AUDUSD Elliott Wave Analysis - Trading Lounge Day Chart

Australian Dollar/U.S. Dollar (AUDUSD) Day Chart Analysis

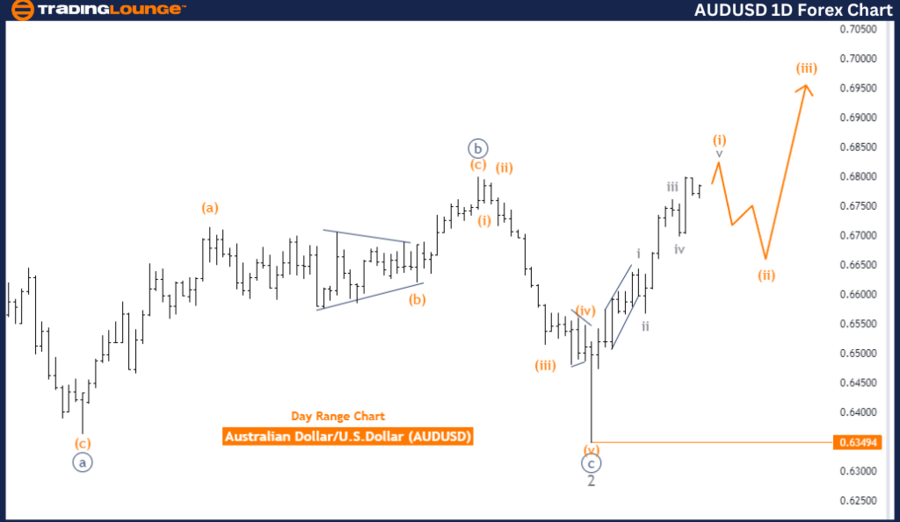

AUDUSD Elliott Wave Technical Analysis

-

Function: Bullish Trend

-

Mode: Impulsive

-

Structure: Orange Wave 1

-

Position: Navy Blue Wave 1

-

Direction Next Lower Degrees: Orange Wave 2

-

Details: Orange Wave 1 remains active and is nearing completion.

- Wave Cancel Invalid Level: 0.63494

The AUDUSD is currently showing a strong bullish trend according to Elliott Wave analysis on the daily chart. The market is operating in an impulsive mode, indicating a persistent upward momentum. The primary structure under analysis is the orange wave 1, which represents the beginning of this upward movement. This wave is still active and approaching its completion, signaling that the ongoing bullish trend is still evolving, though a corrective phase may soon follow.

The current market position is identified as navy blue wave 1 within the broader orange wave 1 structure. This suggests that the overall upward trend is in its early stages, leaving room for further gains before a significant pullback might occur. The analysis anticipates that after the completion of the current wave, a corrective phase, marked as orange wave 2, could ensue. This correction is expected to be a temporary retracement within the broader bullish trend, paving the way for the next phase of upward movement.

A crucial level to watch is 0.63494, known as the wave cancel invalid level. If the price dips below this level, the current wave structure would be invalidated, potentially signaling a shift in market direction or even a possible trend reversal. This level is essential for traders, as it helps determine whether the bullish trend remains intact or if market dynamics are changing.

In summary, the AUDUSD is in a bullish impulsive trend on the daily chart, with the market positioned in navy blue wave 1 of orange wave 1. The trend is upward, but the completion of orange wave 1 is imminent, and traders should closely monitor the 0.63494 level. A breach of this level could invalidate the current wave structure and suggest a potential trend reversal.

AUDUSD Elliott Wave Analysis - Trading Lounge 4-Hour Chart

Australian Dollar/U.S. Dollar (AUDUSD) 4-Hour Chart Analysis

AUDUSD Elliott Wave Technical Analysis

-

Function: Bullish Trend

-

Mode: Impulsive

-

Structure: Orange Wave 1

-

Position: Navy Blue Wave 1

-

Direction Next Lower Degrees: Orange Wave 2

-

Details: Orange Wave 1 remains active and is nearing completion.

- Wave Cancel Invalid Level: 0.63494

The AUDUSD is currently in a bullish trend according to the Elliott Wave analysis on the 4-hour chart. The market is following an impulsive mode, indicating a strong and ongoing upward movement. The primary structure observed is orange wave 1, which shows that the initial phase of this upward trend is still progressing.

The market is positioned in navy blue wave 1, part of the larger orange wave 1 structure. This indicates that the broader upward trend is in its early stages, with further gains anticipated before any significant correction or pullback occurs. Since orange wave 1 remains active, it suggests that the current upward movement is nearing its completion.

The direction of the next lower degrees points to orange wave 2, implying that after the current wave completes, a corrective phase might follow. This correction would represent a temporary pullback within the broader bullish trend, likely setting the stage for further upward movement in subsequent waves.

The key level to watch is 0.63494, identified as the wave cancel invalid level. If the market falls below this level, it would invalidate the current wave structure, signaling a potential shift in the market's direction or a possible trend reversal. This level serves as a critical benchmark for traders to confirm the ongoing bullish trend.

In summary, the AUDUSD is currently in a bullish impulsive trend on the 4-hour chart, with the market positioned in navy blue wave 1 of orange wave 1. The trend remains upward, but traders should closely watch the 0.63494 level, as a drop below this point would invalidate the current wave structure and could indicate a trend reversal.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Euro/British Pound (EUR/GBP) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support