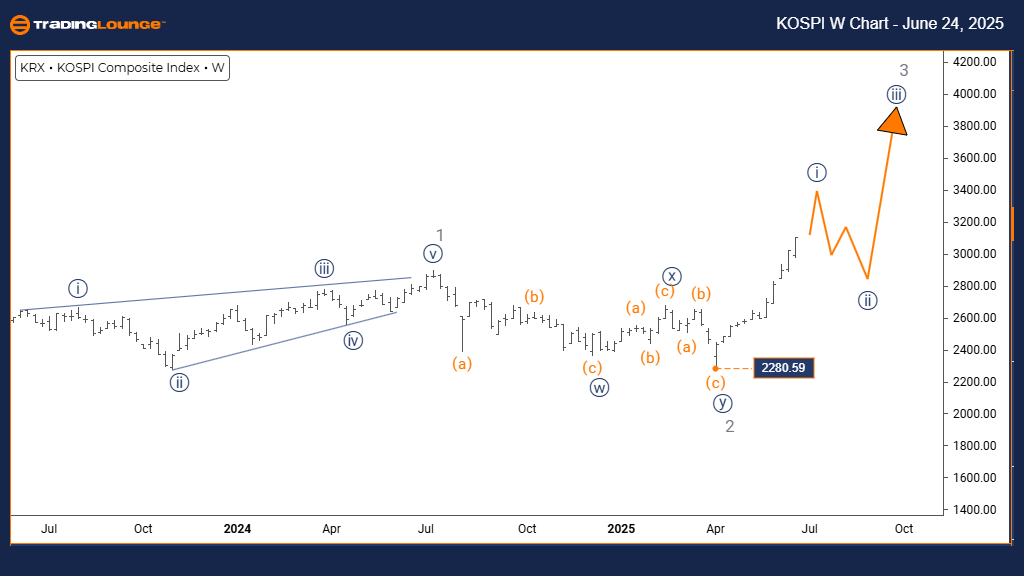

KOSPI Composite Elliott Wave Forecast – Trading Lounge Daily Chart

KOSPI Elliott Wave Technical Analysis

FUNCTION: Bullish Momentum

MODE: Impulsive Structure

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS:

The corrective Gray Wave 2 looks complete. Now initiating is Navy Blue Wave 1 of 3.

Invalidation Level: 2280.59

Daily Elliott Wave analysis of the KOSPI Composite Index indicates a bullish structure. The price is advancing impulsively, signaling strong buyer activity. Currently, Navy Blue Wave 1 is unfolding within a larger Gray Wave 3 movement.

The shift from Gray Wave 2 to Navy Blue Wave 1 suggests a renewed upward leg in the Elliott Wave sequence. The anticipated next move is Navy Blue Wave 2, typically a short-term retracement that follows an initial push.

Monitor the 2280.59 level closely—any drop below this would invalidate the wave count. If the support holds, the pattern implies ongoing bullish action.

Overall, technical indicators show that KOSPI may continue its uptrend. The impulsive structure adds weight to a positive outlook as Gray Wave 3 evolves.

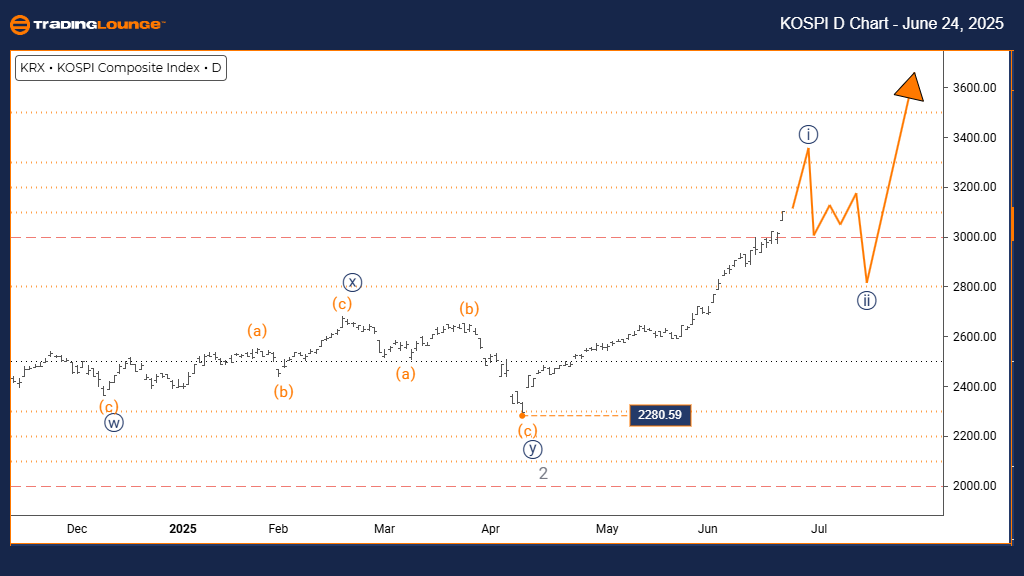

KOSPI Composite Elliott Wave Forecast – Trading Lounge Weekly Chart

KOSPI Elliott Wave Technical Analysis

FUNCTION: Bullish Momentum

MODE: Impulsive Structure

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS:

Gray Wave 2 seems to have concluded. Navy Blue Wave 1 of 3 is gaining ground.

Invalidation Level: 2280.59

The weekly Elliott Wave chart for the KOSPI Composite reaffirms the ongoing bullish trend. The impulsive setup continues with Navy Blue Wave 1 progressing inside Gray Wave 3—an early stage of a potential long-term rally.

Completion of Gray Wave 2 sets the stage for a strong Navy Blue Wave 1 advance. After this wave finishes, expect a corrective Navy Blue Wave 2.

Key support at 2280.59 must hold. If breached, the wave count will need to be reassessed. Otherwise, continued upward action is anticipated under this bullish framework.

This Elliott Wave structure supports further upside for the KOSPI Index. Sustained investor interest and technical momentum suggest the index may climb further in the coming weeks and months.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: RUSSELL 2000 Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support