FTNT Elliott Wave Analysis: Trend Overview and Potential Movements

In this Elliott Wave analysis, we will examine the trend structure of Fortinet Inc. (FTNT) using both daily and 1-hour charts to evaluate the current wave position and predict potential price movements.

FTNT Elliott Wave Analysis: TradingLounge Daily Chart

Fortinet Inc. (FTNT) Daily Chart Analysis

FTNT Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 3

Direction: Upside in Wave 3

Details: A bottom appears to be in place for Minor Wave 2, as the stock progresses higher in Minor Wave 3 of (3). This development should lead to a steep ascent.

FTNT Stock Technical Analysis – Daily Chart Overview

On the daily chart, Fortinet Inc. is advancing through Wave 3 of an impulsive motive structure. After completing the corrective Minor Wave 2, the stock is now pushing higher within Minor Wave 3 of (3). This wave phase typically aligns with stronger price momentum and a steeper upward movement, signaling increased bullish sentiment.

The continuation of this uptrend in Wave 3 is expected to offer substantial upside potential. Traders should watch for confirmation of this momentum as the stock moves higher, likely showing strong bullish activity with minimal retracements during this impulsive phase.

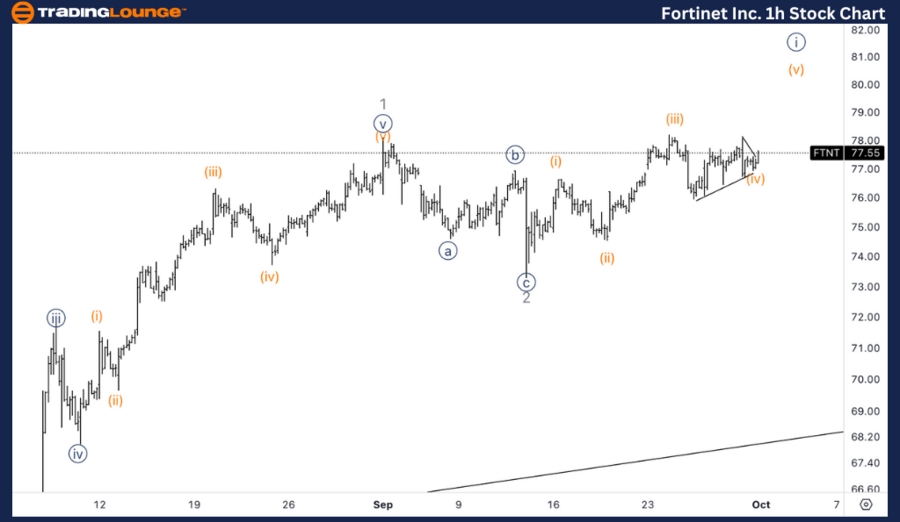

FTNT Elliott Wave Analysis: 1-Hour Chart

Fortinet Inc. (FTNT) 1H Chart Analysis

FTNT Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 3

Direction: Upside in Wave (v) of {i}

Details: Anticipating further upside within Wave (v) as the stock seems to be consolidating in a triangle formation in Wave (iv).

FTNT Technical Analysis – 1-Hour Chart Overview

On the 1-hour chart, Fortinet is progressing within Wave {i} of 3, and more specifically, within Wave (v) of {i}. The wave structure currently shows the stock forming a triangle in Wave (iv), suggesting a consolidation phase before a final upward push in Wave (v) to complete Wave {i}.

This triangle pattern typically signals an imminent breakout, and once Wave (v) concludes, traders can expect a minor corrective movement before the stock resumes its climb in Wave 3.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Meta Platforms Inc. (META) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support