Salesforce Inc. (CRM) Elliott Wave Technical Analysis – Trading Lounge

This analysis examines the current price structure of Salesforce Inc. (CRM) using Elliott Wave Theory on both the daily and 1-hour charts. Below is an in-depth breakdown of CRM's wave position and potential future price movements.

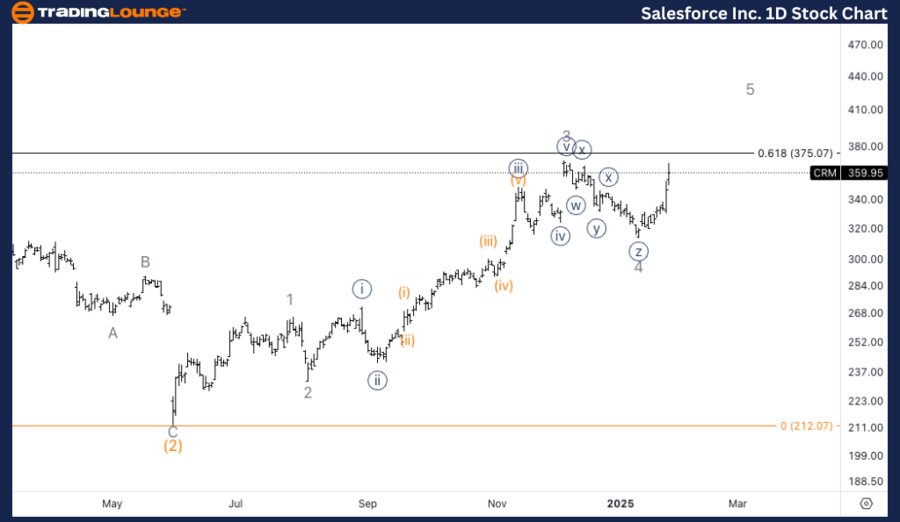

Salesforce Inc. (CRM) – Daily Chart Analysis

CRM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 5 of (3)

Direction: Upside in Wave 5

Technical Insights:

The daily chart suggests continued upside momentum as CRM moves within wave 5 of (3). There is strong potential for further gains, and an alternative scenario suggests that the entire move since June 2023 could belong to a lower-degree count. This interpretation implies that CRM may currently be completing wave 1 of (3), setting the stage for strong bullish momentum in the upcoming phases.

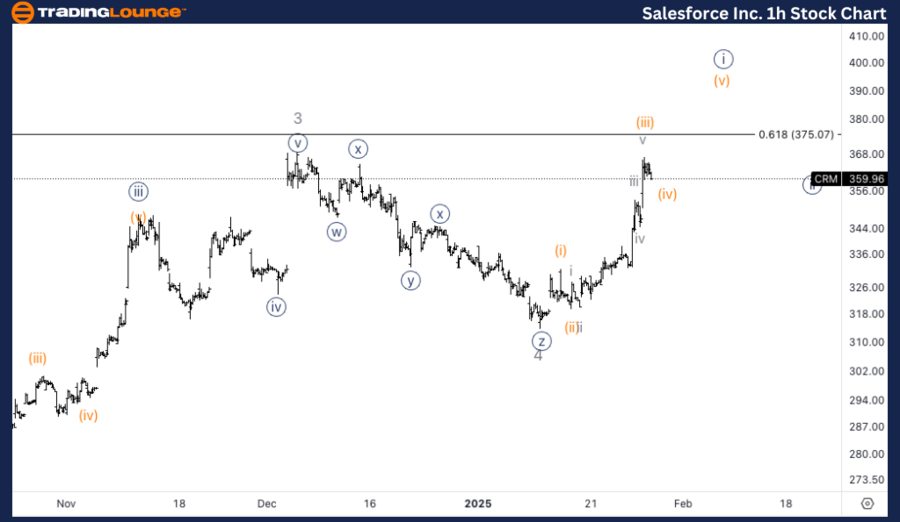

Salesforce Inc. (CRM) – 1H Chart Analysis

CRM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 5

Direction: Completion in Wave {i}

Technical Insights:

On the 1-hour chart, CRM appears to be completing wave {i} within wave 5, suggesting an imminent pullback in wave {ii} before the bullish trend resumes. The price may face resistance near the MG2 level at $380, which could serve as a key decision point before the stock continues its upward trajectory.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Fortinet Inc. (FTNT) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support