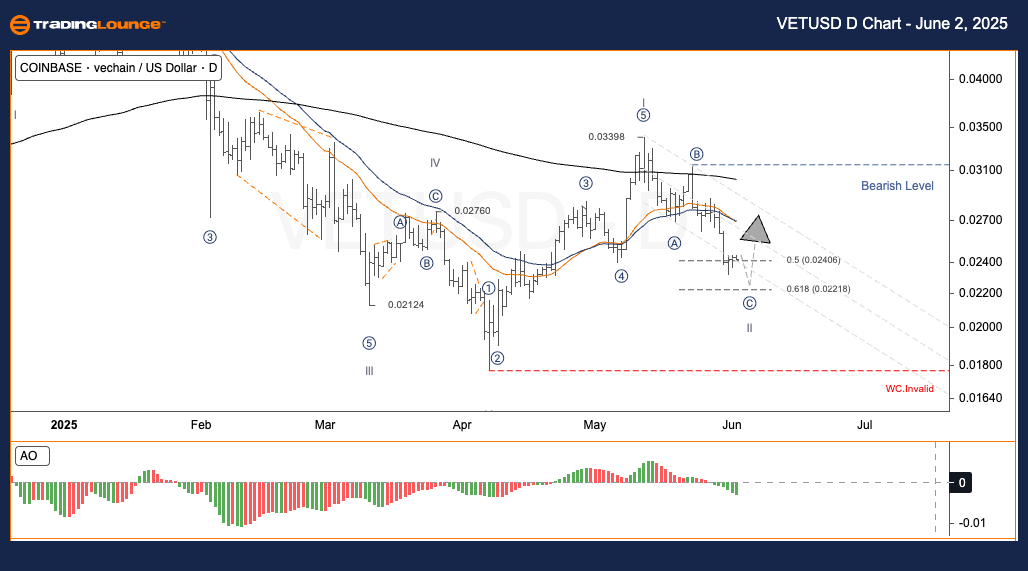

VETUSD Elliott Wave Analysis – TradingLounge Daily Chart

Asset: VeChain / U.S. Dollar (VETUSD) Daily Chart Analysis

VETUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave II

Direction of Higher Degree: Pending

Wave Invalid Level: Not Specified

VETUSD Daily Trading Strategy Overview

After completing the primary Wave V near $0.0212, VETUSD surged to $0.0315, finalizing sub-wave ⑤. This move initiated a classic Elliott Wave A-B-C corrective structure, suggesting a temporary pause in the broader uptrend.

At present, VeChain is likely in the final leg of Wave C. The asset is trading within a crucial Fibonacci retracement zone (0.5–0.618), which historically serves as a strong support area in bullish market corrections.

Trading Strategy for Swing Traders

✅ Buy Opportunity: Monitor price action for bullish reversal signals between $0.022 and $0.024.

Risk Management

🟥 Stop-Loss: Recommended under $0.018 to mitigate downside risk.

VETUSD Elliott Wave Analysis – TradingLounge H4 Chart

Asset: VeChain / U.S. Dollar (VETUSD) 4-Hour Chart Analysis

VETUSD Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave II

Direction of Higher Degree: Pending

Wave Invalid Level: Not Specified

VETUSD H4 Trading Strategy Breakdown

VETUSD rallied from $0.0212 to $0.0315, marking the end of sub-wave ⑤. The pair has since entered an Elliott Wave A-B-C corrective formation, in alignment with the larger bullish momentum.

Wave C appears to be nearing completion, with price consolidating near the 0.5–0.618 Fibonacci support zone. This range frequently acts as a pivot point for bullish reversals post-correction.

Trading Strategy for Swing Traders

✅ Entry Alert: Watch for reversal setups in the $0.022–$0.024 support range.

Risk Management

🟥 Suggested Stop-Loss: Below $0.018 for controlled exposure.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: VETUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support