Coffee Elliott Wave Analysis

Coffee has recently broken past the May 2011 high, which was established over 13 years ago. With this breakout, the commodity has achieved a fresh record high, even surpassing the historical peak from March 1977. Over the past year, coffee prices have surged approximately 80%, making it one of the most lucrative commodities for investors. As this rally reaches new heights, the pressing question is: where could the next resistance for this commodity emerge?

Coffee Long-Term Analysis

From a broader perspective, the all-time chart for coffee, dating back to the early 1970s, reveals a sideways, corrective, and choppy trend. Following the completion of a bearish zigzag structure in May 2019, coffee embarked on a new corrective zigzag structure to the upside. Starting from May 2019, the price completed wave W of the cycle degree by February 2022, which was followed by a wave X pullback of the same degree in January 2023.

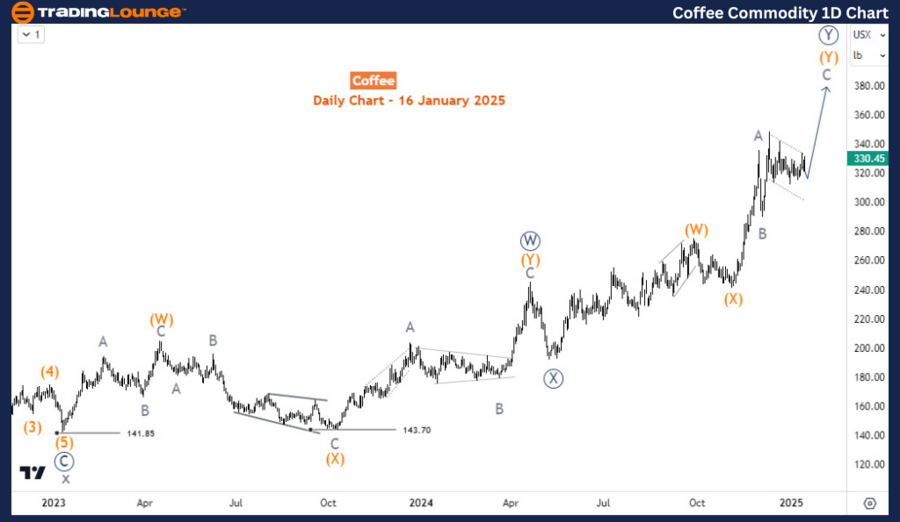

Coffee Daily Chart Analysis

Since January 2023, the cycle degree wave Y has unfolded as a double zigzag structure, completing waves ((W)) and ((X)) in April and May 2024, respectively. The price is now in wave ((Y)), as indicated by the daily chart. Within wave ((Y)), the structure shows completed waves (W) and (X), with the price currently advancing within wave C of (Y). We anticipate wave ((Y)) to conclude within the 317.65–425 range. While the price has already entered this zone, the wave structure appears incomplete, suggesting potential upward movement to 358 or even higher. This scenario implies that buyers may still find opportunities to enter the market during pullbacks for higher price targets.

Coffee H4 Chart Analysis

On the H4 chart, the price action suggests wave ((ii)) of C may be complete. Alternatively, the price could dip further in a double zigzag toward 298. However, as long as the 290.35 level remains intact, wave ((iii)) is expected to extend upward along the trajectory of wave C of (Y) within ((Y)). This setup supports a bullish outlook, with potential for higher prices in the near term.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Soybean Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support