Welcome to Our Latest Elliott Wave Analysis for Meta Platforms Inc. (META)

This report provides an in-depth analysis of META's price movements using Elliott Wave Theory. It aims to equip traders with actionable insights into potential market opportunities based on current trends and wave structures. We will analyze both the daily and 1-hour charts to deliver a thorough understanding of META's market behavior.

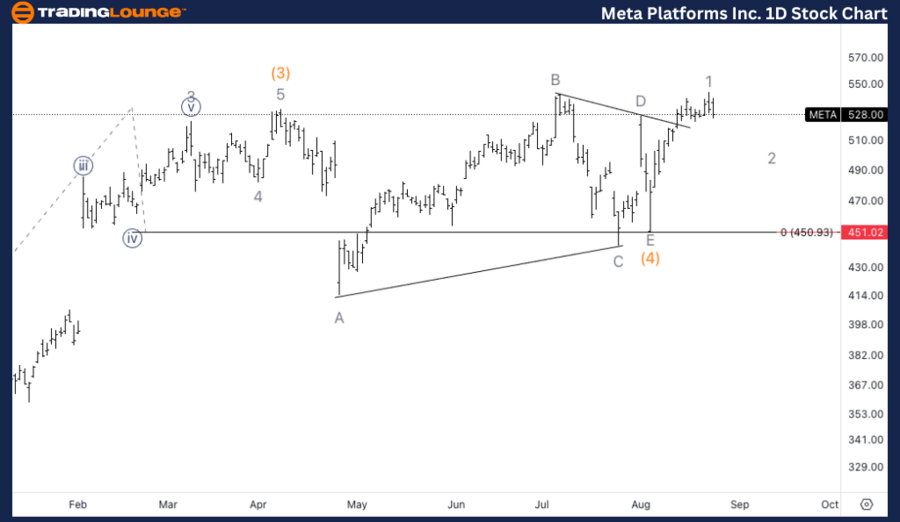

META Elliott Wave Analysis - Trading Lounge Daily Chart

Meta Platforms Inc. (META) Daily Chart Analysis

META Elliott Wave Technical Analysis

- Function: Trend

- Mode: Impulsive

- Structure: Motive

- Position: Intermediate wave (5)

- Direction: Upside in wave (5)

- Details: We anticipate further upside movement in wave (5), with the potential to reach the medium-level target of $650.

META Stock Technical Analysis

META is currently progressing within the intermediate wave (5), showing potential to hit the medium-level target of $650. The overall trend remains bullish, and the market is expected to maintain its upward momentum as wave (5) unfolds. Traders should closely watch price action as it approaches the $650 level, which could act as a significant resistance area and a potential target for this impulsive wave.

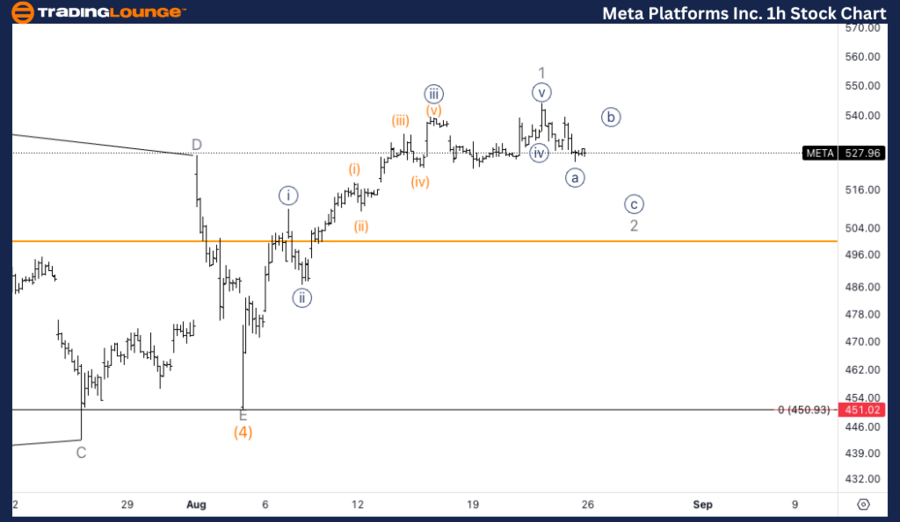

META Elliott Wave Analysis - Trading Lounge 1H Chart

Meta Platforms Inc. (META) 1H Chart Analysis

META Elliott Wave Technical Analysis

- Function: Trend

- Mode: Impulsive

- Structure: Motive

- Position: Minor wave 2

- Direction: Bottom in wave 2

- Details: The 1-hour chart shows the subdivision of wave 5 into what appears to be a clear five-wave move. We seem to have topped in wave 1, and as long as the price remains above TL5 at $500, further upside is anticipated.

META Stock Analysis – 1H Chart

The 1-hour chart highlights a completed five-wave structure in wave 1, followed by a corrective wave 2. Provided the price stays above TL5 at $500, further upside potential is expected. This corrective phase may present a buying opportunity for traders looking to capitalize on the next impulsive move, likely wave 3, which would continue the overall uptrend.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: McDonald’s Corp. (MCD) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support