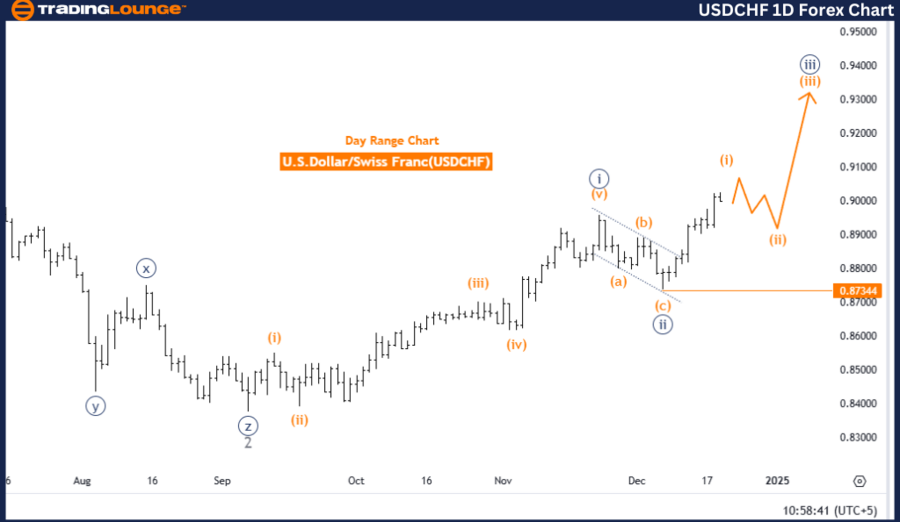

U.S. Dollar / Swiss Franc (USDCHF) - TradingLounge Day Chart

USDCHF Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange wave 1

Position: Navy Blue Wave 3

Direction Next Lower Degrees: Orange wave 2

Details: Orange wave C of 2 is complete. Orange wave 1 of navy blue wave 3 is in progress.

Wave Cancel Invalidation Level: 0.87344

USDCHF Analysis Summary

The USDCHF daily chart highlights a bullish trajectory, analyzed through the lens of Elliott Wave theory. The market is progressing through an impulsive wave pattern, specifically focusing on orange wave 1, which is part of the larger navy blue wave 3. This structure supports sustained upward movement, aligning with the prevailing market direction.

Details of Wave Progression

Next Phase Outlook

Critical Threshold

Conclusion

In conclusion, the USDCHF daily chart suggests a robust bullish trend. The completion of orange wave C and the progression of orange wave 1 within navy blue wave 3 emphasize ongoing upward momentum. Orange wave 2, anticipated as a corrective phase, is expected to consolidate this movement before the bullish trend resumes. This analysis aligns with Elliott Wave principles, providing insights into the structural dynamics driving USDCHF's market behavior.

U.S. Dollar / Swiss Franc (USDCHF) - TradingLounge 4-Hour Chart

USDCHF Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange wave 1

Position: Navy blue wave 3

Direction Next Lower Degrees: Orange wave 2

Details: Orange wave C of 2 is complete. Orange wave 1 of navy blue wave 3 is in progress.

Wave Cancel Invalidation Level: 0.87344

U.S. Dollar / Swiss Franc Analysis Overview

The USDCHF 4-hour chart confirms a bullish trend through the Elliott Wave framework. The observed structure is orange wave 1, an impulsive wave pattern indicating strong upward momentum. Positioned within navy blue wave 3, this movement is consistent with the continuation of a broader bullish trend.

Wave Progression Details

Outlook for Next Lower Degree Movement

Key Market Dynamics

This analysis highlights the cyclical nature of market behavior:

- Corrective waves, such as orange wave C, set the stage for impulsive waves like orange wave 1.

- These transitions illustrate the market's adherence to dominant bullish momentum.

Conclusion

The USDCHF 4-hour chart reinforces the bullish outlook. The completion of orange wave C and the active development of orange wave 1 within navy blue wave 3 demonstrate ongoing upward momentum. The anticipated orange wave 2 is likely to play a pivotal role in shaping subsequent bullish phases.

The wave cancel invalidation level, set at 0.87344, serves as a key threshold for confirming or revising this analysis. This wave structure aligns with Elliott Wave principles, supporting the continued bullish momentum in the USDCHF market.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Euro/U.S. Dollar (EURUSD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support