ASX: COMMONWEALTH BANK OF AUSTRALIA (CBA) Elliott Wave Technical Analysis

Welcome to today's Elliott Wave analysis update on the Australian Stock Exchange (ASX) featuring the COMMONWEALTH BANK OF AUSTRALIA (CBA). Based on our observations, ASX:CBA appears poised for an upward move with a ((v))-navy wave in focus.

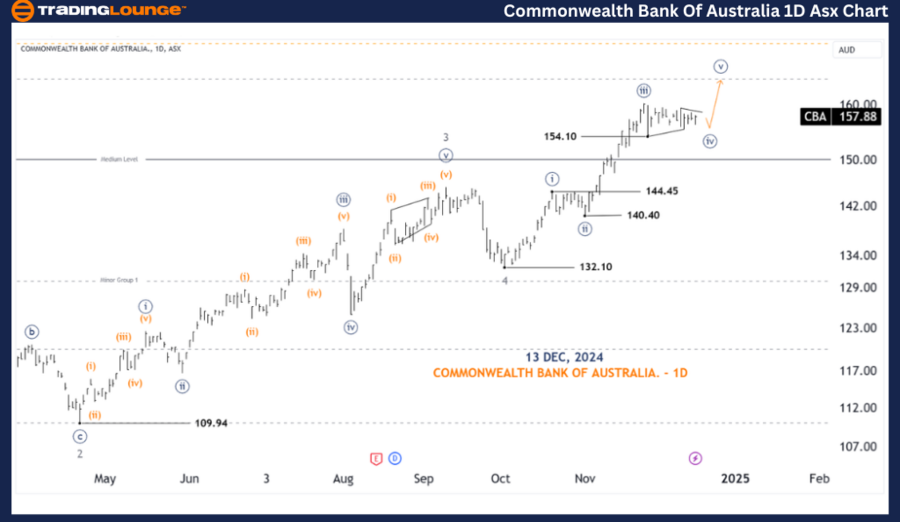

ASX: COMMONWEALTH BANK OF AUSTRALIA (CBA) 1D Chart (Semilog Scale) Analysis

Function: Major Trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iv))-navy of Wave 5-grey

Analysis Details:

Wave ((iv))-navy is progressing as a triangle formation nearing completion. Once finalized, Wave ((v))-navy is projected to push higher, targeting a peak near the 165.00 level.

- Invalidation Point: 154.10

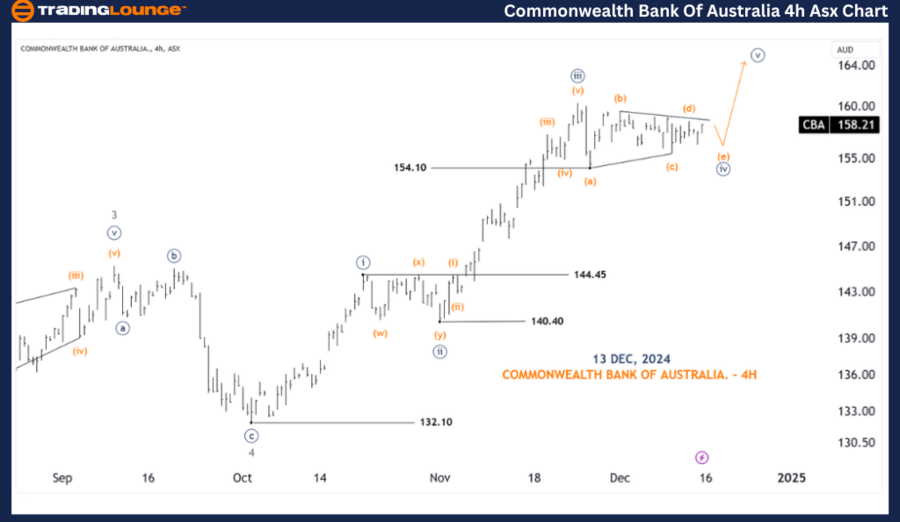

ASX: COMMONWEALTH BANK OF AUSTRALIA (CBA) 4-Hour Chart Analysis

Function: Major Trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((iv))-navy

Analysis Details:

Wave ((iii))-navy has concluded, and Wave ((iv))-navy is unfolding as a triangle. The wave exhibits horizontal narrowing and lengthening characteristics, suggesting that additional time may be required before completion. Post-completion, Wave ((v))-navy is expected to extend upward. Price must hold above the invalidation point of 154.10 to maintain this bullish outlook.

- Invalidation Point: 154.10

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: ASX LIMITED – ASX Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: COMMONWEALTH BANK OF AUSTRALIA (CBA) highlights the importance of current market trends and offers actionable insights. The analysis identifies key price levels serving as validation or invalidation markers to solidify confidence in our wave count. By leveraging this detailed technical outlook, traders and investors can make more informed decisions to capitalize on potential market movements effectively.