USDJPY Elliott Wave Analysis Trading Lounge Day Chart

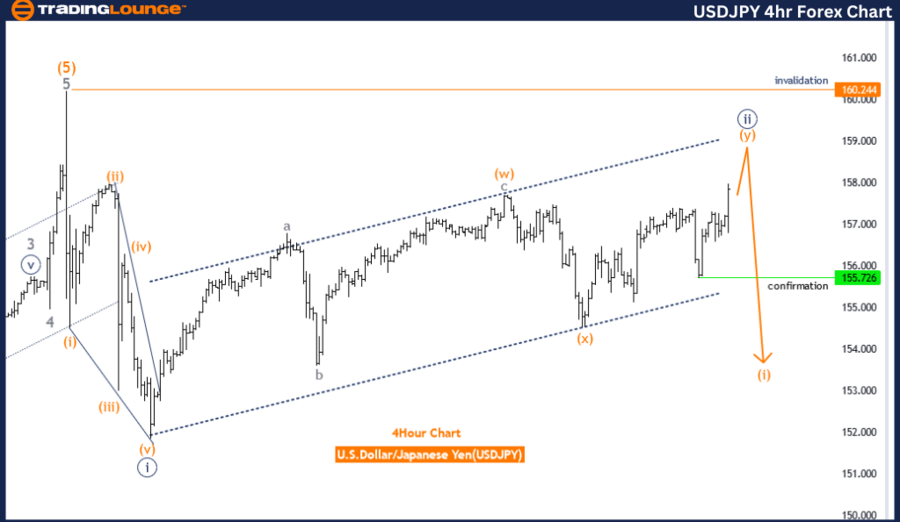

U.S. Dollar/Japanese Yen (USD/JPY) Day Chart

USD/JPY Elliott Wave Technical Analysis

Function: Trend

Mode: Corrective

Structure: Orange wave Y

Position: Navy Blue Wave 2

Direction Next Lower Degrees: Navy blue wave 3

Details: Orange wave X of navy blue wave 2 looking completed, now orange wave Y of 2 is in play.

Wave Cancel Invalid Level: 160.244

The USD/JPY Elliott Wave analysis on the daily chart focuses on identifying the trend within the market's current corrective phase. The primary function of this analysis is to follow the market trend while recognizing the corrective patterns that emerge during this period. The wave structure is categorized as orange wave Y, which is part of a larger navy blue wave 2. This indicates that the market is in the second corrective phase within a broader trend cycle.

The mode of the analysis is corrective, highlighting that the market is undergoing adjustments rather than a straightforward upward or downward trend. The corrective phase is identified as orange wave Y, following the completion of orange wave X within the navy blue wave 2. This positioning suggests that the market is transitioning through the second corrective phase, which is crucial for understanding future price movements.

In terms of wave direction and degrees, the analysis indicates that the next lower degree is navy blue wave 3. This points to the expectation that once the current corrective phase within orange wave Y is complete, the market will transition into navy blue wave 3. This transition marks a shift from the current corrective phase to a new wave cycle, potentially initiating a new trend direction.

Detailed observations in the analysis note that orange wave X of navy blue wave 2 appears to be completed. This completion signifies that the market has finished one part of the correction and has now moved into orange wave Y. This ongoing phase will continue the corrective trend before the market potentially transitions into navy blue wave 3.

An essential aspect of this analysis is the wave cancel invalid level, set at 160.244. This level acts as a critical threshold for validating the current wave structure. If the market price exceeds this level, the existing wave count would be invalidated, necessitating a reevaluation of the Elliott Wave analysis and possibly altering the market outlook.

In summary, the USD/JPY daily chart analysis indicates that the market is in a corrective phase within orange wave Y, which is part of navy blue wave 2. The completion of orange wave X suggests that orange wave Y is now active, continuing the corrective trend. The wave cancel invalid level at 160.244 is pivotal for confirming the current wave count and guiding future market expectations based on Elliott Wave principles.

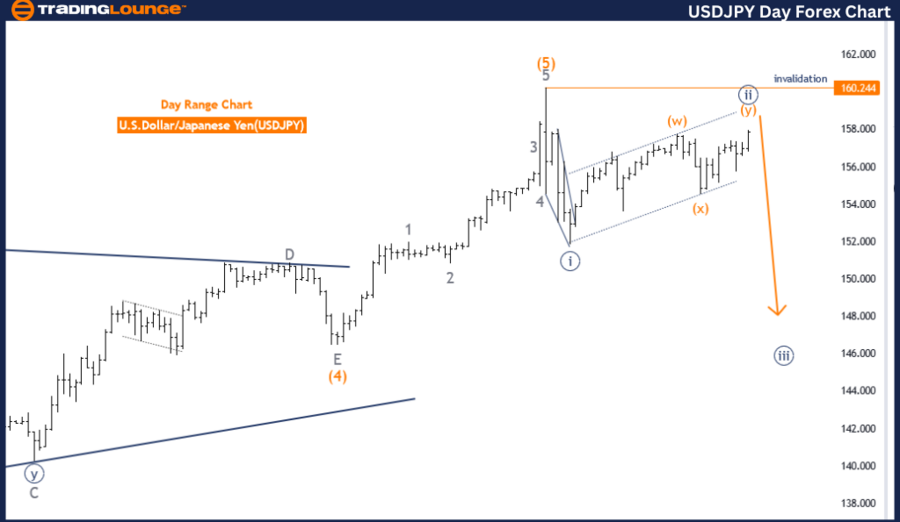

U.S. Dollar/Japanese Yen (USD/JPY) 4 Hour Chart Analysis

USD/JPY Elliott Wave Technical Analysis

Function: Trend

Mode: Corrective

Structure: Orange wave Y

Position: Navy Blue Wave 2

Direction Next Lower Degrees: Orange wave 1 of 3

Details: Orange wave X of navy blue wave 2 looking completed, now orange wave Y of 2 is in play.

Wave Cancel Invalid Level: 160.244

The USD/JPY Elliott Wave analysis on the 4-hour chart focuses on identifying and tracking the trend within the market using a corrective mode. The current wave structure is classified as orange wave Y, positioned within the broader context of navy blue wave 2. This indicates that the market is undergoing a corrective phase as part of the overall wave pattern.

The primary function of this analysis is to observe and interpret the trend behavior in the USD/JPY market. The corrective mode signifies that the market is currently experiencing an adjustment or retracement within the larger trend. Specifically, orange wave Y is in play, indicating an ongoing correction within the framework of navy blue wave 2.

The direction for the next lower degrees is identified as orange wave 1 of 3. This suggests that once the current corrective phase in orange wave Y is complete, the market is expected to transition into the next phase, known as orange wave 1 of 3. This phase will likely mark the beginning of a new trend sequence following the completion of the current correction.

Detailed observations in the analysis indicate that orange wave X of navy blue wave 2 appears to be completed. This means that the market has likely finished the preceding corrective phase and is now moving into orange wave Y of 2. This ongoing wave will continue the corrective pattern within the broader navy blue wave 2 context.

An important aspect of this analysis is the wave cancel invalid level, set at 160.244. This level serves as a critical point for maintaining the validity of the current wave structure. If the market price exceeds this level, the current wave count would be invalidated, necessitating a reassessment of the Elliott Wave analysis and potentially altering the market outlook.

In summary, the USD/JPY 4-hour chart analysis indicates that the market is currently in a corrective phase within orange wave Y, which is part of the larger navy blue wave 2. Once orange wave Y is complete, the market is expected to transition into orange wave 1 of 3, initiating a new trend sequence. The wave cancel invalid level at 160.244 is crucial for confirming the current wave count and guiding future market expectations based on Elliott Wave principles.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDCAD Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support