Gold Market Overview – Elliott Wave Analysis

Gold continues to trade within a strong long-term Elliott Wave bullish cycle, with each major pullback over the past 2–3 years offering fresh long entry opportunities. The current correction from April 2025’s high is expected to follow this same pattern, potentially setting up for another impulsive move higher.

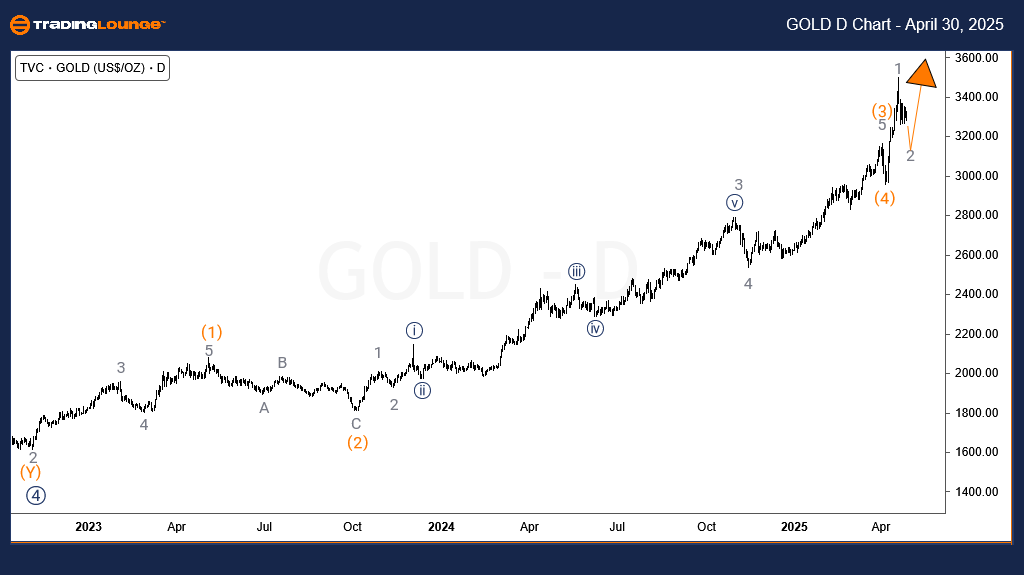

Gold Elliott Wave Analysis - Daily Chart

Wave ((4)) of cycle degree concluded in October 2022, setting the stage for the current bullish advance in wave ((5)).

Wave ((5)) represents the final leg of wave I of (III), the broader Elliott Wave uptrend that began in December 2015.

Within wave ((5)):

- Wave (3) peaked on April 2

- Wave (4) completed on April 7

- Wave (5) initiated from the April 7 low, completing wave 1 of (5) with a clean impulsive structure

The current pullback is wave 2 of (5). As long as price action stays above the key invalidation level at 2956, the bullish outlook remains valid.

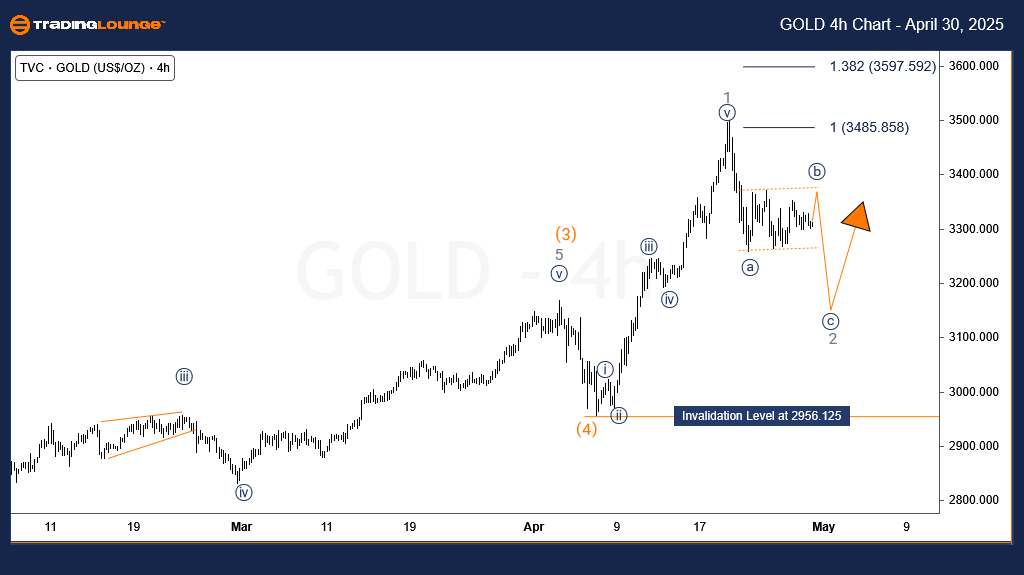

Gold Elliott Wave Analysis – 4-Hour Chart

On the 4-hour chart, a clear sideways consolidation has followed a 5-wave decline from the recent high, indicating wave 2 is developing.

A break below the April 7 low may see wave 2 extend deeper into the 3127–3034 Fibonacci retracement zone — a potential buying area.

A firm rebound from this zone would suggest wave 3 of (5) is underway, with bullish targets projected towards 3700 and higher.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

See Previous: Cocoa Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion – Gold Elliott Wave Outlook

Gold’s ongoing correction aligns with a larger bullish Elliott Wave structure. If wave 2 completes above key support, traders can anticipate the start of wave 3 of (5), opening up potential for significant upside and new multi-year highs.