EURGBP Elliott Wave Analysis - TradingLounge Daily Chart

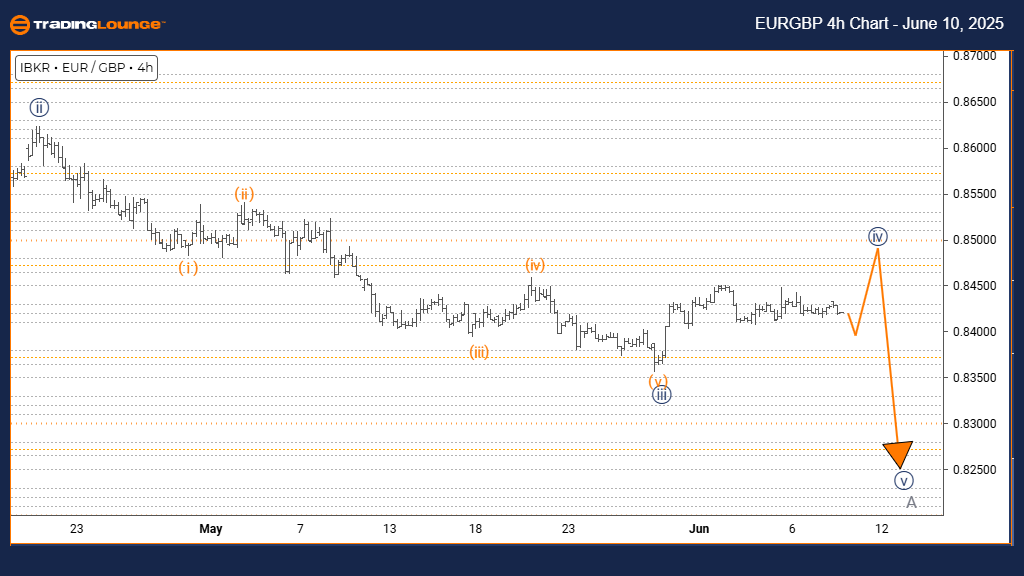

Euro/British Pound (EURGBP) Day Chart Analysis

EURGBP Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: Gray Wave A

POSITION: Orange Wave Y

DIRECTION NEXT HIGHER DEGREES: Gray Wave B

DETAILS: Orange Wave X has likely ended, and Gray Wave A of Orange Wave Y is now active.

The EURGBP daily chart highlights a counter-trend Elliott Wave setup, where impulsive movement suggests a strong price push against the major trend. Currently, the pair is forming Gray Wave A, which is the first leg of Orange Wave Y, a larger corrective pattern.

With Orange Wave X presumed complete, the development of Gray Wave A signifies the beginning of a potential zigzag correction. This movement indicates the early phase of a counter-trend correction, offering signs of upcoming volatility.

As this impulsive Gray Wave A continues to unfold, it is expected to gather momentum before giving way to Gray Wave B, which should correct part of Gray Wave A's movement. This phase is key in defining the structure and strength of the entire corrective pattern.

Traders should observe EURGBP closely for signs that Gray Wave A is peaking. The completion of this wave would likely initiate Gray Wave B, bringing a retracement phase. This segment of the wave count is critical for forecasting the next leg in the broader Orange Wave Y scenario.

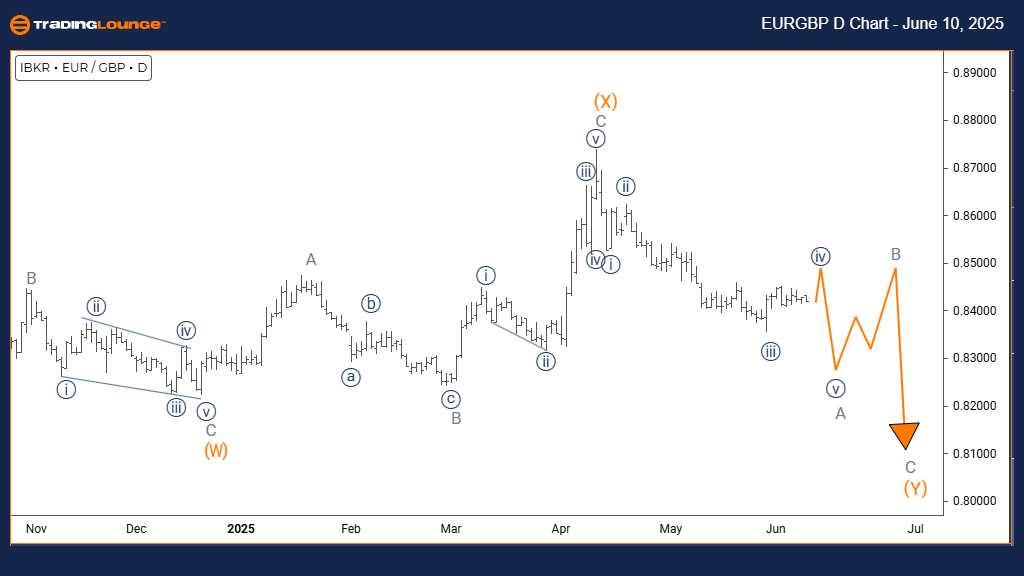

Euro/British Pound (EURGBP) 4-Hour Chart

EURGBP Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Navy Blue Wave 4

POSITION: Gray Wave A

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 5

DETAILS: Orange Wave 3 appears complete; Orange Wave 4 is progressing.

In the 4-hour EURGBP chart, a corrective counter-trend structure is forming, characterized as Navy Blue Wave 4. This wave unfolds within Gray Wave A, suggesting a temporary pause or pullback in the broader pattern.

Following the end of Orange Wave 3, the development of Orange Wave 4 signals a short-term correction. This move is expected to complete before Navy Blue Wave 5 starts, resuming the prior trend at the lower degree.

Currently, EURGBP remains within Orange Wave 4, which reflects short-term consolidation in price. As part of Gray Wave A, this correction may involve minor retracement or range-bound trading conditions.

Traders are advised to watch for indications that Orange Wave 4 is ending. Once confirmed, Navy Blue Wave 5 is likely to emerge, continuing the underlying directional trend. This brief corrective window may offer tactical trade opportunities within the ongoing Gray Wave A correction.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: AUDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support