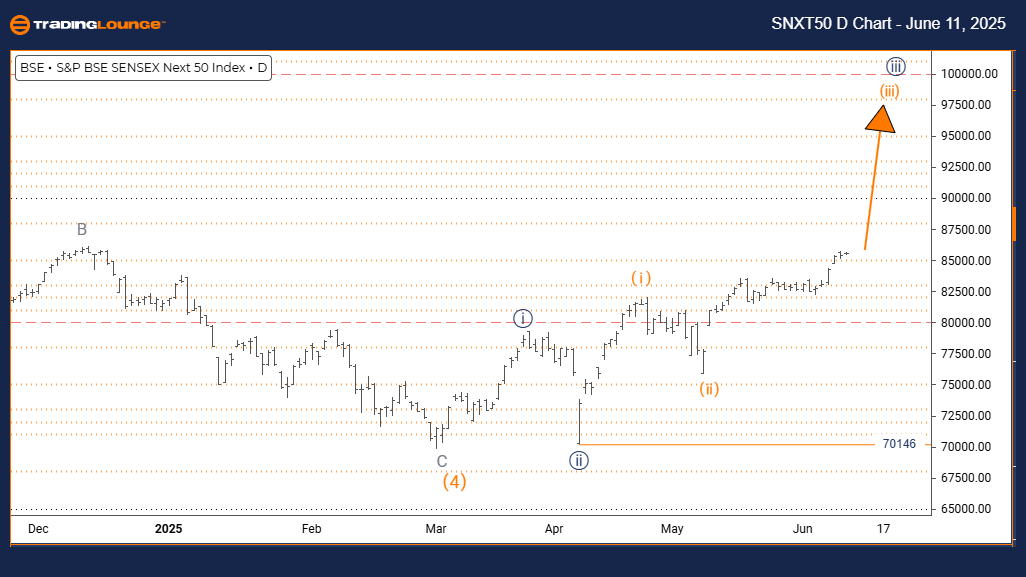

S&P BSE SENSEX NEXT 50 Elliott Wave Analysis – TradingLounge Day Chart

S&P BSE SENSEX NEXT 50 Wave Technical Outlook

FUNCTION: Bullish Momentum

MODE: Impulsive Phase

STRUCTURE: Orange Wave 3 in Motion

POSITION: Advancing Within Navy Blue Wave 3

HIGHER DEGREE DIRECTION: Orange Wave 3 Initiated

OBSERVATIONS: Orange Wave 2 Completion Confirmed, Orange Wave 3 Commences

INVALIDATION LEVEL: 70146

The daily Elliott Wave analysis for S&P BSE SENSEX NEXT 50 indicates a strong bullish trend backed by impulsive price behavior. The chart shows a breakout into Orange Wave 3, forming part of a larger bullish sequence within Navy Blue Wave 3. This reflects a sustained uptrend supported by market momentum.

Orange Wave 2 has completed its corrective phase, signaling the beginning of Orange Wave 3, often characterized by fast, extended gains. This wave generally leads the strongest market rallies within an impulsive cycle.

The key wave invalidation level is 70146. A move below this would nullify the existing Elliott Wave count and call for reevaluation. As long as price holds above this critical threshold, the bullish scenario stays intact, pointing to continued upward potential in S&P BSE SENSEX NEXT 50.

S&P BSE SENSEX NEXT 50 Elliott Wave Analysis – TradingLounge Weekly Chart

S&P BSE SENSEX NEXT 50 Wave Technical Outlook

FUNCTION: Bullish Momentum

MODE: Impulsive Phase

STRUCTURE: Navy Blue Wave 3 Formation

POSITION: Active Navy Blue Wave 3

HIGHER DEGREE DIRECTION: Navy Blue Wave 3 Underway

OBSERVATIONS: Completion of Navy Blue Wave 2, New Impulsive Wave in Progress

INVALIDATION LEVEL: 70146

The weekly Elliott Wave outlook for S&P BSE SENSEX NEXT 50 supports a bullish trajectory, with Navy Blue Wave 3 now active. This phase is commonly the most forceful within an Elliott structure, often suggesting strong continuation of gains.

Following the confirmed end of Navy Blue Wave 2, the market has entered Wave 3, generally associated with extended upward price action. Current developments align with this expectation.

Traders should watch the 70146 wave cancellation level. Falling below it would invalidate the wave count, necessitating a revised analysis. As long as prices stay above, the current wave projection remains valid, forecasting robust upward momentum in the index.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Hang Seng Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support