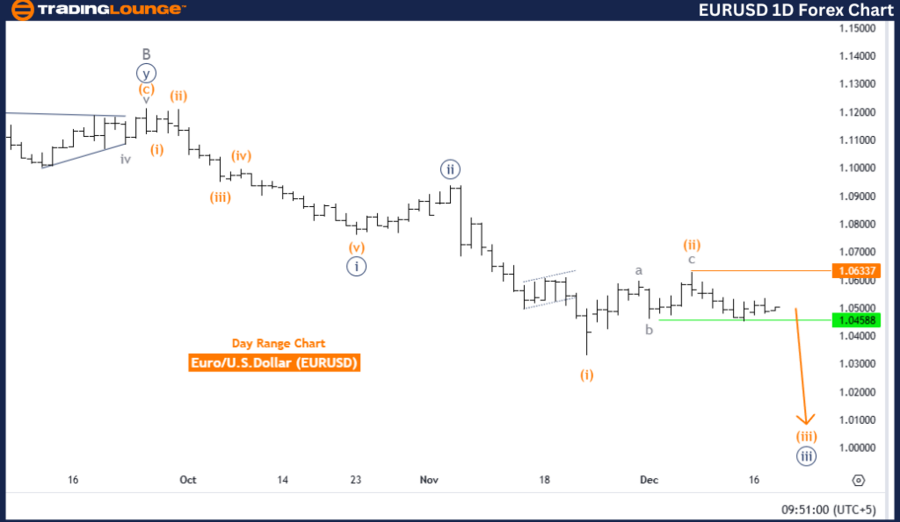

EURUSD Elliott Wave Analysis - Trading Lounge Daily Chart

Euro/U.S. Dollar (EURUSD) Daily Chart Analysis

EURUSD Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Next Lower Degree Direction: Orange Wave 3 (Initiated)

Key Details:

- Orange Wave 2 has been completed.

- Currently, Orange Wave 3 of Navy Blue Wave 3 is in progress.

Wave Cancel Invalid Level: 1.06337

The EURUSD daily chart reflects a strong bearish trend based on Elliott Wave principles. The wave structure demonstrates an impulsive behavior, showcasing significant downward momentum.

Key highlights:

- Completion of Orange Wave 2: This marks the end of the corrective phase.

- Development of Orange Wave 3: Now unfolding as part of the larger Navy Blue Wave 3, it exhibits intensified bearish momentum.

- Reinforcement of Bearish Forces: The wave alignment confirms a bearish outlook at both intermediate and higher degrees, indicating continued declines.

The invalidation level is set at 1.06337, a critical benchmark for risk management. A move above this level would negate the current wave count and require a reassessment of the bearish scenario.

Summary

- Orange Wave 2 has concluded.

- Orange Wave 3 is actively progressing within Navy Blue Wave 3.

- Impulsive wave structures highlight sustained downward momentum.

Invalidation Level: 1.06337 – traders should monitor this threshold to validate or reassess the bearish outlook.

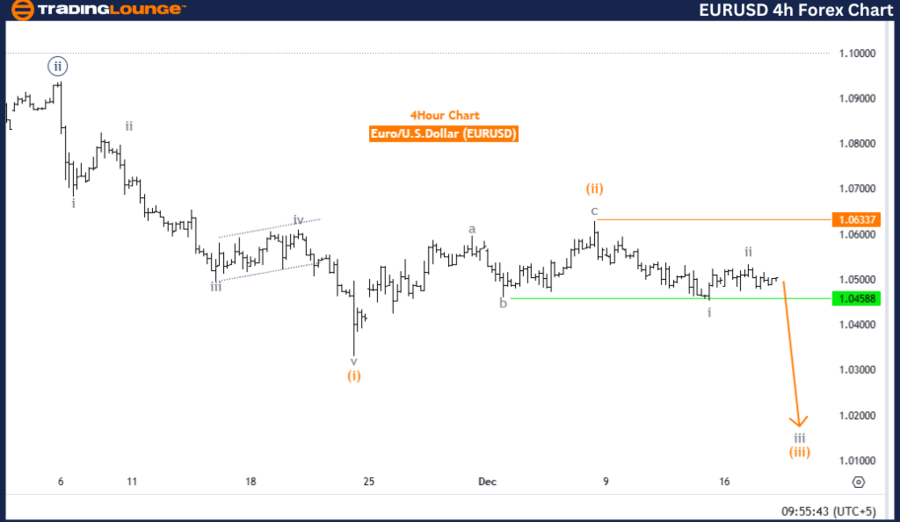

Euro/U.S. Dollar (EURUSD) 4-Hour Chart Tradinglounge

EURUSD Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 3

Next Lower Degree Direction: Gray Wave 3 (Initiated)

Key Details:

- Gray Wave 2 is complete.

- Gray Wave 3 is currently developing.

Wave Cancel Invalid Level: 1.06337

The EURUSD 4-hour chart also confirms a bearish trend under the Elliott Wave framework. The impulsive nature of the wave structure underscores robust downward market momentum.

Key highlights:

- Completion of Gray Wave 2: Marks the conclusion of a corrective phase.

- Progression of Gray Wave 3: Signals dominant bearish sentiment, with strong downward movement.

- Bearish Market Alignment: Gray Wave 3, part of Orange Wave 3, aligns with continued bearish dynamics, indicating no immediate reversal.

The invalidation level remains at 1.06337, a pivotal point for managing risk. If breached, it will necessitate a reassessment of the current Elliott Wave count.

Summary

- Gray Wave 2 has concluded.

- Gray Wave 3 is actively unfolding, reflecting sustained bearish momentum.

- Traders should maintain a bearish bias while keeping an eye on the invalidation level at 1.06337 to evaluate any potential changes in market trends.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AUDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support