GOOGL Elliott Wave Analysis – Daily & 1-Hour Chart Overview

This Elliott Wave analysis for Alphabet Inc. (GOOGL) evaluates both the daily and 1-hour charts to determine the current market trend. Utilizing Elliott Wave Theory, we aim to forecast potential future price movements.

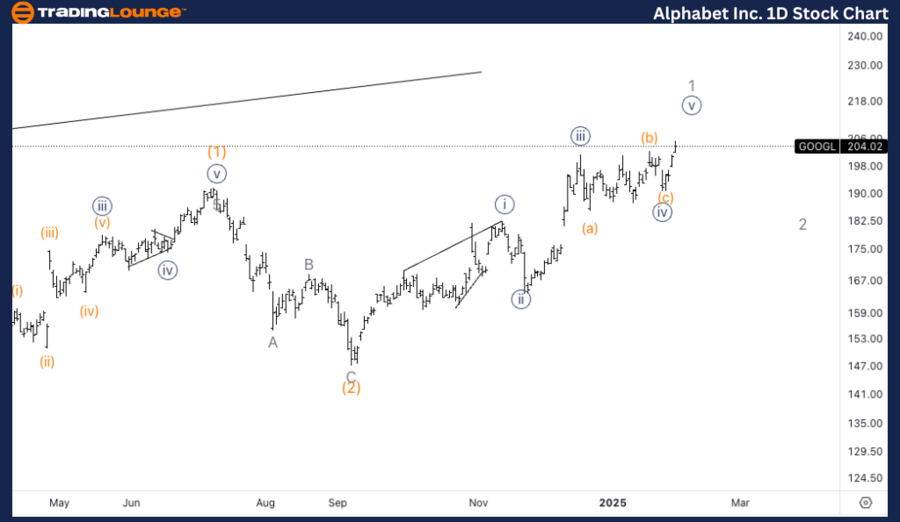

GOOGL Elliott Wave Analysis - Trading Lounge Daily Chart

Alphabet Inc. (GOOGL) Daily Chart Analysis

GOOGL Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 1

Direction: Upside within wave {v} of 1

Details:

GOOGLE is currently in an upward move within wave 1 of (3), aligning with a conservative outlook. As the stock hovers around the $200 level, there is a possibility of a larger pullback, likely forming wave 2. This suggests that a short-term correction might take place before the next bullish wave initiates.

GOOGL Elliott Wave Technical Analysis – Daily Chart

Alphabet Inc. (GOOGL) continues its impulsive rally as it progresses through wave 1 of (3). The $200 price level remains a key psychological barrier, and a potential retracement into wave 2 could emerge before the next bullish phase begins. This wave structure aligns with Elliott Wave Theory, indicating further upside momentum in the long term.

Alphabet Inc. (GOOGL) 1H Chart Analysis

GOOGL Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iii) of {v}

Direction: Targeting the top in wave {v}

Details:

GOOGL is expected to continue its upward trajectory into wave {v}, with parallel trend channel support reinforcing confidence in this Elliott Wave count. This bullish setup suggests that the current structure may see further gains before a possible retracement.

GOOGL Elliott Wave Technical Analysis – 1H Chart

The short-term Elliott Wave outlook for GOOGL anticipates an extension into wave {v}, supported by trend channel strength. As this pattern unfolds, the stock could see additional gains before encountering resistance, leading to a potential pullback. Traders should monitor key support levels to confirm the ongoing bullish wave progression.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: McDonald’s Corp. Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support