ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis

Hello readers,

In today's Elliott Wave technical review, we analyze the ASX-listed Newmont Corporation (ASX: NEM), currently demonstrating strong momentum in a developing third wave. This analysis highlights potential price targets and outlines invalidation levels to monitor for trend confirmation or reversal.

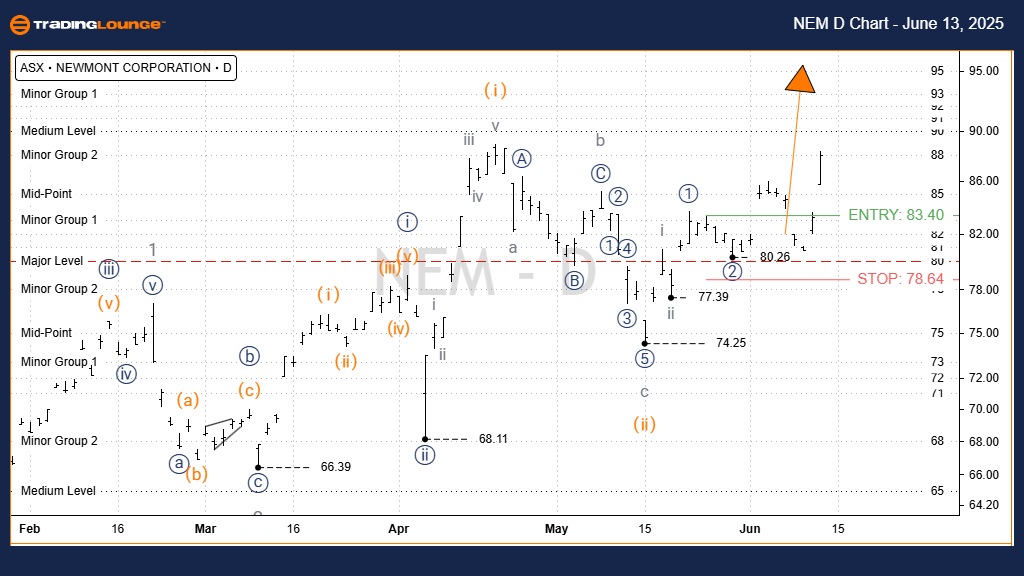

ASX: NEWMONT CORPORATION - NEM (1D Chart - Semilog Scale) Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave iii) orange of Wave iii)) navy of Wave 3 grey

Details:

Wave ii) (orange) most likely ended at 74.25, completing a clear zigzag correction (a-b-c, grey). After reaching that low, wave iii) (orange) initiated a bullish move, targeting an estimated resistance near 100.00.

Invalidation Point: 74.25

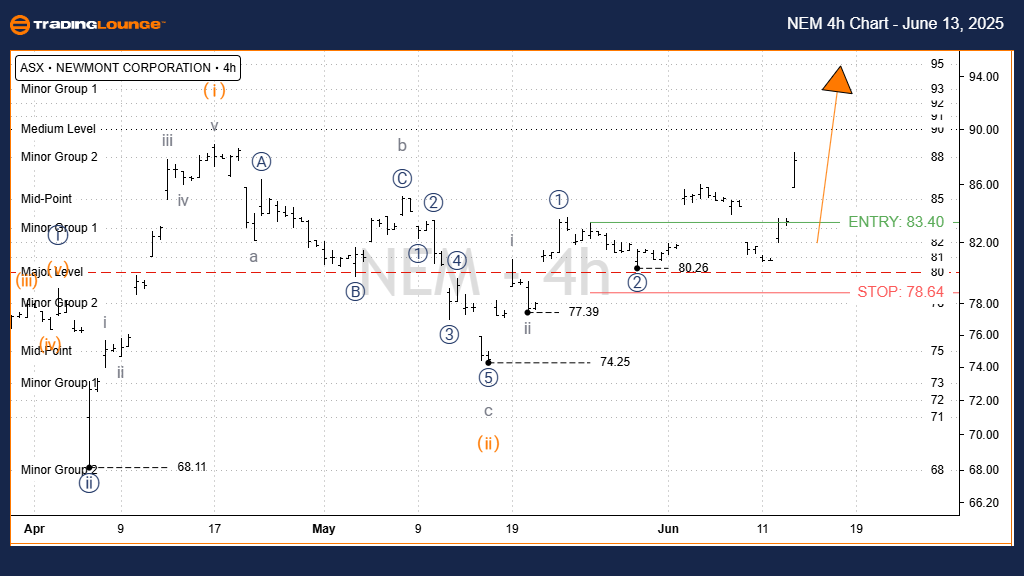

ASX: NEWMONT CORPORATION - NEM Elliott Wave Technical Analysis (4-Hour Chart)

TradingLounge Short-Term Forecast

Supporting the 1D analysis, the 4-hour chart reaffirms the bullish wave structure. Wave iii) (orange) is actively pushing higher, with an immediate target around 90.00 before aiming for the broader objective near 100.00.

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave iii) orange of Wave ((iii)) navy of Wave 3 grey

Invalidation Point: 74.25

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: COCHLEAR LIMITED - COH Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave forecast for ASX: Newmont Corporation (NEM) delivers actionable insights for traders and investors. By identifying precise wave targets and validation points, this analysis supports decision-making aligned with the prevailing bullish structure. With continued wave progression, the technical outlook remains constructive, favoring upside opportunities under current conditions.