JAMES HARDIE INDUSTRIES PLC (JHX) Elliott Wave Technical Analysis – TradingLounge

Greetings,

Our latest Elliott Wave forecast delivers an updated technical outlook on JAMES HARDIE INDUSTRIES PLC (ASX: JHX), a key stock listed on the Australian Stock Exchange (ASX).

We see bullish momentum building in ASX:JHX, signaling a strong probability of an upward breakout. This analysis will identify critical price levels that validate the beginning of a Wave Three bull market trend.

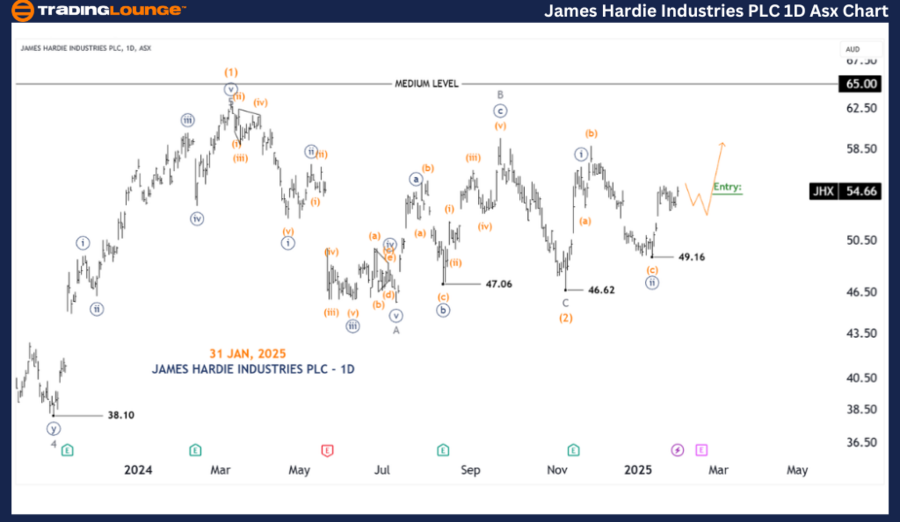

JAMES HARDIE INDUSTRIES PLC (JHX) - 1D Chart Analysis

JHX Elliott Wave Technical Analysis

Function: Major trend (Intermediate degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((iii)) - Navy of Wave (2) - Orange

Details:

✔ Wave ((ii)) - Navy concluded as an Expanded Flat at the 46.16 low.

✔ Wave ((iii)) - Navy is currently advancing upward, confirming the trend continuation.

✔ We anticipate a minor corrective pullback, creating a potential buying opportunity before a stronger rally.

✔ Invalidation Level: 49.16 – A break below this level negates the bullish scenario.

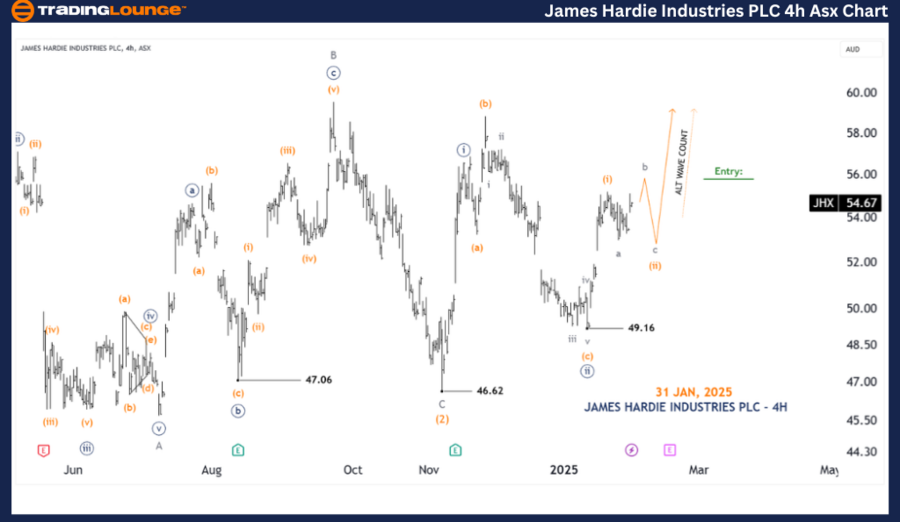

JAMES HARDIE INDUSTRIES PLC (JHX) – 4-Hour Chart Analysis

ASX: JHX Elliott Wave Technical Analysis

Function: Major trend (Minor degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave (ii) - Orange of Wave ((iii)) - Navy

Details:

✔ Price action from 49.16 suggests Wave (i) - Orange has likely completed.

✔ Wave (ii) - Orange is currently unfolding as an Expanded Flat pattern, expected to complete soon.

✔ Upon completion, Wave (iii) - Orange is projected to resume the upward trend, reinforcing the bull market outlook.

✔ Invalidation Level: 49.16 – A break below this level would require a reassessment of the Elliott Wave structure.

✔ Key Level to Watch: The end of Wave b - Grey, which could determine the next bullish impulse.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WISETECH GLOBAL LIMITED (WTC) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis on JAMES HARDIE INDUSTRIES PLC (JHX) offers an in-depth perspective on current price action and future market direction. By identifying key validation and invalidation levels, we strengthen our bullish Elliott Wave projections.

Through technical precision and structured analysis, our objective is to equip traders and investors with actionable market insights to navigate ASX:JHX trading strategies effectively.