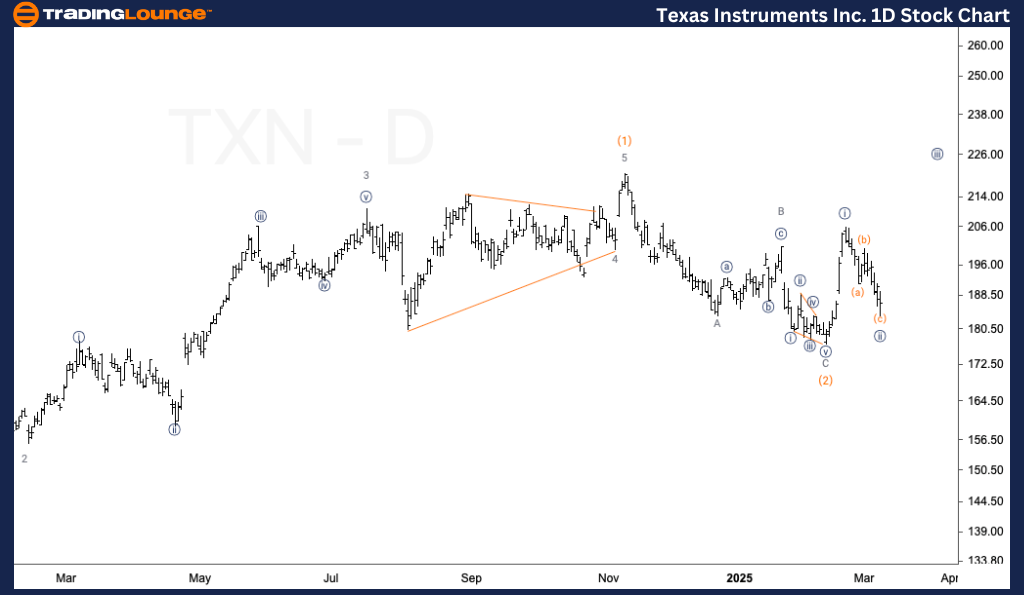

Texas Instruments Inc. (TXN) Elliott Wave Analysis - TradingLounge Daily Chart

TXN Daily Chart – Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {ii} of 1

Direction: Possible bottom in wave {ii}

Texas Instruments Inc Stock Analysis Details:

Texas Instruments Inc. (TXN) appears to have formed a key bottom in wave (2). However, if the stock price continues declining, there is an increasing probability of a double correction in Intermediate wave (2). If this bottom holds, the next move is likely an upside rally, aligning with the Elliott Wave principle's trend-following behavior.

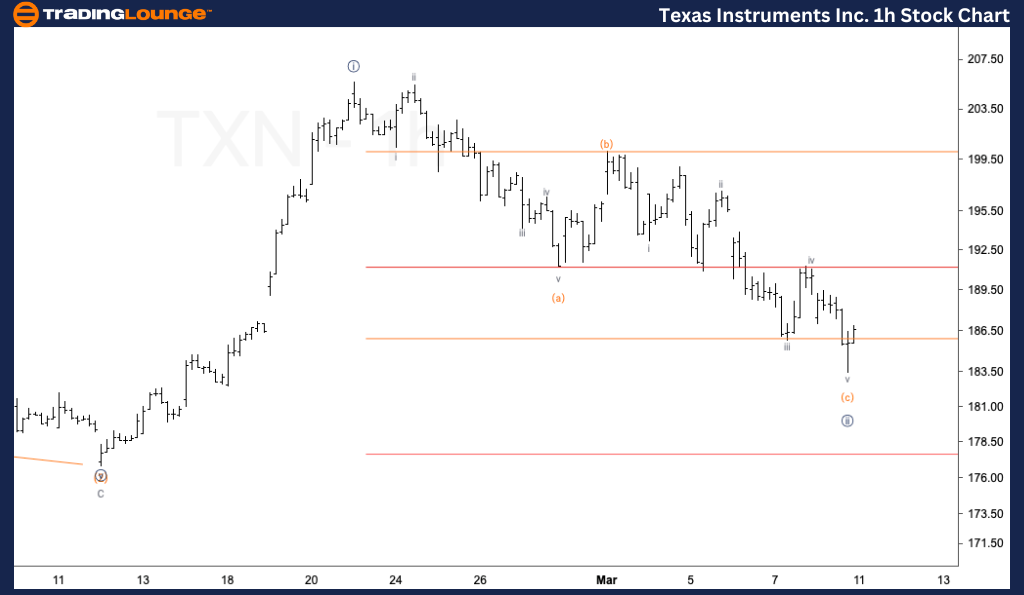

Texas Instruments Inc 1-Hour Chart Analysis

TXN – Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (c) of {ii}

Direction: Downside in wave (c)

Analysis Details:

On the 1-hour chart, TXN is showing potential signs of forming a bottom as wave (c) nears completion. The five-wave count in wave (c) aligns with the wave (c) = wave (a) ratio, suggesting wave {ii} is close to ending. If price action confirms a reversal, an upward move may follow, marking the beginning of a new bullish cycle.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Walmart Inc Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis of Texas Instruments (TXN) evaluates both daily and 1-hour charts to identify key trend developments. The daily chart suggests wave {ii} may have reached a significant bottom, though a double correction remains possible if downward momentum persists. The 1-hour chart further supports this outlook by indicating wave (c) completion, aligning with anticipated price movements.

Traders should monitor price action closely for confirmation of an upside move before entering new positions. Staying aligned with Elliott Wave principles can help navigate market trends effectively.