Welcome to Our Latest Elliott Wave Analysis for McDonald’s Corp. (MCD)

This Elliott Wave analysis delves into McDonald's Corp. (MCD) price action, offering traders insights into potential trading opportunities by examining current trends and market structure. We will review both daily and 1-hour charts to provide a thorough understanding of MCD's market behavior.

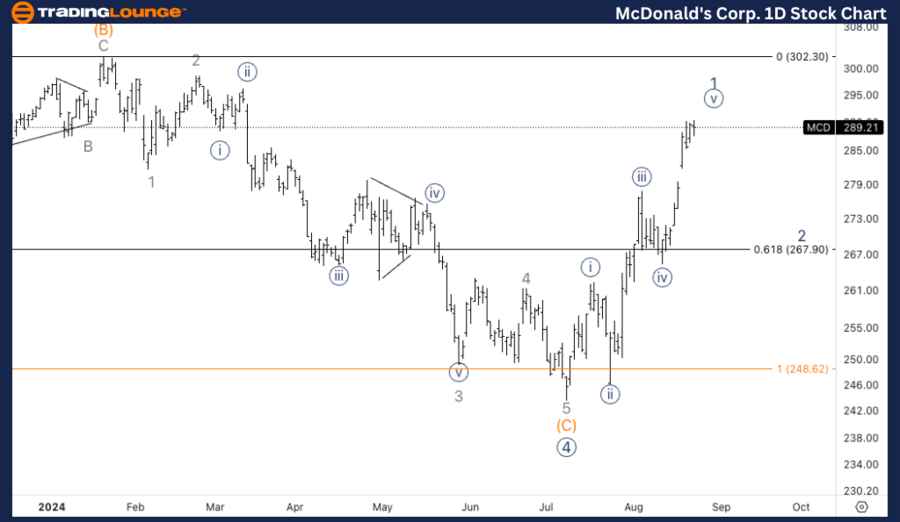

MCD Elliott Wave Analysis - Trading Lounge Daily Chart

McDonald’s Corp. (MCD) Daily Chart Analysis

MCD Elliott Wave Technical Analysis

- FUNCTION: Trend

- MODE: Impulsive

- STRUCTURE: Motive

- POSITION: Wave 1 of (1)

- DIRECTION: Upside into wave 1

DETAILS: Anticipating a potential peak in wave 1 or (1) of Primary wave 5. Resistance may be encountered around the $300 mark (TL3), where a pullback in wave 2 or (2) could occur.

MCD Stock Technical Analysis – Daily Chart Insight

MCD is progressing in wave 1 or (1) of the larger Primary wave 5. The price action indicates that a potential top for this wave is near, with the $300 level (TL3) serving as a crucial resistance point. As the price approaches this resistance, traders should be vigilant for a potential reversal, as wave 2 or (2) might initiate a corrective phase. This is a critical level where traders should prepare for possible shifts in market dynamics.

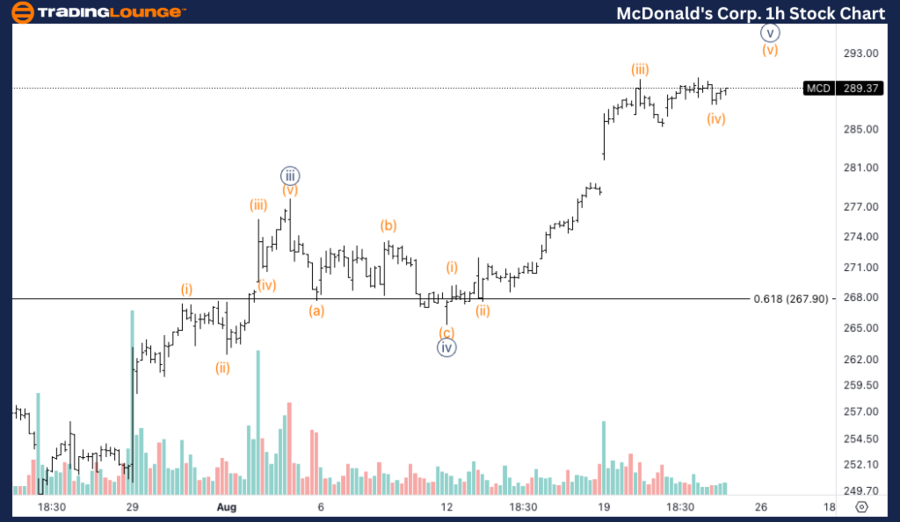

MCD Elliott Wave Analysis - Trading Lounge 1H Chart

McDonald’s Corp. (MCD) 1H Chart Analysis

MCD Elliott Wave Technical Analysis

- FUNCTION: Trend

- MODE: Impulsive

- STRUCTURE: Motive

- POSITION: Wave {v} of 1

- DIRECTION: Upside in wave {v}

DETAILS: A clear subdivision within wave {v} suggests the current uptrend is still intact, with at least one more upward movement likely, potentially reaching the $300 level. Volume analysis also supports this continuation.

MCD Stock Technical Analysis – 1H Chart

On the 1-hour chart, a clear subdivision within wave {v} of 1 indicates that the uptrend remains incomplete. Another leg higher is expected, which could push the price towards the $300 level. Volume patterns align with this projection, showing sustained buying interest that might drive the price to the $300 target before any significant correction begins.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Advanced Micro Devices Inc Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support