WTI Elliott Wave Analysis: Market Trends & Forecasts

WTI crude oil continues its downward momentum from January 2025, following a corrective bounce in September 2024, when prices briefly surged above $65. The broader market trend indicates a sideways price action, forming a consolidation phase. As WTI approaches the lower boundary of this range, a potential rebound may be on the horizon.

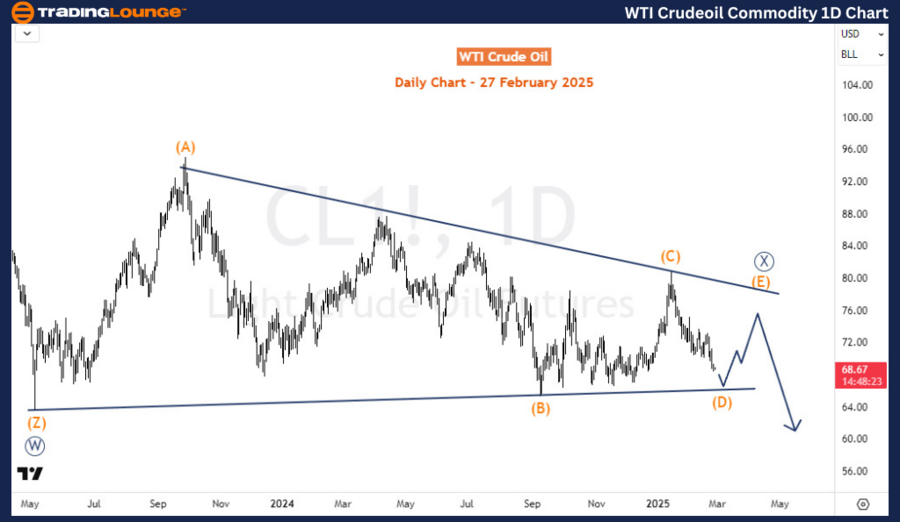

WTI Crudeoil Daily Chart Analysis: Triangle Structure in Play

The daily chart highlights a triangle consolidation pattern that emerged in May 2023, following a steep sell-off from the $131 peak in March 2022, at the height of the Russia-Ukraine conflict.

- The March 2022 - May 2023 decline is classified as a zigzag/double zigzag correction, labeled as wave ((W)).

- The sideways price movement from May 2023 remains incomplete, forming wave ((X)).

- Once wave ((X)) concludes, WTI prices could decline further, possibly falling below $50, completing the bearish corrective cycle initiated in March 2022.

WTI Crudeoil H4 Chart Analysis: Final Stages of Triangle Pattern

The H4 chart suggests that WTI is in the last stages of the triangle formation for wave ((X)). The price action is currently positioned within wave (D) of ((X)), extending from the January 2025 high.

- Wave C of (D) is still in progress and could push WTI toward $66 before a bounce occurs for wave (E).

- If WTI drops below $65.25, the triangle structure would be invalidated.

- In such a case, prices could retreat further to the $61.85 - $54.59 range, indicating stronger bearish pressure.

This Elliott Wave outlook helps traders assess critical support and resistance zones for strategic decision-making.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver (XAGUSD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support