KO Elliott Wave Analysis Trading Lounge Daily Chart

Welcome to our KO Elliott Wave Analysis Trading Lounge, your go-to destination for comprehensive insights into The Coca-Cola Company (KO) using Elliott Wave Technical Analysis. As of the Daily Chart, we delve into significant trends shaping the market.

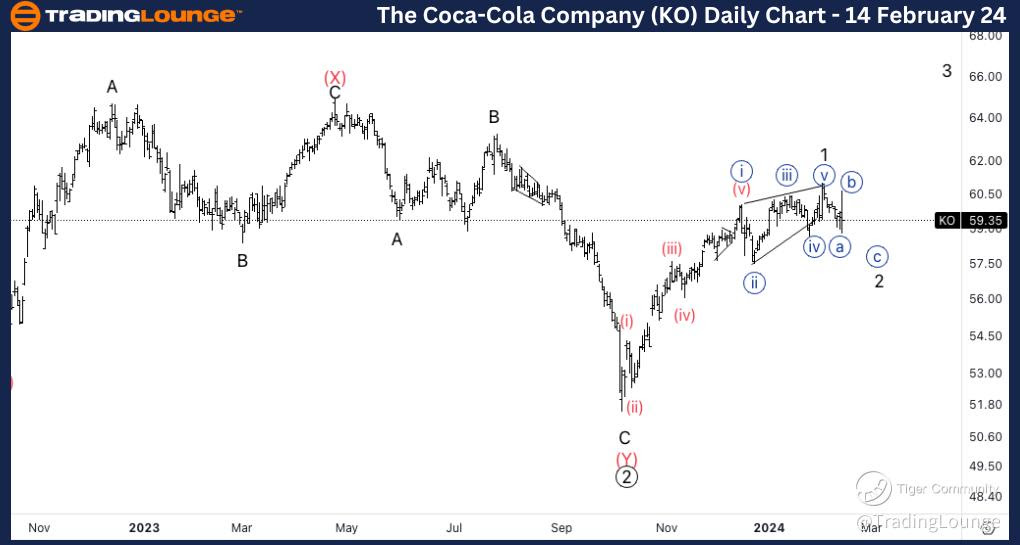

The Coca-Cola Company, (KO) Daily Chart Analysis:

KO Elliott Wave Technical Analysis

Function: Trend

Mode: Impulse

Structure: Motive

Position: Minor wave 2 of (1)

Direction: Anticipating completion of wave 2 before upward continuation

In this analysis, a leading diagonal within wave 1 is considered, leading to the expectation of the completion of Minor wave 2. The current wave appears to be in {b} of 2, with a potential upward trajectory towards All-Time Highs (ATH) anticipated thereafter.

KO Elliott Wave Analysis Trading Lounge 4Hr Chart, 14 February 24

The Coca-Cola Company, (KO) 4Hr Chart Analysis:

Function: Countertrend

Mode: Corrective

Structure: Flat

Position: Wave {b} of 2

Direction: Upside movement within wave {b} of 2

This segment of the analysis indicates a corrective phase, specifically a Flat structure within wave {b} of 2. The focus is on finding support around $59 and subsequently experiencing a pullback in wave {b}. Resistance might be encountered around $60 before a potential decline into wave {c}, leading towards wave {ii} of the diagonal.

In summary, the Elliott Wave analysis of The Coca-Cola Company (KO) on both the daily and 4-hour charts reveals potential trends and corrective movements, guiding traders in their decision-making processes.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Pepsico Inc. (PEP)

* KO Elliott Wave Technical Analysis – Daily Chart*

In terms of wave dynamics, we identify a prevailing impulse function with a motive structure. The current position is in Minor wave 2 of (1), indicating a completion of wave 2 before further upward movement. We explore an alternative count where a leading diagonal is present in wave 1. Our focus is on the completion of Minor wave 2, with the current wave appearing to be wave {b} of 2, followed by an anticipated continuation higher towards All-Time Highs (ATH).

* KO Elliott Wave Technical Analysis – 4Hr Chart*

Here, the wave function shifts to a counter trend approach with a corrective mode, reflecting a flat structure. The present position is in Wave {b} of 2, indicating an upside movement into wave {b} of 2. We anticipated finding support above $59, followed by a pullback in wave {b}. Potential resistance is expected around $60 before a subsequent fall back into wave {c}, ultimately heading towards wave {ii} of the diagonal.