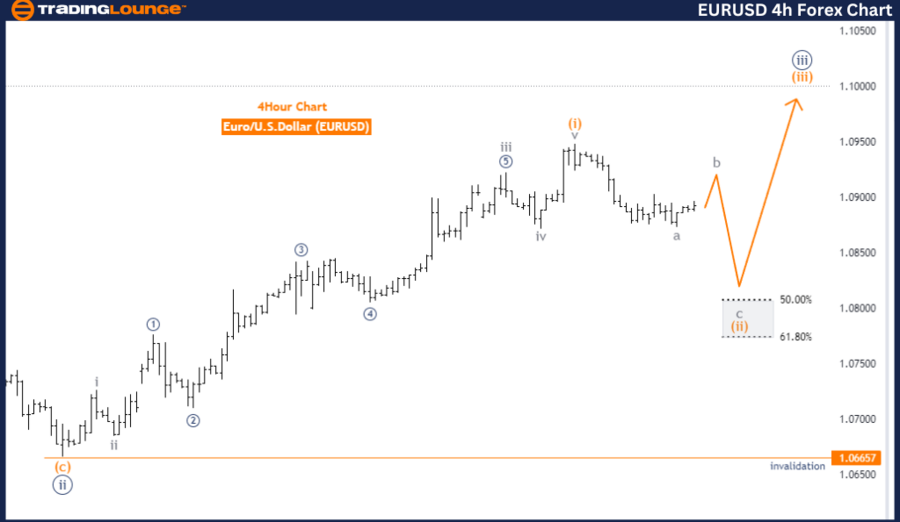

TradingLounge Forex EURUSD Elliott Wave Analysis - Daily Chart

EURUSD Elliott Wave Analysis Trading Lounge Day Chart

Euro/ U.S. Dollar (EURUSD) Day Chart

EURUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 3

Next Higher Degrees Direction: Orange Wave 3

Details: Orange wave 1 appears completed, and orange wave 2 is currently in play. Wave cancel invalid level: 1.06657.

The EURUSD Elliott Wave Analysis on the day chart provides insights into market behavior using Elliott Wave Theory. The primary function of the current market movement is identified as a counter trend, indicating that the market is moving against the primary trend direction.

The mode of this movement is corrective, suggesting the market is experiencing a retracement or consolidation phase rather than a strong directional trend. The specific structure under analysis is orange wave 2, a corrective wave within the broader Elliott Wave framework.

The current position of the market is within navy blue wave 3. This analysis focuses on the third wave of a higher-degree sequence within the navy blue wave category. Wave 3 in Elliott Wave Theory is typically significant, often exhibiting strong and impulsive characteristics.

For the next higher degrees, the direction is towards orange wave 3. Following the completion of the current corrective phase of orange wave 2, the market is expected to transition into orange wave 3. Orange wave 3 is anticipated to be an impulsive wave, resuming the primary trend direction.

The analysis notes that orange wave 1 appears completed. Orange wave 1 represents the initial impulsive move in the sequence. Currently, the market is in the corrective phase of orange wave 2. This phase is critical for setting up the subsequent major move, which will be orange wave 3.

An essential aspect of this analysis is the wave cancellation invalid level, identified as 1.06657. This level serves as a threshold; if the market moves below this point, the current wave analysis would be invalidated, necessitating a reevaluation of the wave count.

In summary, the EURUSD day chart analysis indicates the market is in a corrective phase, identified as orange wave 2 within navy blue wave 3. The next anticipated move is a transition into orange wave 3, expected to resume the primary trend. The wave cancel invalid level is set at 1.06657, serving as a critical point for validating or invalidating the current wave structure.

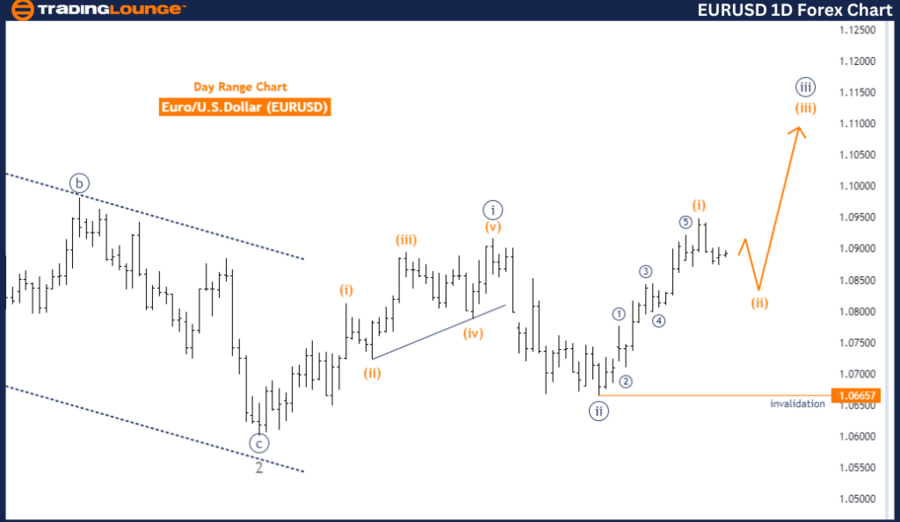

TradingLounge Forex EURUSD Elliott Wave Analysis - 4-Hour Chart

EURUSD Elliott Wave Analysis Trading Lounge 4-Hour Chart

Euro/ U.S. Dollar (EURUSD) 4-Hour Chart

EURUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 3

Next Higher Degrees Direction: Orange Wave 3

Details: Orange wave 1 appears completed, and orange wave 2 is currently in play. Wave cancel invalid level: 1.06657.

The EURUSD Elliott Wave Analysis on the 4-hour chart provides insights into the market using Elliott Wave Theory. The primary function identified is counter trend, indicating that the market is currently moving against the primary trend.

The mode of this movement is corrective, suggesting the market is undergoing a retracement or consolidation phase rather than a strong directional move. The specific structure in focus is orange wave 2, a corrective wave within the Elliott Wave framework.

The market position is identified as navy blue wave 3. This means the analysis is examining the third wave of a higher-degree sequence within the navy blue wave category. Wave 3 is typically significant in Elliott Wave Theory, often associated with strong and impulsive movements.

The direction for the next higher degrees is orange wave 3. Once the current corrective phase of orange wave 2 is complete, the market is expected to transition into orange wave 3. Orange wave 3 is anticipated to be an impulsive wave, resuming the primary trend direction.

The analysis details that orange wave 1 appears completed. Orange wave 1 represents the initial impulsive move in the sequence. Now, the market is in the corrective phase of orange wave 2. This phase is essential for setting up the next major move, which will be orange wave 3.

A critical aspect of this analysis is the wave cancellation invalid level, identified as 1.06657. This level acts as a threshold; if the market moves below this point, the current wave analysis would be invalidated, suggesting a reevaluation of the wave count is necessary.

In summary, the EURUSD 4-hour chart analysis indicates that the market is in a corrective phase, identified as orange wave 2 within navy blue wave 3. The next anticipated move is a transition into orange wave 3, which is expected to resume the primary trend. The wave cancel invalid level is set at 1.06657, serving as a crucial point for validating or invalidating the current wave structure.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AUDJPY Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support