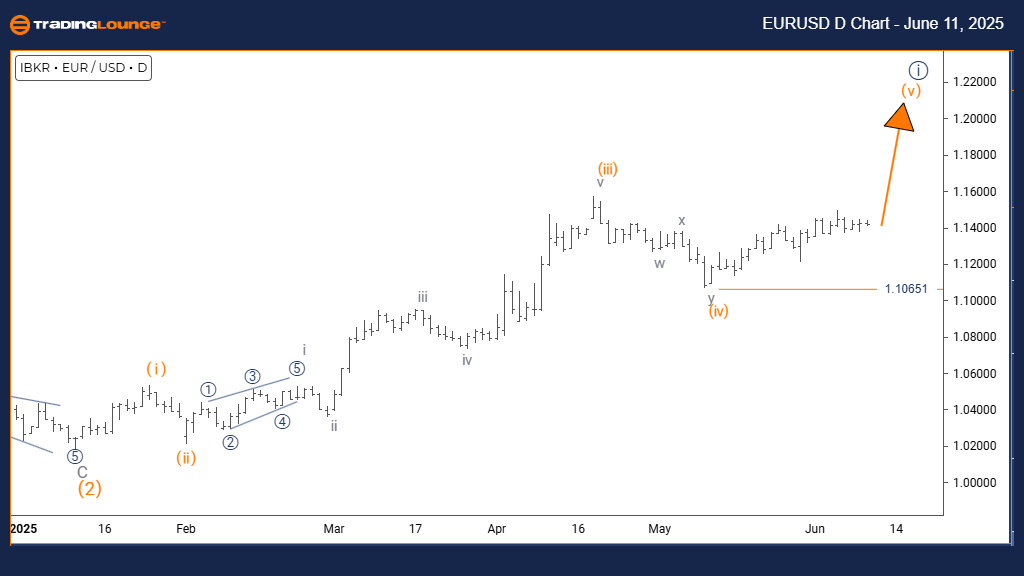

Euro/U.S. Dollar (EURUSD) Elliott Wave Analysis – TradingLounge Day Chart

EURUSD Elliott Wave Technical Forecast

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 5

POSITION: Navy Blue Wave 1

DIRECTION NEXT HIGHER DEGREES: Orange Wave 5 (Initiated)

DETAILS: Orange Wave 4 appears complete; Orange Wave 5 is currently developing.

Wave Cancel Invalid Level: 1.10651

The EURUSD daily Elliott Wave analysis presents a bullish market outlook. Price movement currently follows an impulsive structure, signifying sustained upward momentum. The active sequence is Orange Wave 5, which aligns with the beginning of Navy Blue Wave 1, reinforcing a broader bullish formation. This indicates that EUR/USD may be progressing through the final phase of this impulsive leg.

Completion of Orange Wave 4 suggests the market has exited its corrective phase, allowing Orange Wave 5 to drive further gains. This wave typically features strong price action and aims to complete the five-wave cycle. Traders should monitor Orange Wave 5 for confirmation of sustained bullish momentum.

The key invalidation point stands at 1.10651. A move beneath this level would disrupt the current wave count, requiring a new analysis. As long as EUR/USD trades above this threshold, the upward Elliott structure remains valid. With Orange Wave 5 exhibiting impulsive strength, continued bullish activity is likely—though caution is advised as the pattern nears completion within Navy Blue Wave 1.

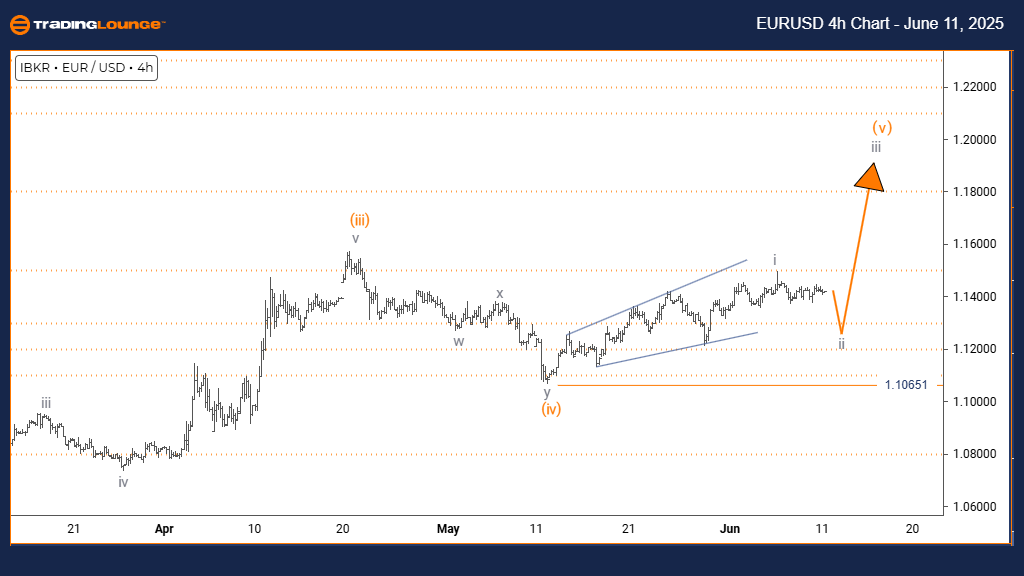

Euro/U.S. Dollar (EURUSD) Elliott Wave Analysis – TradingLounge 4 Hour Chart

EURUSD Elliott Wave Technical Forecast

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Gray Wave 2

POSITION: Orange Wave 5

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3

DETAILS: Gray Wave 1 looks completed; Gray Wave 2 is in progress.

Wave Cancel Invalid Level: 1.10651

The EURUSD 4-hour Elliott Wave forecast points to a corrective, counter-trend movement within the broader bullish trend. Price action is now forming Gray Wave 2, a retracement within Orange Wave 5. This structure suggests a temporary pause in upward momentum before the next bullish phase unfolds.

Having finalized Gray Wave 1, the market is now retracing via Gray Wave 2, typically characterized by sideways or downward corrective moves. This phase often results in a consolidation range, which precedes a continuation in the primary direction—potentially through Gray Wave 3.

Technical analysis implies that EUR/USD remains in a short-term correction. Traders should watch for signals of Gray Wave 2 concluding, as Gray Wave 3 would then likely commence, aligning with the prevailing bullish pattern of Orange Wave 5. The critical invalidation level of 1.10651 still applies; price stability above this point maintains the current wave scenario.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: EURGBP Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support