PYPL Elliott Wave Technical Analysis: Future Price Movements & Key Levels

This Elliott Wave analysis of PayPal Holdings Inc. (PYPL) examines both the daily and 1-hour chart structures, identifying the prevailing market trends and potential future price action.

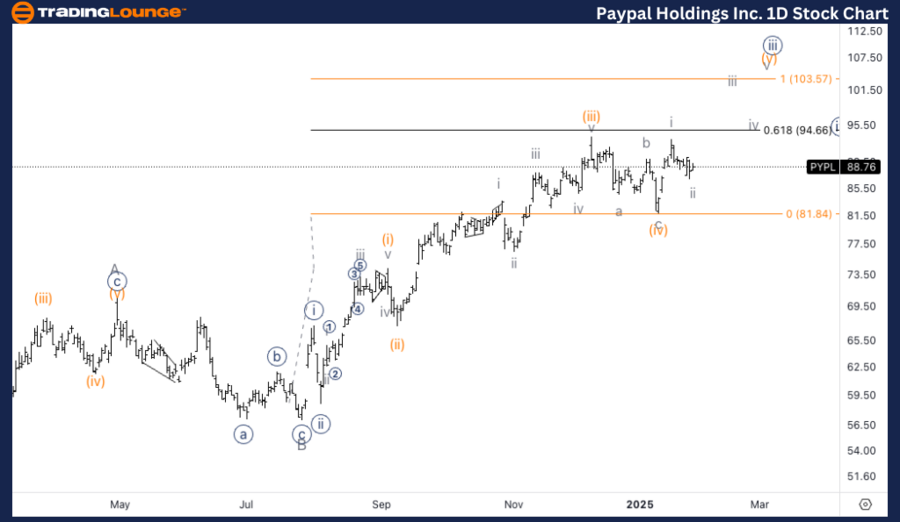

PYPL Elliott Wave Analysis – Daily Chart

PayPal Holdings Inc. (PYPL) Daily Chart Overview

PYPL Technical Analysis

- Function: Trend

- Mode: Corrective

- Structure: Impulsive

- Position: Wave {iii} of C

- Direction: Upside in wave {iii}

Analysis:

PayPal Holdings Inc. (PYPL) is displaying bullish momentum within Minute wave {iii}, as price action continues its upward movement. The stock is trending higher, targeting TradingLevel1 at $100, where we anticipate a larger pullback, potentially forming wave {iv} before the uptrend resumes.

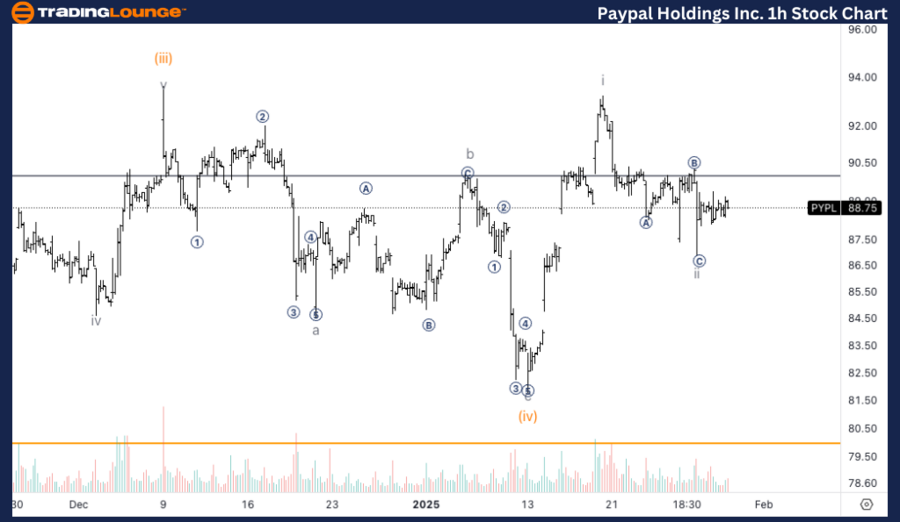

PYPL Elliott Wave Analysis – TradingLounge 1H Chart

PayPal Holdings Inc. (PYPL) 1-Hour Chart Overview

PYPL Elliott Wave Technical Analysis

- Function: Trend

- Mode: Corrective

- Structure: Impulsive

- Position: Wave ii of (v)

- Direction: Bottom in wave ii

PYPL Stock Analysis:

On the 1-hour chart, wave ii appears to have bottomed, with a three-wave move confirmed within wave iii. This suggests that further upside potential remains in play, with wave iii expected to continue developing in the upcoming sessions.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Salesforce Inc. (CRM) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

By applying Elliott Wave Theory, traders can anticipate key support and resistance levels, aiding in precise entry and exit strategies. Keep an eye on wave {iii}'s development and potential reactions at TradingLevel1 ($100) for further trading opportunities.