Welcome to our latest Elliott Wave analysis for NVIDIA Corp. (NVDA) as of August 5, 2024. This analysis provides an in-depth look at NVDA's price movements using the Elliott Wave Theory, helping traders identify potential opportunities based on current trends and market structure. We will cover insights from both the daily and 4-hour charts to offer a comprehensive perspective on NVDA's market behavior.

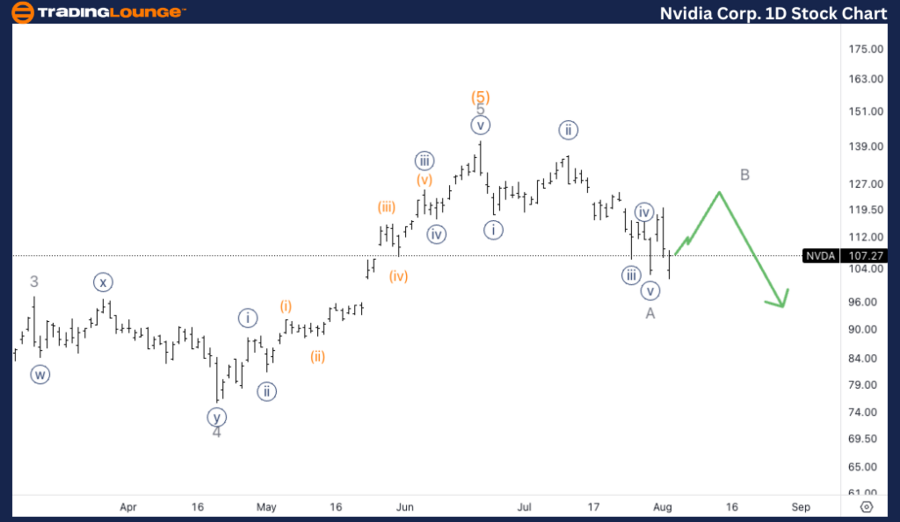

NVDA Elliott Wave Analysis Trading Lounge Daily Chart

NVIDIA Corp. (NVDA) Daily Chart Analysis

NVDA Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Intermediate wave (A)

Direction: Downside within wave (A)

Details: Looking for a top in wave (5), as we seem to have failed to find support on top of MG1 of $100. Looking for a clear break and retest of TL1 at $100 to have additional confidence in further downside developments for the longer term.

NVDA Technical Analysis – Daily Chart

The analysis indicates that NVIDIA has likely reached a top in wave (5), failing to find support on top of the medium-grade level (MG1) at $100. This failure suggests further downside potential. A clear break and subsequent retest of the trendline (TL1) at $100 would provide additional confidence in the bearish outlook for the longer term.

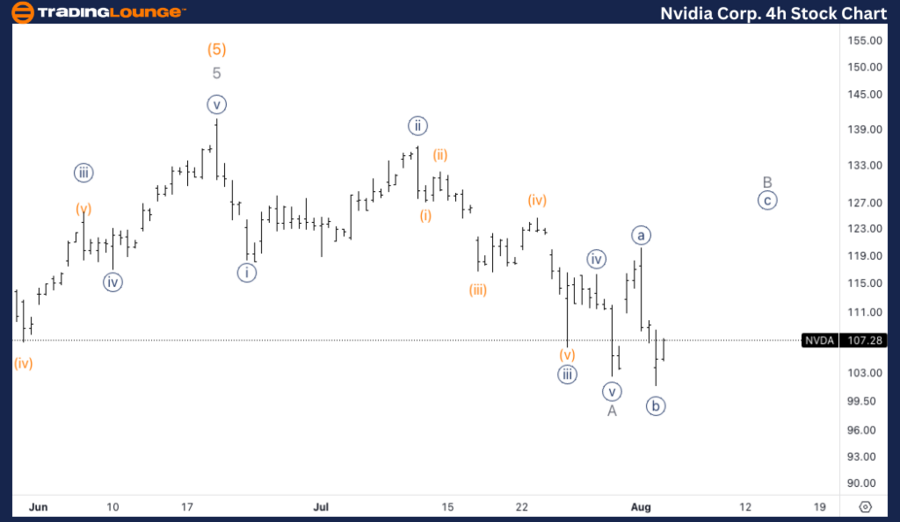

NVDA Elliott Wave Analysis Trading Lounge 4H Chart

NVIDIA Corp. (NVDA) 4H Chart Analysis

NVDA Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Zigzag

Position: Minor wave A

Direction: Bounce in wave B

Details: Here we are entertaining the possibility of a bounce in either wave B or 2 to then fall back lower, breaking the $100 barrier.

NVDA Stock Technical Analysis – 4H Chart

The shorter time frame suggests the possibility of a bounce within wave B or wave 2, which could provide a temporary relief rally before the continuation of the downward move. This bounce would precede a further decline, potentially breaking below the $100 barrier as the corrective phase progresses.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Visa Inc. (V) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support