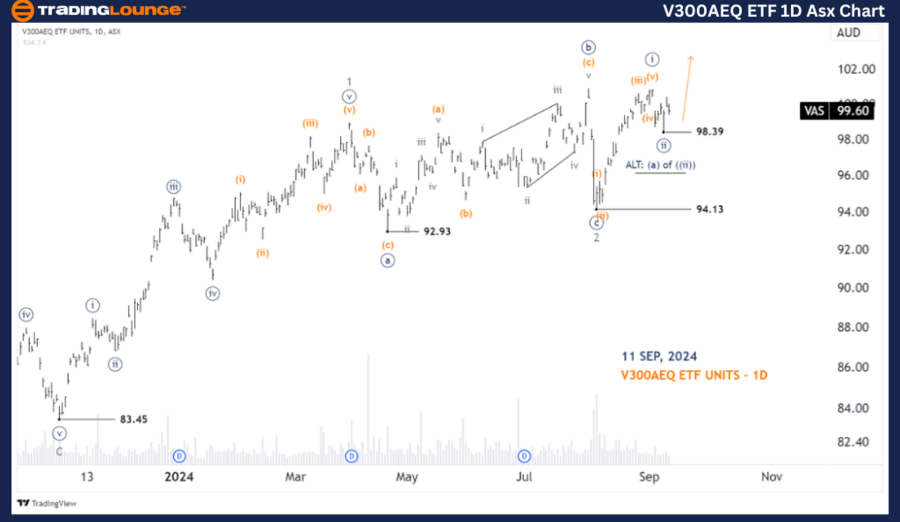

ASX: V300AEQ ETF UNITS – VAS Elliott Wave Analysis TradingLounge (1D Chart)

Greetings, our updated Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) with V300AEQ ETF UNITS – VAS. VAS has completed wave 2-grey, and wave 3-grey is currently unfolding, which could drive higher prices.

VAS Elliott Wave Technical Analysis

ASX: V300AEQ ETF UNITS – VAS 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy of Wave 3-grey

Details: Wave 2-grey concluded at the 94.13 low, forming an Expanded Flat. Now, wave 3-grey is in progress, subdividing as it unfolds. Wave ((i)) and ((ii))-navy are complete, and wave ((iii))-navy is likely unfolding to push prices higher. The dip below 98.39 indicates that wave ((ii))-navy extended more than initially anticipated, but the overall expectation remains that wave ((iii))-navy will continue pushing upwards.

Invalidation point: 98.39

ASX: Vanguard Australian Shares – VAS TradingLounge (4-Hour Chart)

ASX: V300AEQ ETF UNITS – VAS 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy

Details: Wave ((i))-navy completed as a Five-wave sequence, while wave ((ii))-navy appears to have ended as a Zigzag at the 98.39 low. Wave ((iii))-navy is currently developing and should drive prices higher. A break below the 98.39 level suggests that wave ((ii))-navy extended longer than expected. We are now observing trading setups near the 100.00 level for potential opportunities.

Invalidation point: 98.39

Conclusion:

Our Elliott Wave analysis of ASX: V300AEQ ETF UNITS – VAS provides a strategic forecast on current market trends. We highlight key price points for validation or invalidation of our wave count, allowing traders to approach the market with confidence. By considering both short-term setups and longer-term trends, our analysis is designed to help readers capitalize on market movements effectively.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: XERO LIMITED - XRO Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support