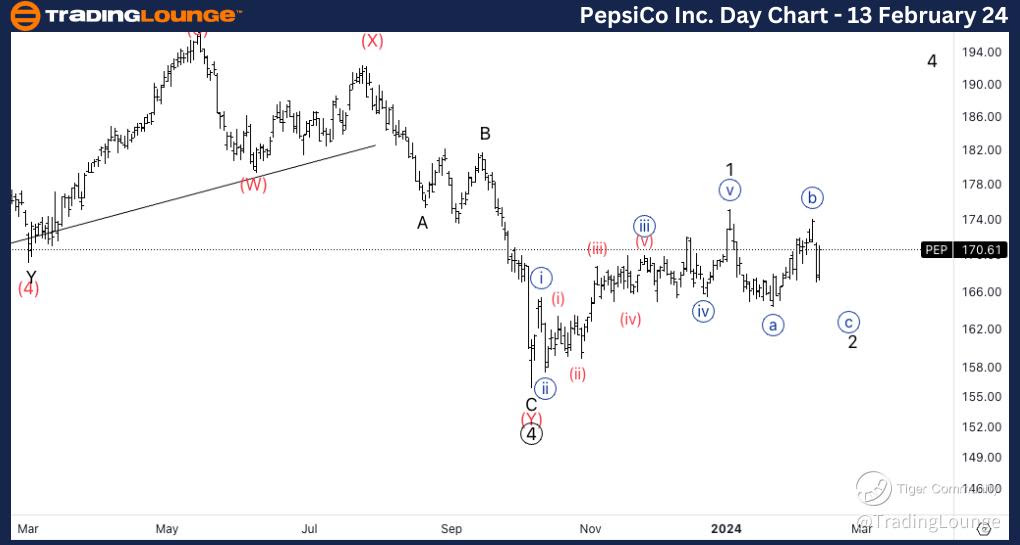

PEP Elliott Wave Analysis Daily Chart, 13 February 24

Pepsico Inc., (PEP) Daily Chart

Pepsico Inc (PEP) Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulse

STRUCTURE: Motive

POSITION: Minor wave 2 of (1).

DIRECTION: Resumption lower before turning higher into wave 3.

DETAILS: Looking for another leg lower into wave {c} to then resume higher. As we are trading below ATH, we are aware we could be in a wave B and not 2, meaning we could expect a three-wave move to the upside(ABC) instead of (123) to the double correct lower.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Berkshire Hathaway Inc. (BRK.B)

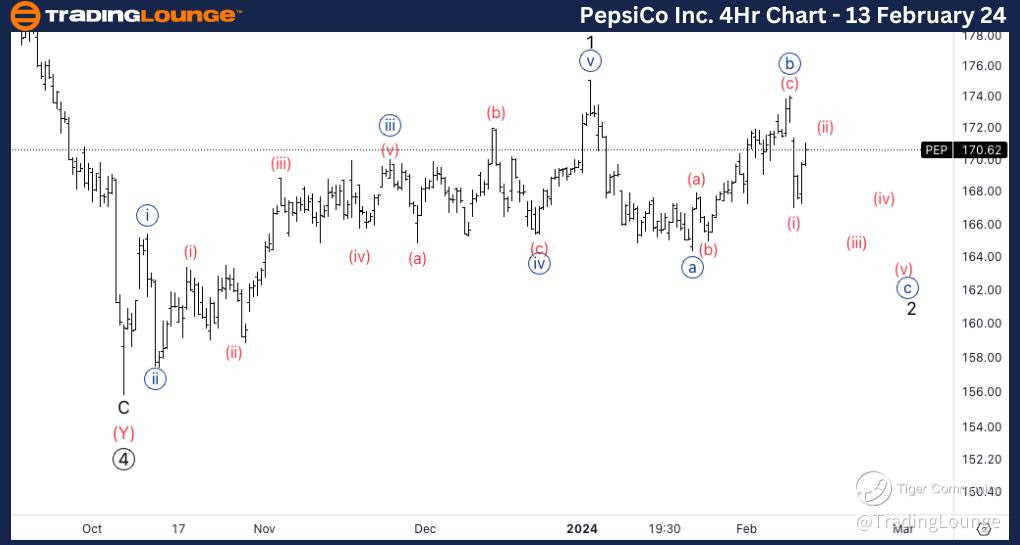

PEP Elliott Wave Analysis Trading Lounge 4Hr Chart, 13 February 24

Pepsico Inc., (PEP) 4Hr Chart

PEP Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave (ii) of {c}

DIRECTION: Downside into wave (iii) of {c}.

DETAILS: Looking for a continuation lower into wave {c} towards the lower end of 160$, to then turn higher.

Welcome to our PEP Elliott Wave Analysis Trading Lounge, your premier destination for insightful analysis of Pepsico Inc. (PEP) using Elliott Wave Technical Analysis. As of the Daily Chart on 13th February 2024, we delve into pivotal trends guiding the market.

* BRK.B Elliott Wave Technical Analysis – Daily Chart*

In terms of wave dynamics, we discern a dominant impulse function with a motive structure. The current position is in Minor wave 2 of (1), indicating a temporary resumption lower before turning higher into wave 3. Our focus is on anticipating another leg lower into wave {c} before the expected upward movement resumes. It's important to note that trading below All-Time Highs (ATH) suggests the possibility of being in a wave B rather than 2, which could result in a corrective ABC pattern instead of a bullish 123 pattern, potentially followed by another corrective move lower.

* BRK.B Elliott Wave Technical Analysis – 4Hr Chart*

Here, the wave function adopts a counter trend approach with a corrective mode, reflecting a flat structure. The present position is in Wave (ii) of {c}, indicating a downside movement into wave (iii) of {c}. We anticipate continuation lower into wave {c}, targeting the lower end around $160, before expecting a reversal and upward movement.