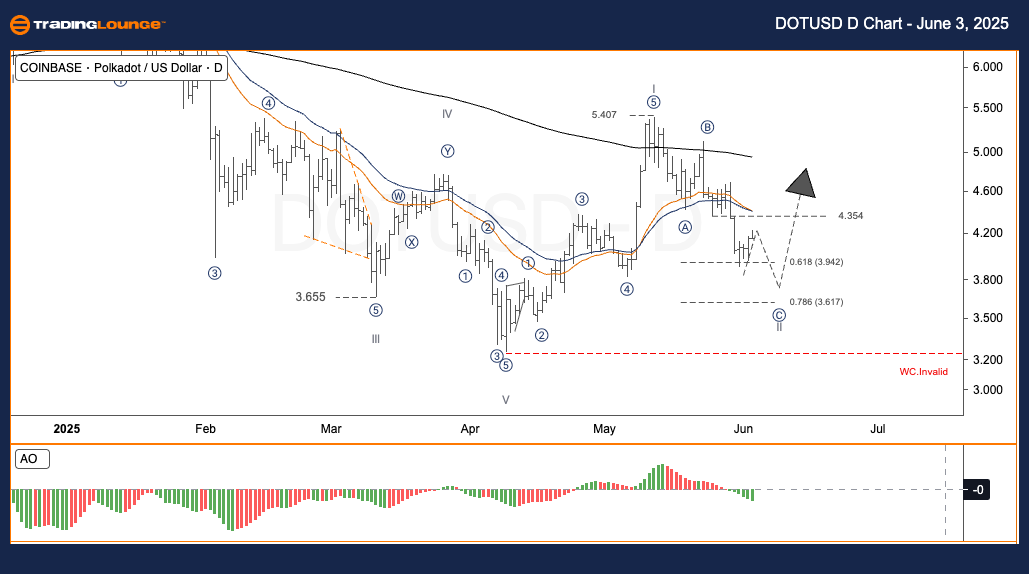

DOTUSD Elliott Wave Analysis – TradingLounge Daily Chart

Polkadot / U.S. Dollar (DOTUSD) Daily Chart Analysis

DOTUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Next Higher Degrees Direction: N/A

Invalidation Level: N/A

Polkadot Trading Strategy – Daily Chart

Polkadot (DOT) is currently correcting in a wave II structure, aligning with the Elliott Wave principle. Once this phase concludes, a wave III surge could emerge, often marked by strong upward momentum. The preceding wave I completed at $5.407, forming a well-defined five-wave pattern. Presently, wave II is unfolding as an ABC correction. Potential support and reversal zones for wave C include:

Fibonacci 0.618 retracement ≈ $3.94

Fibonacci 0.786 retracement ≈ $3.62

Suggested Strategies

✅ For Short-Term Traders (Swing Trade):

- Observe price action closely between $3.62 and $3.94.

- Confirm entry through bullish reversal candlestick patterns (e.g., Engulfing, Pin Bar).

🟥 Risk Management:

- Maintain a Stop Loss below $3.40 to manage invalidation risk in the wave count.

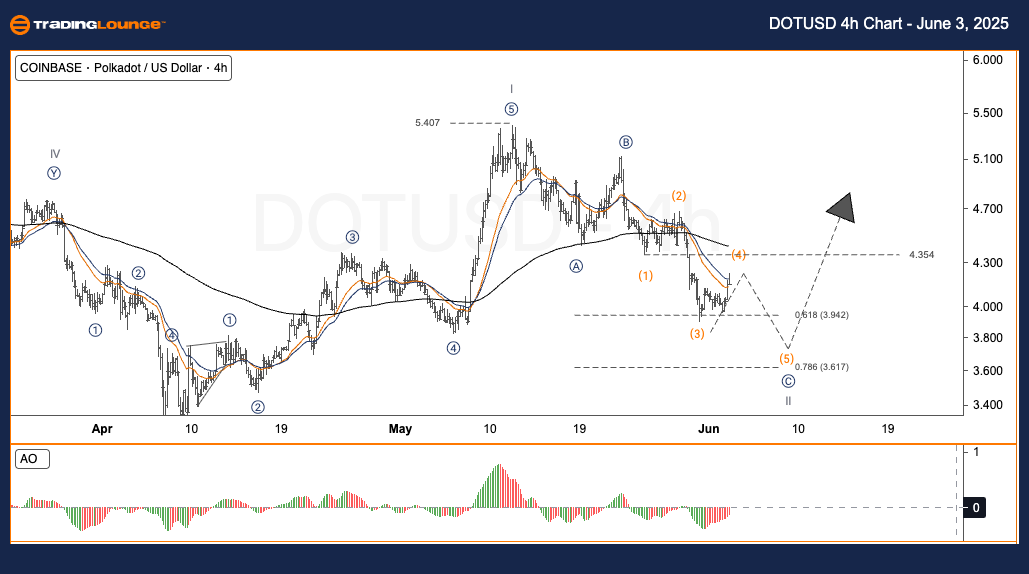

DOTUSD Elliott Wave Analysis – TradingLounge H4 Chart

Polkadot / U.S. Dollar (DOTUSD) 4-Hour Chart Analysis

DOTUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Next Higher Degrees Direction: N/A

Invalidation Level: N/A

Polkadot Trading Strategy – H4 Chart

The 4-hour chart for Polkadot (DOT) also reflects a wave II corrective phase, preparing for a potential wave III advance. The initial bullish wave (Wave I) completed at $5.407 with five distinct internal legs. Currently, the market retraces via an ABC structure within wave II. Anticipated price targets for wave C include:

Fibonacci 0.618 retracement ≈ $3.94

Fibonacci 0.786 retracement ≈ $3.62

Suggested Strategies

✅ For Short-Term Traders (Swing Trade):

- Wait for a price test within the $3.62 to $3.94 range.

- Look for bullish reversal confirmation.

🟥 Risk Management:

- Suggested Stop Loss should be placed below $3.40 for protective coverage.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: VETUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support