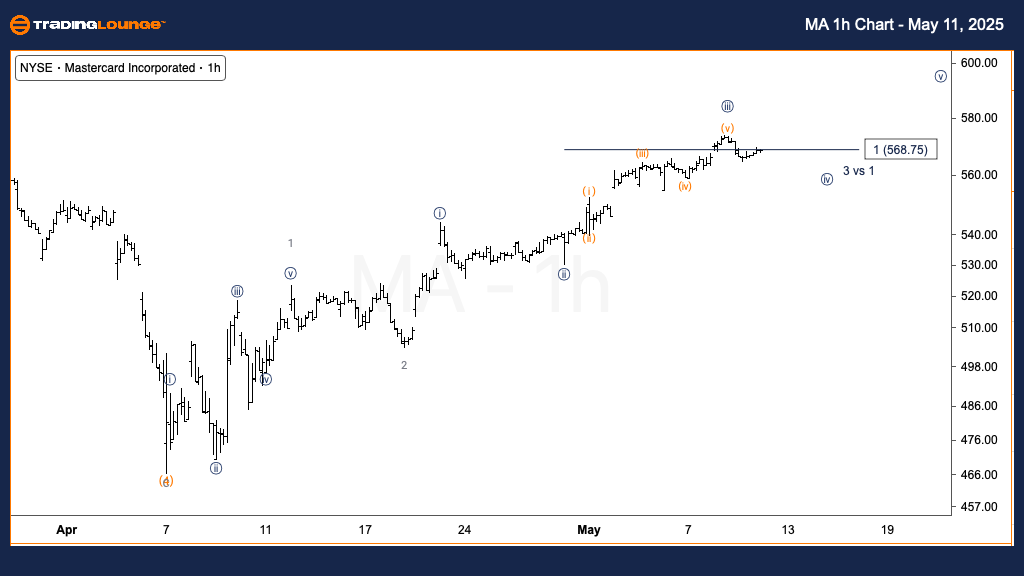

Mastercard Inc. (MA) Elliott Wave Analysis - TradingLounge Daily Chart

MA Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave 3

DIRECTION: Upside in wave 3

DETAILS: Minor wave 3 is progressing higher as Mastercard approaches its previous all-time high (ATH). A key technical resistance zone lies near $650, which could act as the potential termination point of wave 3.

Mastercard Inc. (NYSE: MA) shows continued bullish momentum on the daily chart within an Elliott Wave impulsive structure. The stock is currently advancing in Minor wave 3, aiming to breach its former ATH. Analysts and traders closely watch the $650 resistance level, as it may represent the peak of this current wave 3. A rejection here could lead to a corrective wave 4, potentially offering a buying opportunity before the next bullish leg begins.

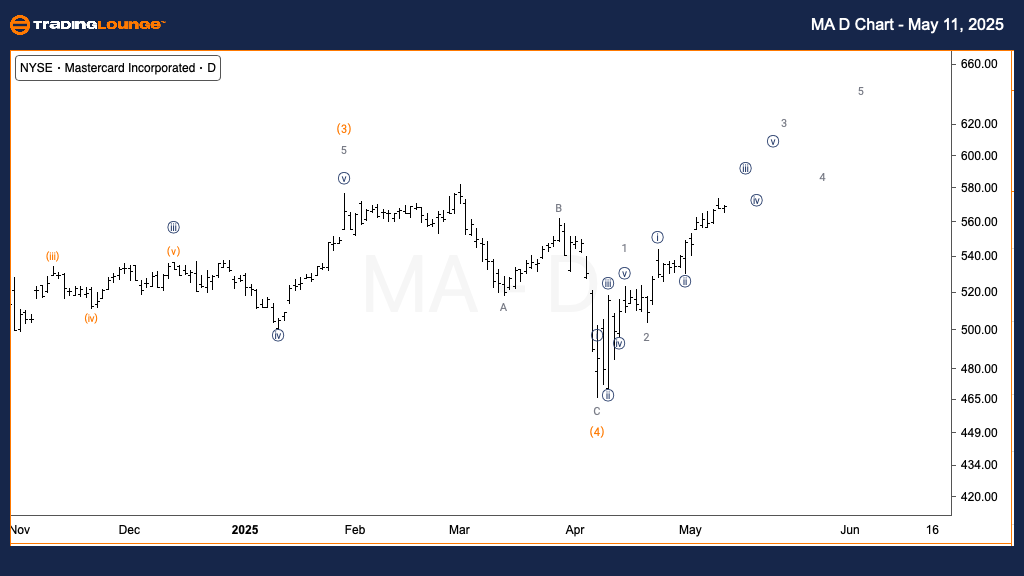

Mastercard Inc. (MA) Elliott Wave Analysis - TradingLounge 1-Hour Chart

MA Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave {iii} of 3

DIRECTION: Potential top in wave {iii}

DETAILS: Wave {iii} may be nearing completion, suggesting a probable retracement in wave {iv}. Given the proportionality between waves {i} and {iii}, a possible extension in wave {v} may follow after the pullback.

On the 1-hour chart, Mastercard stock (ticker: MA) appears to be concluding wave {iii} within the broader wave 3 sequence. A short-term decline in wave {iv} could soon develop, consistent with standard Elliott Wave principles. If confirmed, this move would precede a bullish extension in wave {v}, reinforcing the strong uptrend visible on higher timeframes. Traders should monitor this potential setup for a continuation of the upward momentum.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Spotify Technology S.A. (SPOT) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support