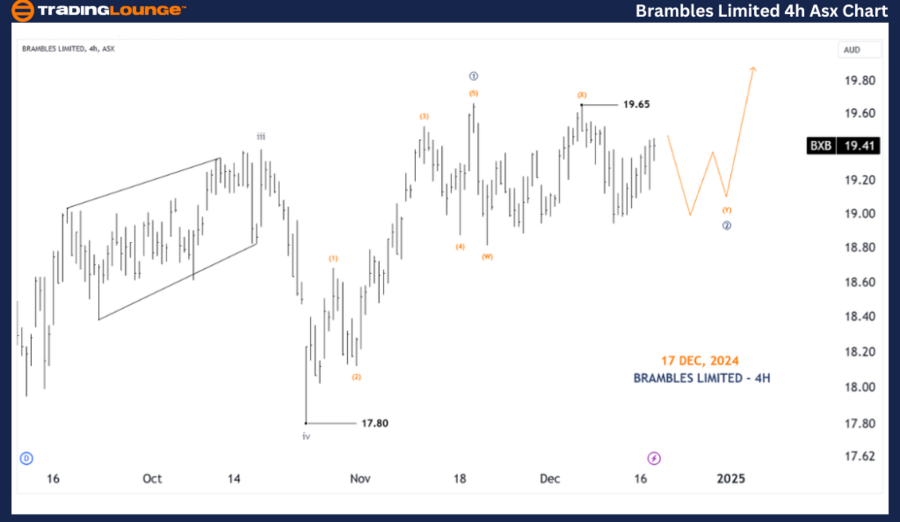

BRAMBLES LIMITED - BXB 4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave (y)-orange of Wave ((2))-navy

Details:

- The ((1))-navy wave of the v-grey sequence has completed.

- The ongoing ((2))-navy wave is pushing lower and may be developing as a complex Double Three pattern.

- The wave (y)-orange likely requires additional time to finalize.

- A ((3))-navy wave may begin once the price breaks above the 19.65 high, signaling upward momentum.

Key Levels to Watch:

- Invalidation Point: 17.80

- Confirmation Point: 19.65

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX: Aristocrat Leisure Limited - ALL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis offers a clear and structured forecast for BRAMBLES LIMITED - BXB. By identifying specific price points for confirmation (19.65) and invalidation (17.80), we provide actionable insights into the current market trends. This enhances confidence in our wave count and trading outlook.

Our goal is to help traders and investors capitalize on emerging opportunities in BRAMBLES LIMITED while maintaining a professional, objective view of the market.