ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG Elliott Wave Technical Analysis – TradingLounge

Overview:

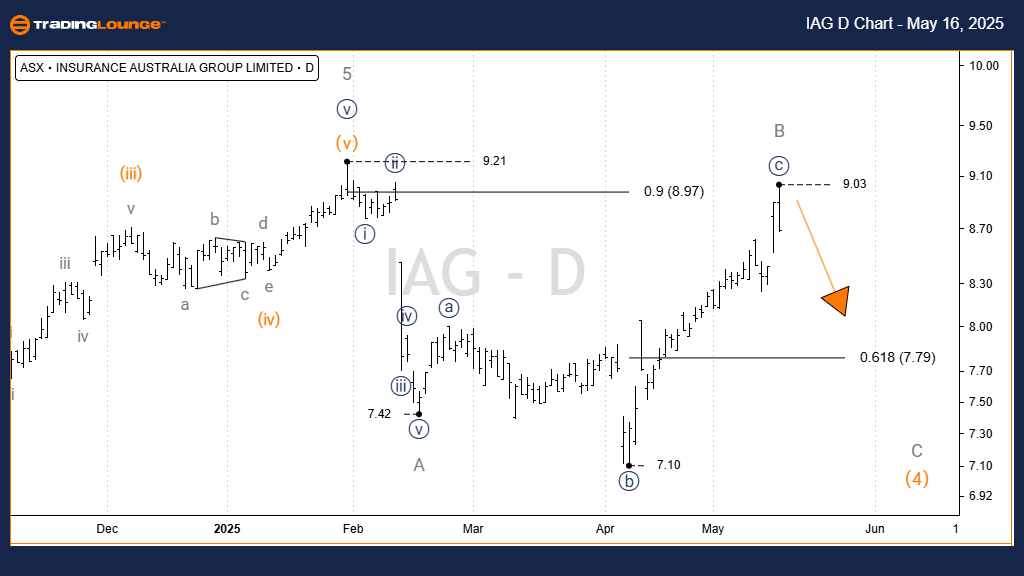

Welcome to today's Elliott Wave analysis for ASX: INSURANCE AUSTRALIA GROUP LIMITED (IAG). Current technical indicators suggest ASX:IAG is nearing the completion of Wave B-grey, potentially transitioning into a downward Wave C. The existing wave structure does not support a bullish scenario, making it a less favorable environment for long positions at this time.

ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG 1D Chart (Semilog Scale) Analysis

Trend Function: Primary trend (Minor degree, grey)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave C-grey

Key Insights:

- Wave 3-orange has successfully completed its five-wave impulse pattern.

- The market is now undergoing a Wave 4-orange correction, unfolding as a Zigzag (A-B-C-grey).

- Wave A-grey has concluded.

- Wave B-grey likely ended as an Expanded Flat.

- Wave C-grey is currently pushing lower with a projected price target near 7.79.

- Critical Invalidation Level: A move above 9.03 would invalidate the current wave count.

ASX: INSURANCE AUSTRALIA GROUP LIMITED – IAG Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

Trend Function: Major trend (Minor degree, grey)

Wave Mode: Motive

Wave Structure: Impulse

Current Position: Wave C-grey

Detailed Breakdown:

- Waves A-grey and B-grey are both completed.

- After peaking at 9.03, the stock has entered a downward leg consistent with Wave C-grey.

- Primary support target is 7.79, with potential lower zones between 7.42 and 7.10.

- This scenario is valid only if price remains below the 9.03 invalidation point.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: BLOCK, INC – XYZ (SQ2) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our updated Elliott Wave forecast for ASX: IAG provides a structured view of expected price movements. We highlight both validation and invalidation levels to support confident trading decisions. This analysis aims to offer clear, unbiased technical guidance for traders focused on ASX:IAG’s short-to-medium term trend direction.