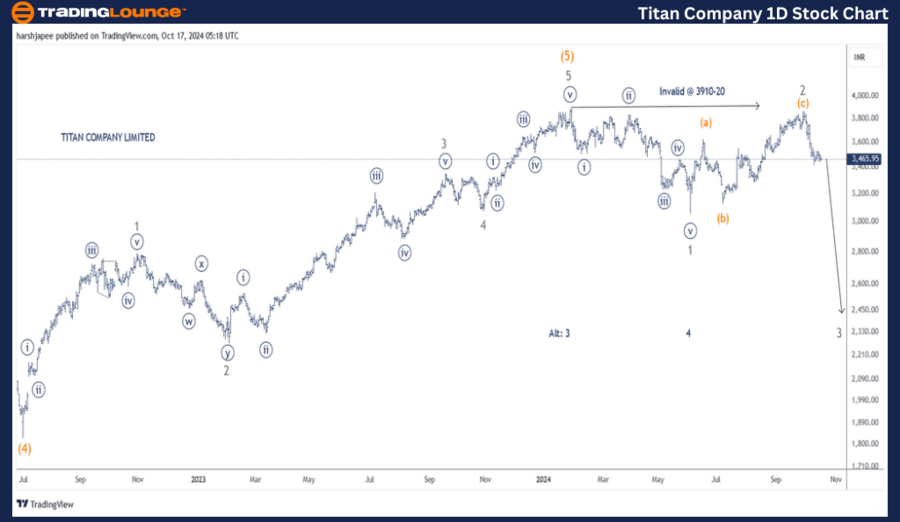

TITAN COMPANY (TITAN) Elliott Wave Analysis-TradingLounge 1D Chart

ITAN COMPANY 1 Day Chart Analysis

TITAN Elliott Wave Technical Analysis

Function: Counter Trend (Intermediate Degree, Orange)

Mode: Corrective

Structure: Impulse within Larger Degree Corrective Wave

Position: Minor Wave 2 Grey

Details: The stock may have formed a top around the 3920 level earlier. Additionally, an impulse drop has been seen, finishing just above the 3000 mark, followed by a corrective rally between the 3780-3870 levels. Currently, the stock is turning lower as Minor Wave 3 Grey progresses, working against the 3920 level. Alternative counts are indicated on the chart, which will be evaluated if the price action aligns.

Invalidation Point: 3910-3920

TITAN Company Daily Chart Technical Analysis and Elliott Wave Forecast

The daily chart for TITAN Company suggests that a major top has formed around the 3910-3920 range, signaling the potential completion of Intermediate Wave (5) Orange. The stock has since moved lower, with Minor Waves 1 and 2 Grey forming near 3060 and 3800, respectively. There is a possibility that Minor Wave 3 Grey is currently unfolding.

In July 2022, the stock dropped near the 1830 mark, marking the end of Intermediate Wave (4) Orange. Following this, the price moved upward in a five-wave structure, marked as Minor Waves 1 through 5. If this analysis is correct, a larger degree corrective wave has started.

Alternative Scenario: The peak around 3910-3920 may represent Minor Wave 3, followed by Minor Wave 4 finishing near the 3060 level. In this scenario, Minor Wave 5 could be moving higher, potentially breaking through the 3910-3920 range.

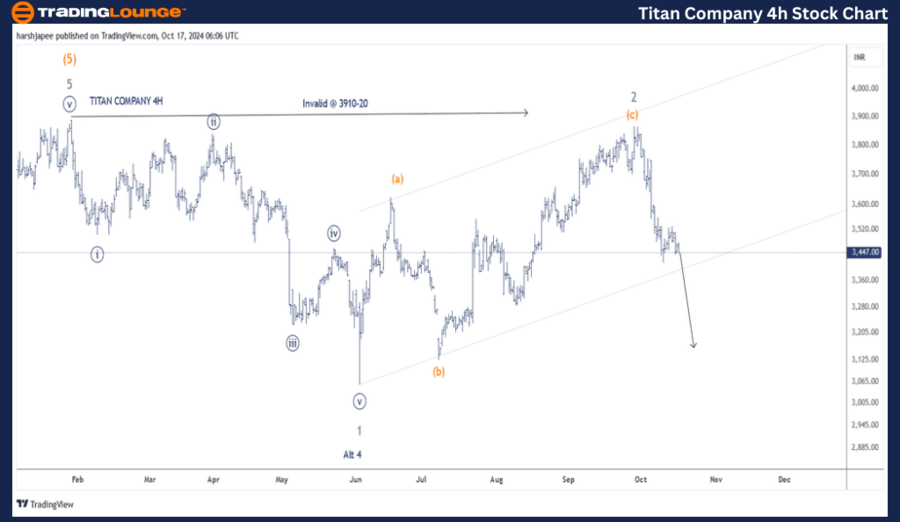

ITAN COMPANY (TITAN) Elliott Wave Analysis-TradingLounge 4H Chart

TITAN COMPANY – TITAN (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Intermediate Degree, Orange)

Mode: Corrective

Structure: Impulse within Larger Degree Corrective Wave

Position: Minor Wave 2 Grey

Details: The stock may have formed a top around the 3920 level earlier. An impulse drop followed, completing just above the 3000 mark, followed by a corrective rally between 3780-3870. Currently, the stock has started moving lower as Minor Wave 3 Grey unfolds, working against the 3920 level. A break below 3145 would confirm the bearish outlook. Alternative wave counts are shown on the chart, which will be revisited if price action behaves as expected.

Invalidation Point: 3910-3920

TITAN Company 4H Chart Technical Analysis and Elliott Wave Forecast

The 4H chart of TITAN Company shows a potential impulse drop from the 3910-3920 high, labeled as Minor Wave 1, followed by a corrective rally to 3800, marked as Minor Wave 2. If this wave count is correct, Minor Wave 3 is now moving downward.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: JSW Steel Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

TITAN Company appears to be trending lower as Minor Wave 3 Grey progresses, acting against the 3910-3920 resistance zone.