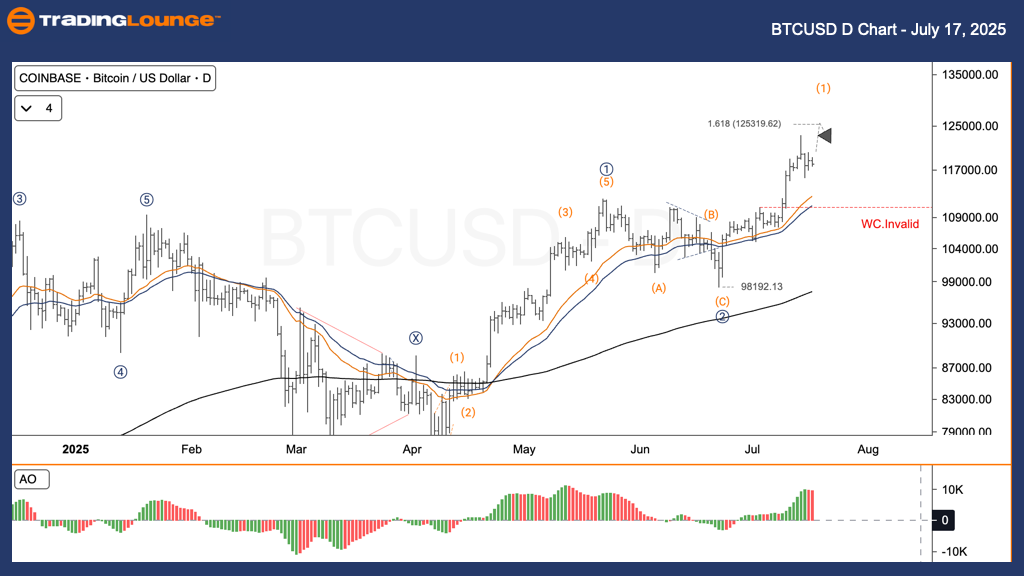

Bitcoin / U.S. Dollar (BTCUSD) Elliott Wave Analysis – TradingLounge Daily Chart

BTCUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 1

Wave Cancel Invalid Level: Not Specified

Bitcoin Price Analysis and Strategy – Daily Timeframe

Bitcoin (BTCUSD) is progressing through an impulsive bullish wave (1) since surpassing the W–X–Y corrective structure in April. Currently, it's approaching the critical resistance, known as the Fibonacci 1.618 extension zone—frequently where impulse waves encounter strong selling pressure. The wave (1) rally initiated from the post-correction low of 74,773.69 and has been forming a clean 5-wave pattern: sub-waves 1–2–3–4–5. The current market activity is unfolding in the final leg of this wave (1) pattern.

Trading Strategy for BTCUSD

✅ Short-Term Strategy (Swing Trading)

Watch closely for the formation of wave (2). If wave (2) consolidates near strong support levels, it may provide a strategic buy opportunity aligned with the broader bullish momentum.

🟥 Wave Count Invalidation

If BTCUSD drops below 98,192.13, the current Elliott Wave count becomes invalid, requiring a fresh structural analysis.

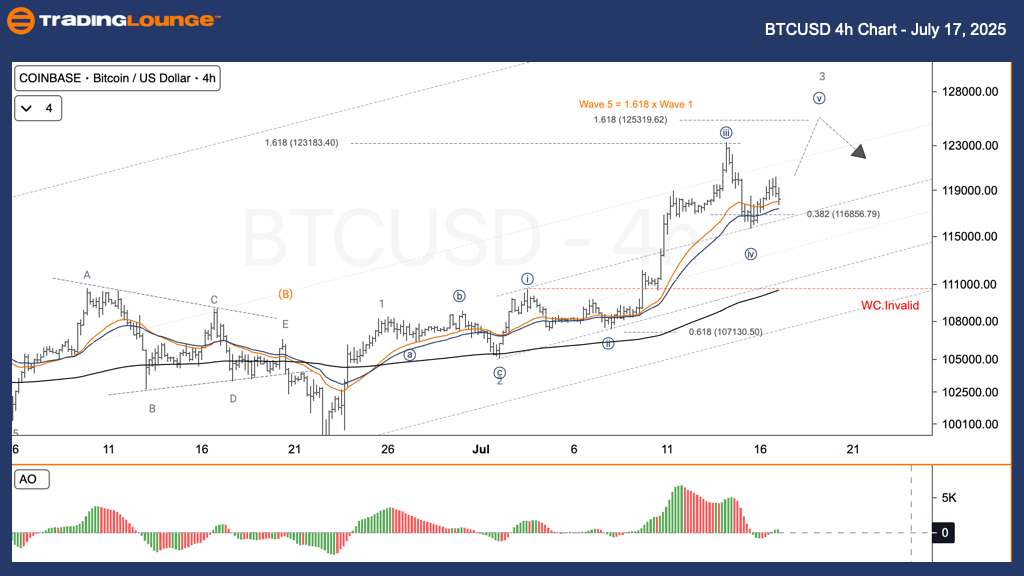

Bitcoin / U.S. Dollar (BTCUSD) Elliott Wave Analysis – TradingLounge H4 Chart

BTCUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave V

Wave Cancel Invalid Level: Not Specified

Bitcoin Price Outlook and Strategy – 4-Hour Chart

Bitcoin continues its bullish impulse structure in the 4-hour chart. The cryptocurrency is now within wave iv of the broader wave (1), setting the stage for a possible push higher via wave v. Wave iii has already peaked above $122,000, and wave iv is undergoing a corrective phase. Current support aligns closely with the 0.382 Fibonacci retracement at 118,656.79, a key technical level.

BTCUSD Swing Trade Strategy

✅ Short-Term Strategy (Swing Trading)

Anticipate a potential bounce from the wave iv support zone. This could provide a favorable entry point into wave v for bullish continuation.

🟥 Wave Count Invalidation

(No specific invalidation level has been defined for this chart setup.)

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: VETUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support