Corn Elliott Wave Analysis: Understanding the Latest Trends and Predictions

Function: Trend Analysis

Mode: Counter-Trend Movements

Structure: Anticipation of an Impulse Wave

Position: Wave 3 Dynamics

Direction: Ongoing Development of Wave 3

Corn Elliott Wave Technical Analysis

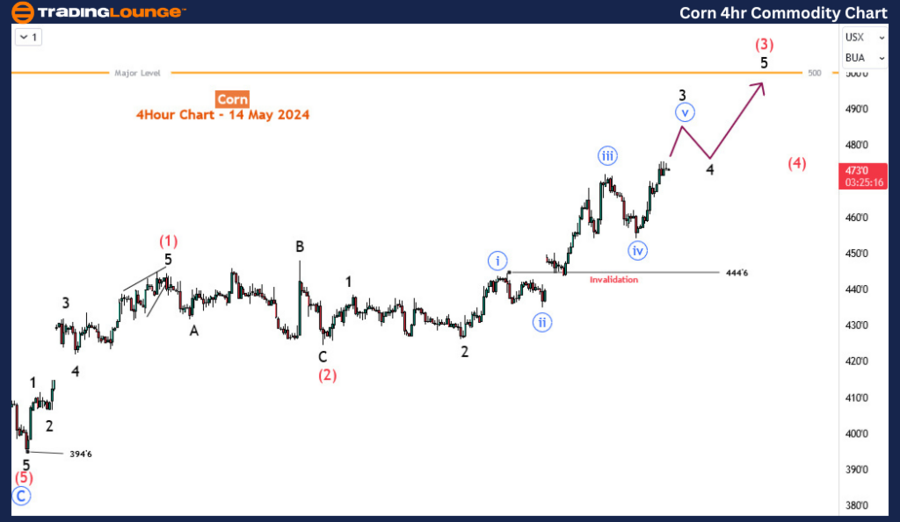

Detailed Overview: Currently, Wave 3 is active and has finished its fourth sub-wave, maintaining a crucial level above 444’6. This positioning suggests a significant rise to complete Wave 3 of (3). The bullish sequence initiated from 394’6 is expected to climb further, as long as the 444’6 mark holds firm. This analysis remains consistent with recent updates.

Market Recovery and Historical Context

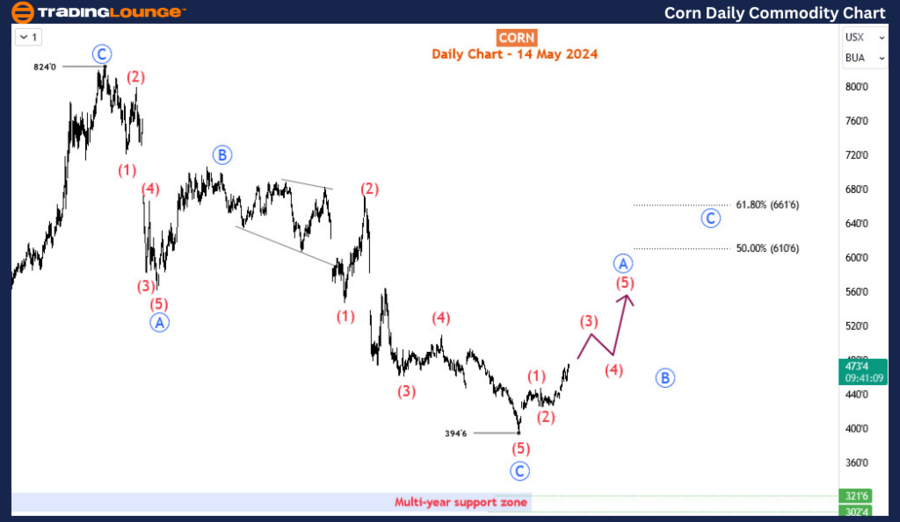

Corn prices have experienced a substantial surge, increasing over 20% from the February 2024 low. This rise comes after a severe 22-month downturn, where prices plummeted by nearly 59%. Although the market has shown recovery, it’s still modest compared to the previous downward trend that started in April 2022. Investors are now faced with determining whether the recent uptick is a temporary correction or the start of a robust recovery that could exceed past highs.

Technical Analysis on the Daily Chart

The decline from the April 2022 peak of 824 followed an A-B-C corrective pattern, a stark contrast to the lengthy bullish phase preceding it. If the downturn from June 2022 was merely a market correction, there's potential for the bullish trend to resume. With the sell-off phase concluding, we anticipate either an impulse wave recovery or another A-B-C or W-X-Y pattern to emerge.

Implications of the Current Impulse Wave

The rebound from February 2024 is morphing into an impulse wave, potentially marking the beginning of a recovery sequence. Simplifying our analysis to an A-B-C recovery allows us to foresee the continuation of the current bullish impulse, aiming to complete the 'A' wave in the blue on the daily chart. This projection indicates a promising upside for Corn prices in the upcoming weeks.

Short-Term Technical Outlook on the H4 Chart

A closer examination of the H4 chart reveals the final stages of wave 3 of (3), suggesting an approach towards the critical 500 level. At this juncture, prices may face resistance, likely leading to a corrective wave (4). Consequently, the primary wave A (blue circled) on the daily chart is approximately at its midpoint. This analysis supports a bullish outlook for Corn in the near to medium term, with buying on pullbacks recommended as a strategic approach to capitalize on the prevailing upward momentum.

Conclusion

The current Elliott Wave analysis for Corn suggests a continuing bullish trend with potential for significant gains. As the market dynamics evolve, maintaining vigilance on the key levels of 444’6 and 500 will be crucial for traders. The suggested trading strategy focuses on leveraging pullbacks within the bullish trend, aligning with the overall positive market sentiment.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Natural Gas Commodity

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support