ASX: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis – TradingLounge

Greetings,

This Elliott Wave forecast for Newmont Corporation (ASX:NEM) highlights its current bullish trend, indicating progress within a strong Wave 3 structure. Based on our latest technical analysis, this phase presents ongoing upside potential. The following report details Elliott Wave targets and invalidation levels for assessing the stock’s strength and trading opportunities.

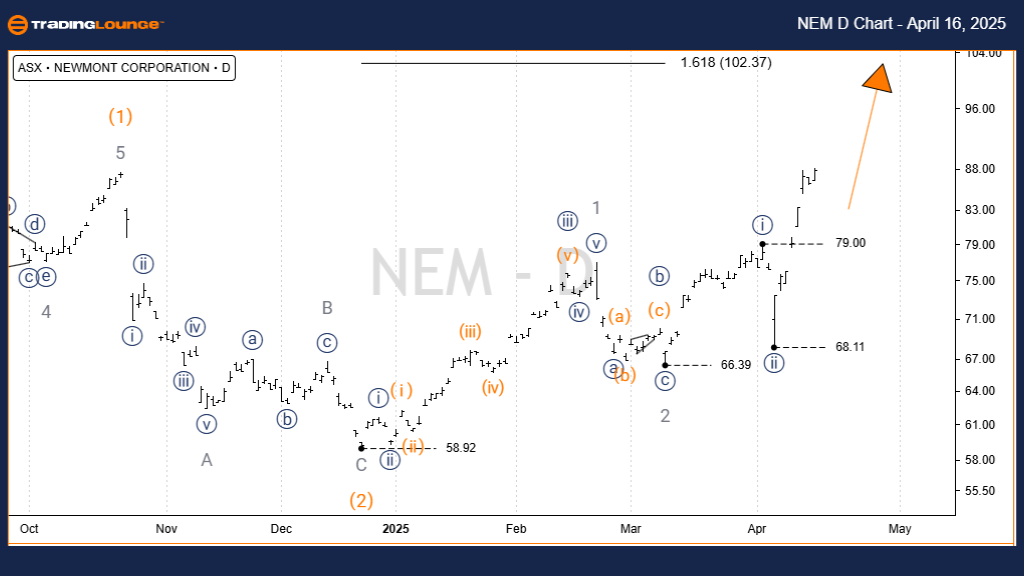

ASX: NEWMONT CORPORATION – NEM 1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave 3 - grey of Wave (3) - orange

Details:

Wave (2) - orange completed near 58.92, marking the beginning of a new bullish phase in Wave (3) - orange. This upward impulse is unfolding into sub-waves: Wave 1 - grey, Wave 2 - grey, and the currently active Wave 3 - grey. Key near-term resistance is projected at $100.00, with an extended bullish target at $102.37.

Invalidation Point: 68.11

ASX: NEWMONT CORPORATION – NEM 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - navy of Wave 3 - grey

Details:

Since the $58.92 low, Wave (3) - orange has shown consistent bullish development. Within this broader wave, Wave ((iii)) - navy is currently unfolding, with price action aiming toward the $102.37 level. To confirm this impulsive move, the price must stay above the $79.00 threshold to prevent overlap between Wave ((iv)) - navy and Wave ((i)) - navy.

Invalidation Point: 79.00

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: AMCOR PLC – AMC Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis for ASX: NEWMONT CORPORATION – NEM offers strategic insights into the prevailing uptrend and potential bullish targets. Clear validation and invalidation points enhance the accuracy of this wave count, supporting better-informed trading decisions. Traders can use this analysis to confidently monitor market conditions and capitalize on high-probability setups in Newmont’s price action.