META Elliott Wave Analysis | Trading Lounge Daily Chart

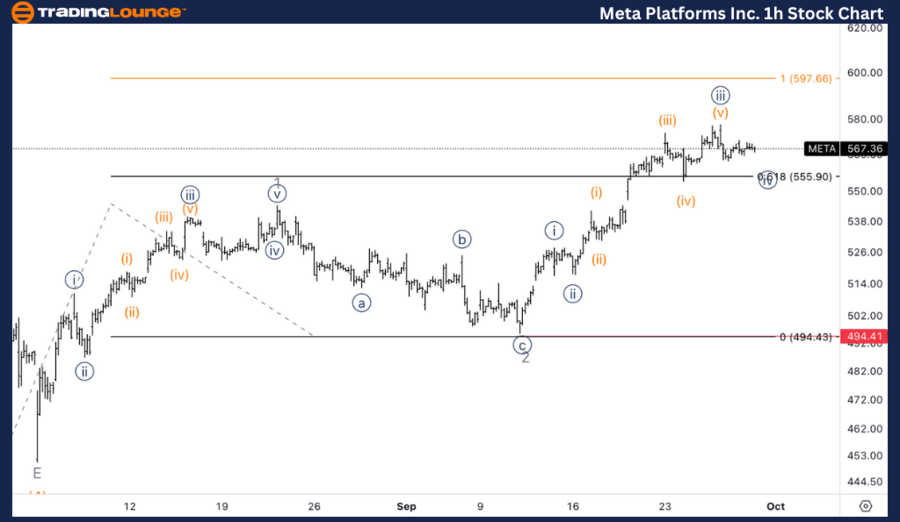

Meta Platforms Inc. (META) Daily Chart Analysis

META Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Intermediate wave (5)

Direction: Upside within wave (5)

Details: Meta Platforms is currently advancing from TradingLevel5 at $500, targeting the next upside level at MediumLevel $650.

META Stock Technical Analysis with Daily Chart

In the daily chart, Meta Platforms Inc. is within an impulsive wave structure, advancing in Intermediate Wave (5). After bouncing off the TradingLevel5 support at $500, the stock continues its upward trend, aiming for $650 as the next key resistance level at the Medium Level.

This upward movement within Wave (5) reinforces the current bullish trend. Meta is expected to see further gains as it approaches the $650 target. Traders should keep an eye on potential resistance at this level, as it may indicate the possibility of a corrective wave following this strong upward momentum.

Meta Platforms Inc Elliott Wave Analysis | Trading Lounge 1H Chart

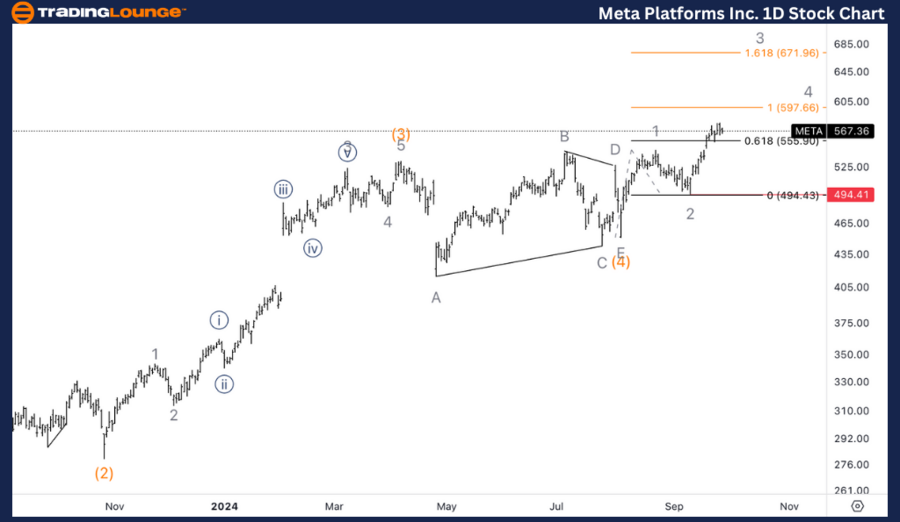

Meta Platforms Inc. (META) 1-Hour Chart Analysis

Meta Platforms Inc. Stock Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 3 of (5)

Direction: Upside within wave 3

Details: The price action suggests we are subdividing within wave 3, with continued upside expected in wave {v} of 3.

META Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, Meta Platforms is progressing within Minor Wave 3 of (5). Current analysis shows the stock continuing to trend higher, with further subdivisions forming within Wave {v} of 3. This indicates that the stock is approaching the final stages of Wave 3, though there remains potential for further upside as Wave {v} completes.

As traders monitor this upward movement, they should watch for any signs of exhaustion in Wave 3, which could signal a pullback or correction before the next wave sequence begins. This could provide opportunities for short-term adjustments based on evolving market conditions.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: McDonald’s Corp. (MCD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support