GX Uranium ETF Elliott Wave Analysis

After surpassing the May 2024 high in October, GX URA ETF began correcting the bullish impulse that initiated in August 2024. The current pullback has reached a critical Fibonacci retracement zone, suggesting a potential bounce that could propel the long-term bullish trend higher. Traders are closely monitoring this zone for confirmation of further upside momentum.

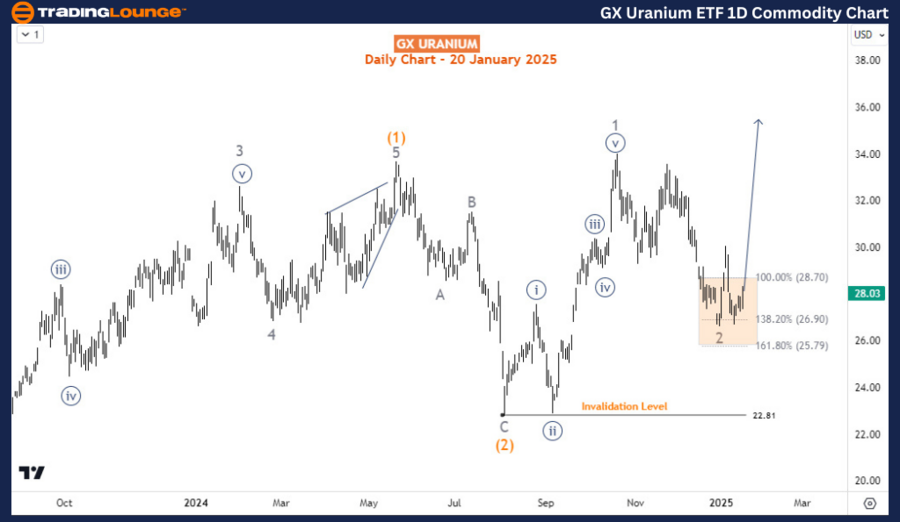

GX URA ETF Daily Chart Insights

In the long-term perspective, GX URA ETF is undergoing a correction of the bearish impulse pattern that spanned from February 2011 to March 2020. This corrective phase completed wave ((A)) in November 2021 and wave ((B)) in July 2022, leading to the development of wave ((C)).

The daily chart analysis indicates the completion of waves (1) and (2) of wave ((C)) in May 2024 and August 2024, respectively. The rally from August 2024, which broke above the May 2024 high, is identified as wave 1 of (3). The ongoing pullback from October 2024 is considered wave 2 of (3). As long as the 22.81 support level holds, bullish traders can anticipate upward momentum, potentially driving prices higher in the upcoming weeks.

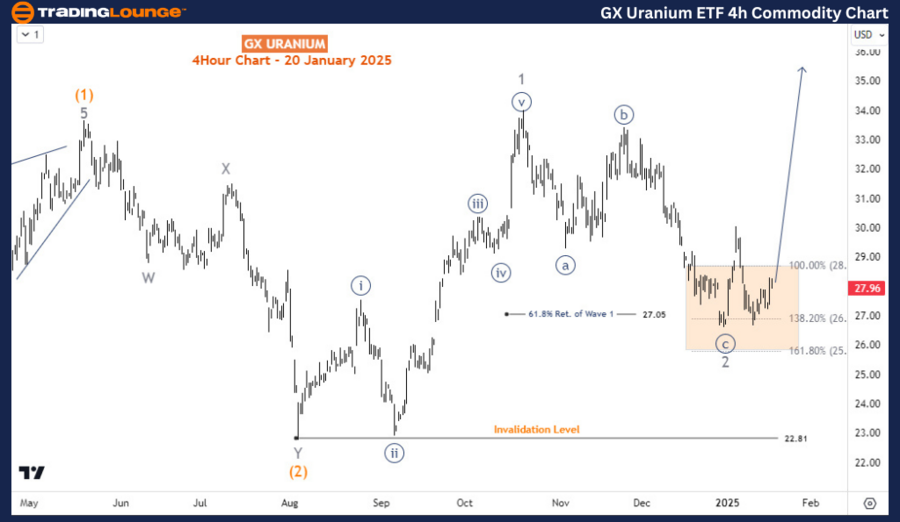

GX URA ETF H4 Chart Overview

The H4 chart analysis provides a closer look at the sub-waves of waves 1 and 2. The current pullback is approaching a critical Fibonacci support zone between 28.7 and 25.79. If this zone remains intact, it could reinforce bullish sentiment, paving the way for a rally in wave 3 of (3) toward the $42 mark in the coming weeks. The outlook remains bullish, with short- and medium-term upside potential favored.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Coffee Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support