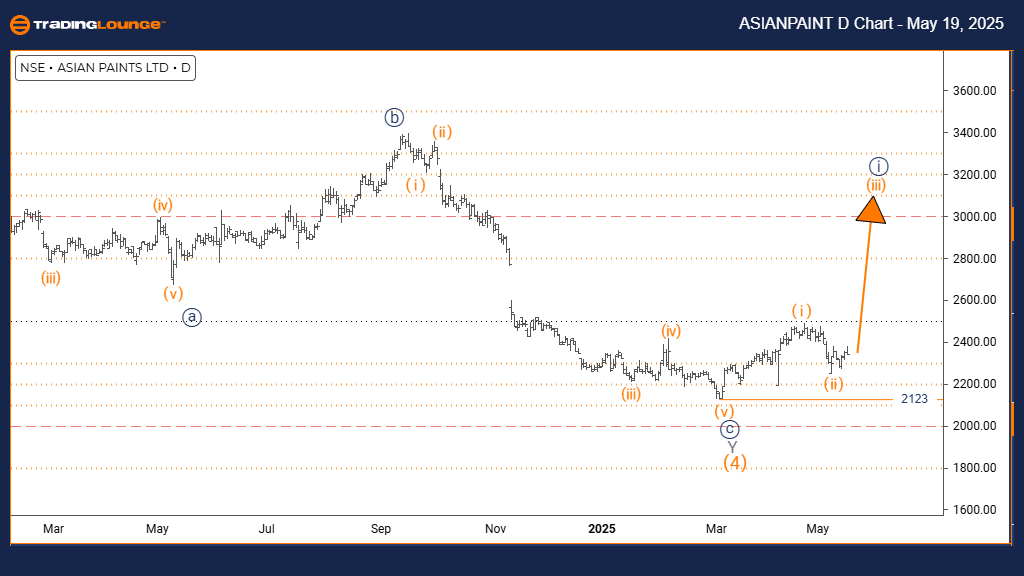

ASIAN PAINT Elliott Wave Analysis – Trading Lounge Day Chart

ASIAN PAINT Stock Day Chart Analysis

ASIAN PAINT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange Wave 1

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 2

DETAILS: Orange Wave 1 of 1 is unfolding, signaling the initiation of a new bullish trend. Wave invalidation level: 2123

The daily Elliott Wave analysis for Asian Paints highlights the emergence of a new upward trend, backed by a clear impulsive wave structure. Current technical indicators confirm the formation of Orange Wave 1 nested within Navy Blue Wave 1, pointing to the early stages of a bullish move in the stock price.

Presently, Asian Paints is developing Orange Wave 1 under a larger Navy Blue Wave 1, suggesting the market is entering a new impulse phase. The pattern signals strong buying momentum, indicating continued upside potential. The 2123 support level acts as the critical invalidation point. A break below it could negate the current wave structure and imply a reevaluation is necessary.

This wave setup provides essential insight into the stock’s position in an early bullish cycle. If the impulsive structure remains intact, Orange Wave 2—a corrective pullback—is likely to follow, providing strategic opportunities for market participants.

Traders are advised to monitor the stock's price movements closely to confirm the impulsive progression. Protecting the 2123 invalidation level is crucial. Sustained momentum above this point may validate the trend, offering possible trading advantages while maintaining technical caution.

ASIAN PAINT Elliott Wave Analysis – Trading Lounge Weekly Chart

ASIAN PAINT Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 1

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Orange Wave 4 appears finalized; Navy Blue Wave 1 of 1 is developing. Wave invalidation level: 2123

The weekly Elliott Wave analysis for Asian Paints supports a bullish trend continuation, driven by the development of Navy Blue Wave 1 inside the broader Gray Wave 1 structure. The likely completion of Orange Wave 4 strengthens the outlook for the current upward momentum.

This transition into Navy Blue Wave 1 marks the beginning of a renewed impulsive phase. The pattern exhibits significant strength, with the 2123 invalidation level acting as key technical support. A breach below this level would challenge the existing wave count and could suggest a structural reassessment.

Within this framework, Asian Paints appears positioned at the early stage of a larger trend, offering potential for extended gains. Upon completion of this impulsive movement, Navy Blue Wave 2, a corrective phase, is projected to follow.

Market participants should track price behavior to confirm the impulsive character of Navy Blue Wave 1. Holding above the 2123 support zone is critical for maintaining the bullish wave outlook. Overall, the weekly chart supports continued upward strength, providing insights into the broader Elliott Wave roadmap for Asian Paints.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: NIFTY 50 INDEX Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support