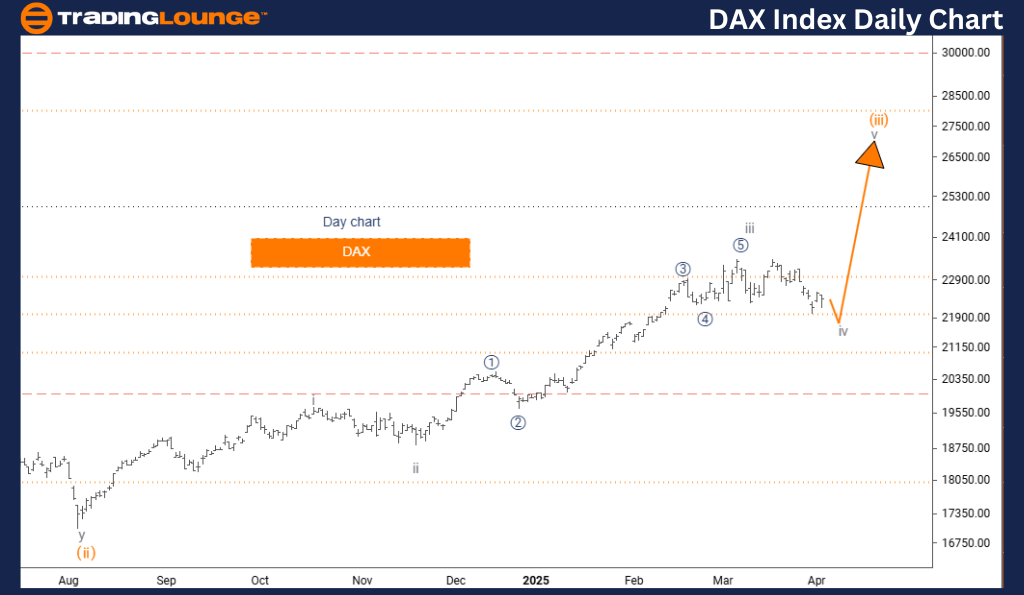

DAX (Germany) Elliott Wave Forecast – TradingLounge Daily Chart

DAX (Germany) Daily Chart Analysis

DAX (Germany) Elliott Wave Technical Analysis

Function: Counter-Trend Movement

Mode: Corrective Phase

Structure: Gray Wave 4 Development

Position: Within Orange Wave 3

Next Higher Degree Direction: Toward Gray Wave 5

DAX Index Analysis Summary

The DAX daily Elliott Wave forecast reveals a corrective counter-trend structure. The current phase is gray wave 4, forming inside the broader orange wave 3 sequence.

The preceding gray wave 3 impulsive leg has likely ended. Now, the DAX Index is consolidating in gray wave 4, a common pause before resuming the primary uptrend.

DAX Index Technical Outlook

Once gray wave 4 finalizes, analysts anticipate an advance into gray wave 5, continuing the bullish progression of orange wave 3. This scenario suggests potential for upward movement aligned with the higher-degree trend.

The updated wave chart provides traders with a visual guide to the current DAX Index Elliott Wave position, helping identify optimal entry points and anticipate future trend direction.

DAX Index Trading Strategy

Traders should monitor for classic corrective characteristics such as sideways consolidation or ABC three-wave patterns typically found in wave 4 scenarios. These movements may present both short-term trading opportunities and chances to position for the next bullish leg.

Waiting for clear confirmation of gray wave 4 completion enhances timing strategies and supports better execution as gray wave 5 initiates. Strong wave analysis and timing remain essential in leveraging this setup.

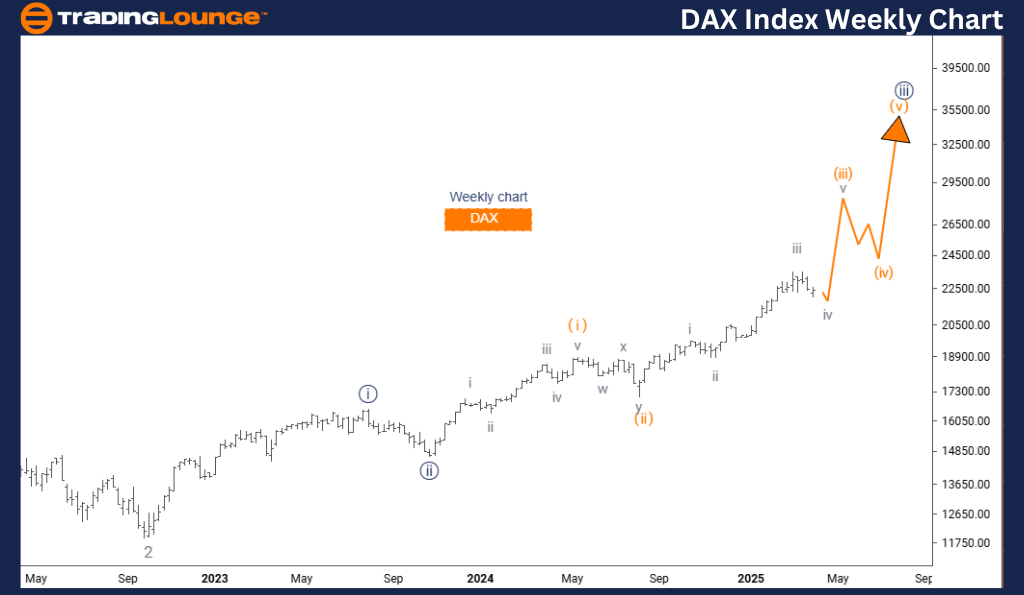

DAX (Germany) Elliott Wave Forecast – TradingLounge Weekly Chart

DAX (Germany) Technical Wave Analysis

Technical Overview

Function: Bullish Continuation

Mode: Impulsive Structure

Structure: Advancing Orange Wave 3

Position: Within Navy Blue Wave 3

Next Lower Degree Direction: Toward Orange Wave 4

DAX Index Analysis Summary

The weekly Elliott Wave outlook for DAX (Germany) confirms a strong bullish trend. The analysis centers on the unfolding of orange wave 3, nested inside a larger navy blue wave 3 structure.

With orange wave 2 likely complete, the DAX Index has entered a robust impulsive advance via orange wave 3, a stage often linked with strong momentum and extended price rallies.

DAX Index Technical Outlook

This current setup implies significant upside potential as orange wave 3 continues within the overarching navy blue wave 3 trend. Upon its completion, a corrective orange wave 4 is expected, followed by the start of orange wave 5.

The wave pattern offers long-term investors clarity on the market’s current path and helps anticipate the next directional move with greater precision.

DAX Index Trading Strategy

Investors should watch for third-wave signals, including increased volume, sharp price movement, and sustained bullish rallies—key characteristics of strong impulsive waves.

This environment favors holding or initiating long positions, in line with the broader bullish Elliott Wave setup. However, sound risk management is essential as the wave matures and conditions evolve.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Shanghai Composite Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support