ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

Greetings, Welcome to today’s Elliott Wave update on the Australian Stock Exchange (ASX) for CAR GROUP LIMITED – CAR, focusing on its potential bullish setup and key technical levels.

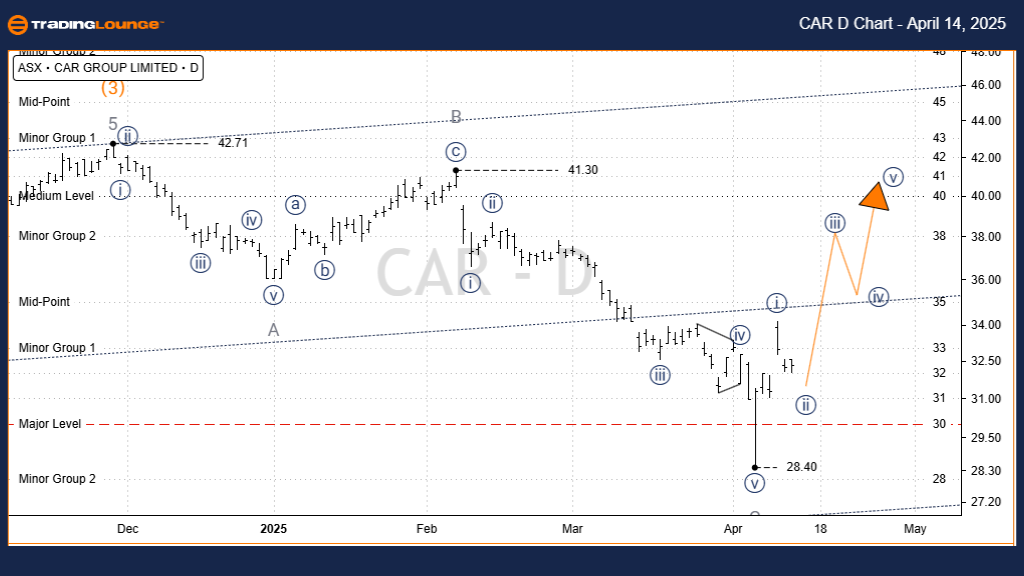

ASX: CAR GROUP LIMITED Elliott Wave Analysis – TradingLounge 1D Chart

ASX: CAR GROUP LIMITED – CAR – 1D Chart (Semilog Scale) Analysis

Function: Major trend (Intermediate degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave (5) - orange

Details:

CAR GROUP LIMITED (ASX: CAR) appears to have completed wave (4) - orange in a classic Zigzag correction, unfolding after the high near 42.71 and terminating at 28.40. This corrective move includes an A-B-C (grey) sequence, with wave C - grey showing a full five-wave internal structure. This pattern strongly suggests that wave (5) - orange has now commenced. The first leg, wave i)) - navy, is nearing completion, implying an imminent move higher via wave iii)) - navy.

Invalidation Point: 28.40 – Price must stay above this level to confirm the bullish impulse structure.

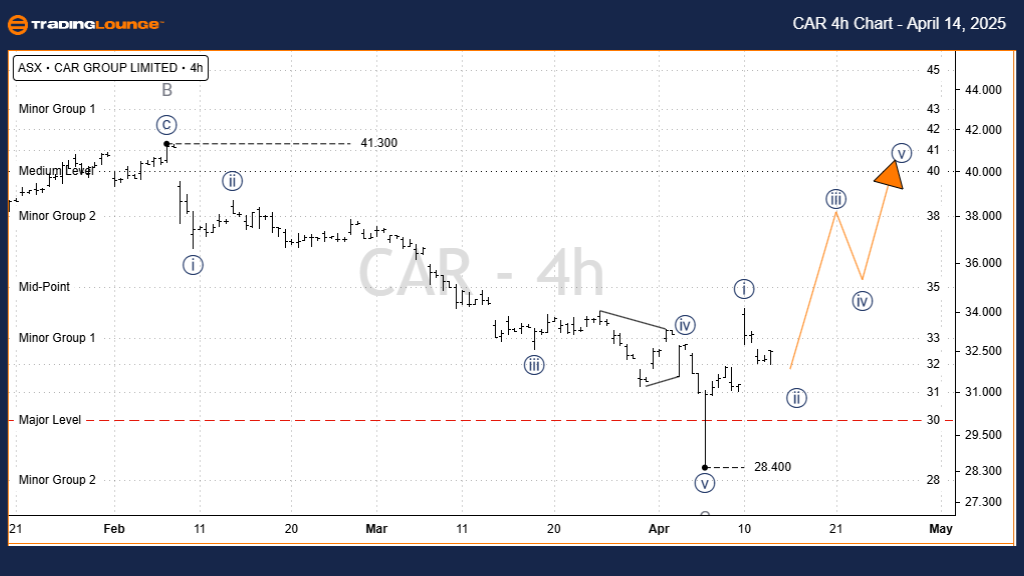

ASX: CAR GROUP LIMITED – CAR – 4-Hour Chart Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((ii)) - navy of Wave (5) - orange

Details:

Following the low of 28.40, wave i)) - navy has completed as the initial move of wave (5) - orange. Currently, wave ii)) - navy is unfolding as a pullback and may still be developing. Once this corrective leg concludes, wave iii)) - navy is anticipated to rally, with a potential target retest near 41.30.

Invalidation Point: 28.40 – The sustained price action above this level supports the continuation of the bullish wave count.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: SUNCORP GROUP LIMITED – SUN Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis of ASX: CAR GROUP LIMITED – CAR provides a clear forecast within a larger bullish trend. By identifying the completion of wave (4) - orange and the potential rise in wave (5) - orange, we offer traders key levels to watch. The 28.40 support acts as a crucial invalidation marker. Use this technical roadmap to support confident and strategic trading decisions.