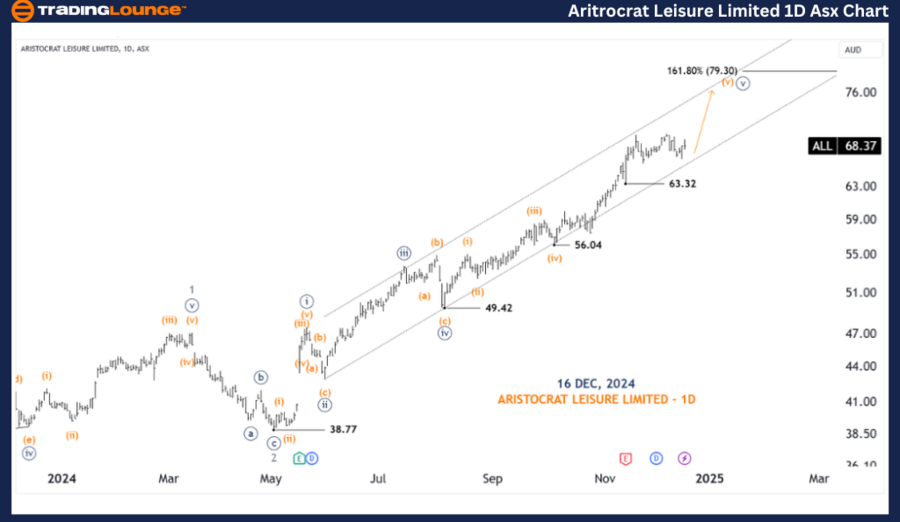

ASX: Aristocrat Leisure Limited (ALL) Elliott Wave Technical Analysis

Greetings! Today's Elliott Wave analysis updates the Australian Stock Exchange (ASX) Aristocrat Leisure Limited – ALL. Based on our insights, ASX:ALL is nearing the completion of a Triangle formation, signaling a potential upward movement in the short term.

ASX: Aristocrat Leisure Limited - ALL 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave (v)-Orange of Wave ((v))-Navy

Details:

- Wave ((v))-Navy is projected to push higher, potentially reaching the upper boundary of the channel.

- The price must stay above 65.92 to maintain this bullish perspective.

- If the price dips below 65.92, it would suggest that Wave 3-Grey has concluded, and Wave 4-Grey is unfolding.

Key Invalidation Point: 65.92

ASX: Aristocrat Leisure Limited - ALL 4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave ((e))-Navy of Wave IV-Grey

Details:

- Wave III-Grey has concluded, and Wave IV-Grey is forming as a Triangle labeled ((a))((b))((c))((d))((e))-Navy.

- The Triangle is likely nearing its completion, suggesting a short-term upward advance with Wave V-Grey.

Key Invalidation Point: 65.92

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: COMMONWEALTH BANK OF AUSTRALIA (CBA) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis provides a structured forecast of trends for ASX: Aristocrat Leisure Limited (ALL). By identifying specific price levels as validation or invalidation points, we aim to increase confidence in our perspective and help readers capitalize on actionable insights. Our analysis incorporates both contextual and short-term market trends, delivering a professional and objective outlook.