AMCOR PLC – AMC Elliott Wave Technical Analysis

Introduction:

Welcome to today’s Elliott Wave forecast for AMCOR PLC (ASX: AMC). AMC has recently concluded its second corrective phase, unfolding as a Double Zigzag pattern. This structure sets the stage for a third motive wave, typically the most powerful in Elliott Wave terms, hinting at a bullish trend. This technical review highlights the potential upside and outlines the detailed Elliott Wave count behind this scenario.

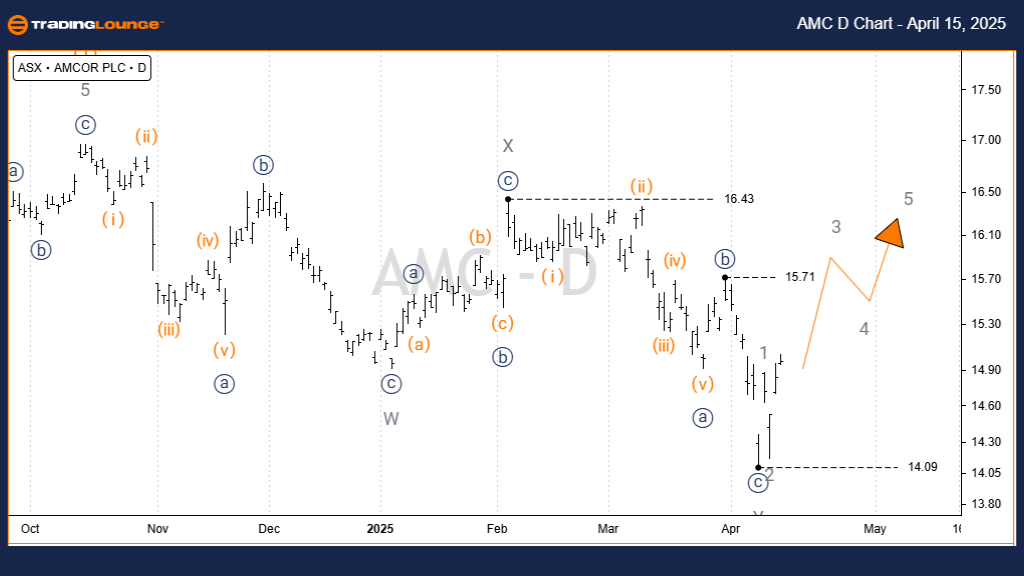

AMCOR PLC – AMC Elliott Wave Technical Analysis TradingLounge (1D Chart – Semilog Scale)

Function: Major Trend (Intermediate Degree – Orange)

Mode: Motive

Structure: Impulse

Position: Wave (3) – Orange

Details:

- Wave (1) – Orange: Successfully completed.

- Wave (2) – Orange: Recently finalized as a Double Zigzag (W, X, Y – Grey).

- Now entering Wave (3) – Orange, with upward price action gaining traction.

Invalidation Point: 14.11

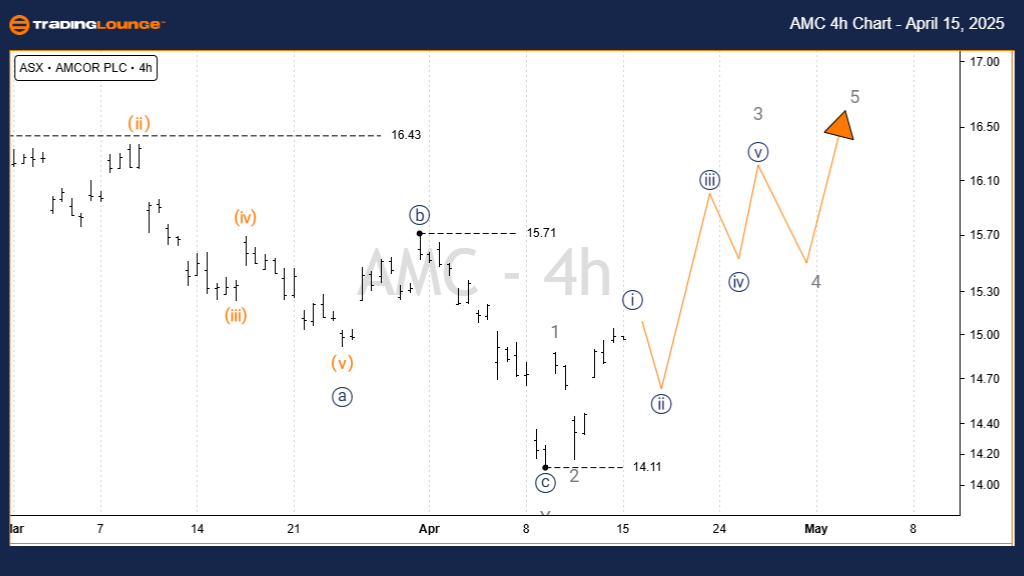

AMCOR PLC – AMC Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

Function: Major Trend (Minor Degree – Grey)

Mode: Motive

Structure: Impulse

Position: Wave i)) – Navy of Wave 3 – Grey of Wave (3) – Orange

Details:

- Wave Y – Grey of Wave (2) – Orange concluded as a Zigzag, signaling the end of the correction.

- From the 14.11 level, waves 1, 2, and 3 – Grey are developing.

- Currently, Wave 3 – Grey is in progress, subdividing into five waves (i)) to v)) – Navy.

- Price action suggests continuation of the upward impulse.

Invalidation Point: 14.11

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis for AMCOR PLC – AMC offers a data-driven view on the ongoing bullish wave cycle. With the correction completed and impulse waves forming, traders can monitor key levels for confirmation. By leveraging wave counts and invalidation points, this forecast supports informed trading strategies aligned with the broader market trend. Stay tuned for further updates as AMC develops within this emerging structure.