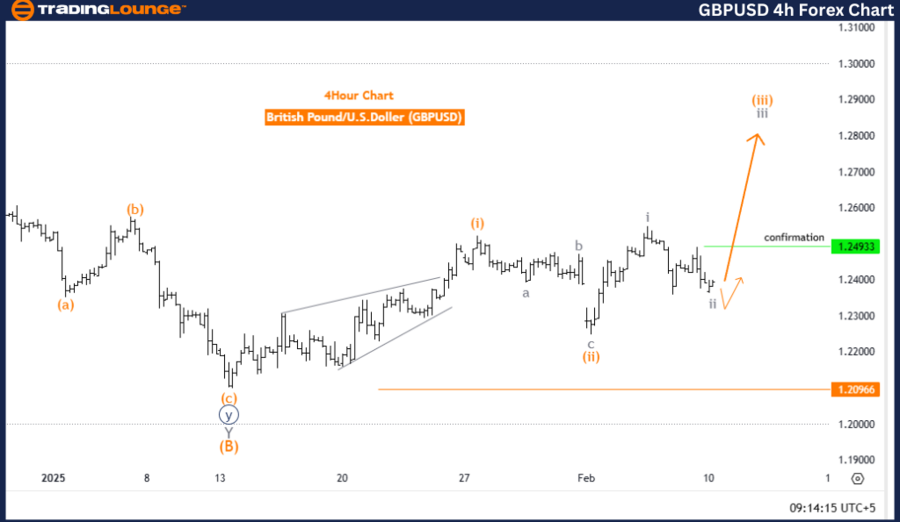

British Pound/ U.S. Dollar (GBPUSD) - TradingLounge Daily Chart

British Pound/ U.S. Dollar Currency Pair Daily Chart Analysis

GBPUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave

Direction Next Lower Degrees: Orange Wave 4

Details: Orange Wave 2 of 3 appears completed; Orange Wave 3 is now in progress.

Wave Cancellation Invalidation Level: 1.20966

GBPUSD Forex Pair Analysis Overview

The GBPUSD Elliott Wave Analysis for the daily chart presents a bullish trend, driven by impulsive market movement. The price structure indicates that Orange Wave 3 is unfolding within the larger Navy Blue Wave, signaling strong upward momentum.

Wave Progression and Key Levels

Summary

The GBPUSD daily chart analysis confirms a bullish Elliott Wave structure, with the pair progressing in Orange Wave 3 within the Navy Blue Wave. The recent completion of Orange Wave 2 supports further upside movement.

📌 Key Takeaways:

✔ Bullish momentum remains intact as long as the price stays above 1.20966.

✔ Orange Wave 3 is expected to push the price higher, followed by Orange Wave 4 as a correction.

✔ This structure provides traders with a roadmap to navigate potential price movements.

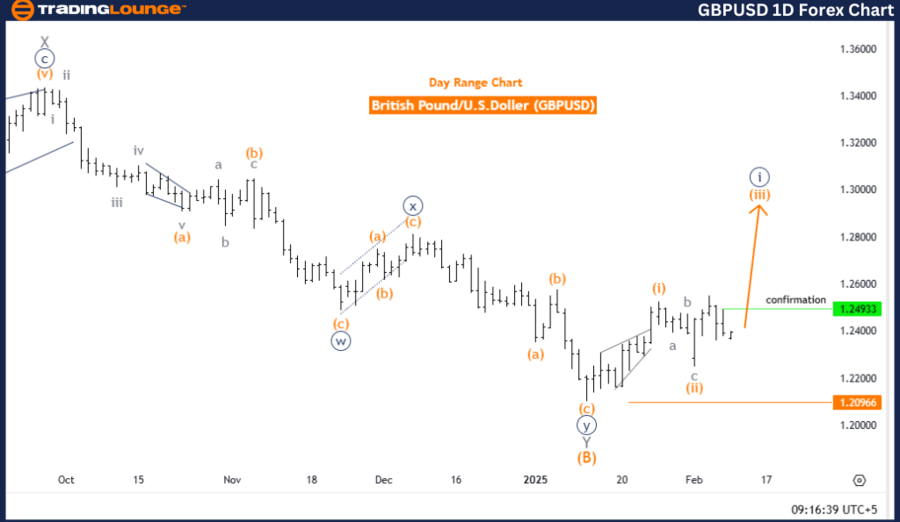

British Pound/ U.S. Dollar (GBPUSD) - 4-Hour Chart

GBPUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 3

Direction Next Higher Degrees: Gray Wave 3 (Started)

Details: Gray Wave 2 of Orange Wave 3 appears completed; Gray Wave 3 is now in progress.

Wave Cancellation Invalidation Level: 1.20966

GBPUSD Currency Analysis Overview

The GBPUSD Elliott Wave Analysis on the 4-hour chart indicates an ongoing bullish trend with an impulsive wave structure. The market is currently developing Gray Wave 3, which forms a segment of the broader Orange Wave 3, reinforcing the bullish sentiment.

Wave Progression and Key Levels

Summary

The GBPUSD 4-hour chart analysis suggests that the currency pair remains in a strong bullish phase, progressing through Gray Wave 3 of Orange Wave 3.

📌 Key Takeaways:

✔ The bullish trend remains intact unless the price drops below 1.20966.

✔ Gray Wave 3 is expected to continue pushing the price higher, confirming strong momentum.

✔ This analysis offers traders a structured outlook to anticipate future price movements.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDCHF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support