TradingLounge Commodity Corn Elliott Wave Technical Analysis

Function: Trend

Mode: Trend

Structure: Expected Impulse Wave for (3)

Position: Wave 4 of (3)

Direction: Wave 5 of (3)

Details: Wave 4 is nearing completion. Wave 5 down is anticipated to finalize wave (3).

Corn Elliott Wave Technical Analysis

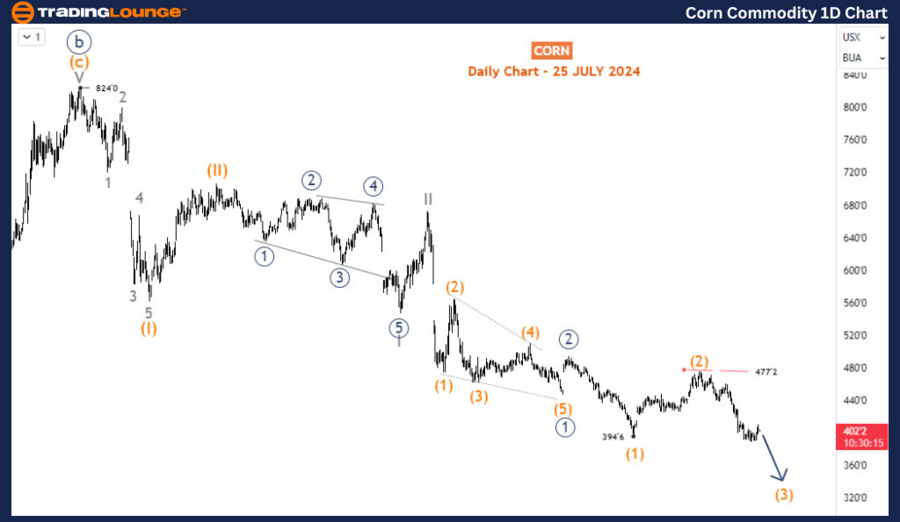

Corn's current price movement signals a continuation of the bearish trend that started in April 2022. The market is trading near the lows seen in October 2020, indicating that this decline is part of a larger bearish cycle originating from April 2022. In this scenario, selling on price rebounds could be a sound strategy.

Daily Chart Analysis

On the daily chart, Corn displays a distinct bearish impulse wave pattern that began at the April 2022 peak of 824. The initial two waves, (I) and (II), concluded in July 2022 and October 2022, respectively. Currently, wave (III) is unfolding from the October 2022 high. Within this phase, wave (2) of 3 (circled) of III has ended, suggesting further downside potential. Wave (3) started at 477'2 and is evolving into a bearish impulse wave. Fibonacci projections indicate that this wave could descend to 345 or lower.

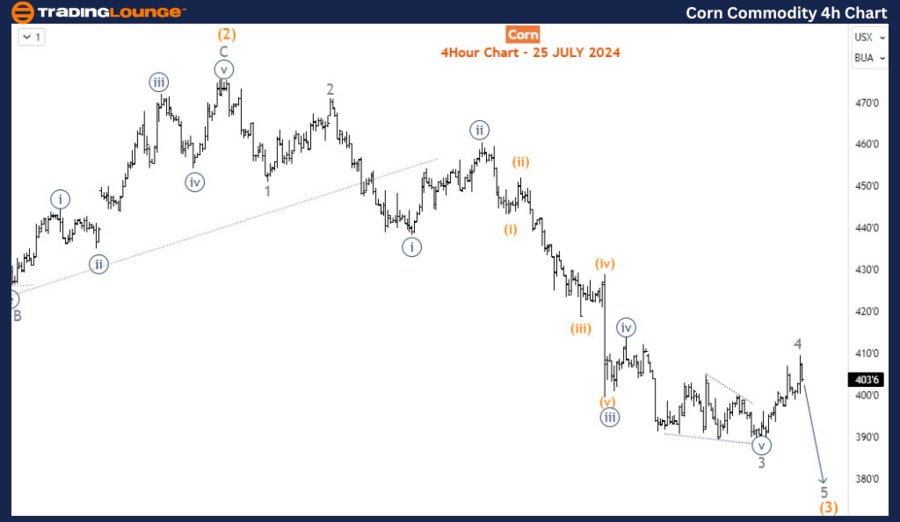

H4 Chart Analysis

The H4 chart closely examines the sub-waves within wave (3). Corn has completed an extended move for wave 3 of (3). The current rebound represents wave 4, which has already touched the 23.6% retracement level of wave 3 at 409 and might continue up to the 38.2% retracement level at 420. Once this corrective phase concludes, the commodity is expected to resume its downward trajectory in wave 5 of (3).

Summary

In conclusion, the Elliott Wave analysis for Corn points to a bearish outlook both in the long and short term. Critical levels to monitor include support at 345 and resistance at 420. The analysis indicates that wave (III) is still developing, with wave 3 of (III) likely to push prices further down. Traders should look for selling opportunities during corrective bounces, especially around the 420 level, as the trend remains bearish. By tracking wave structures and key price levels, traders can anticipate future movements in the Corn market and make informed decisions to benefit from the ongoing downtrend.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WTI Crude Oil Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support