KO Elliott Wave Analysis: Trading Lounge Daily and 4-Hour Charts

The Coca-Cola Company (KO) Daily Chart Analysis

KO Elliott Wave Technical Analysis

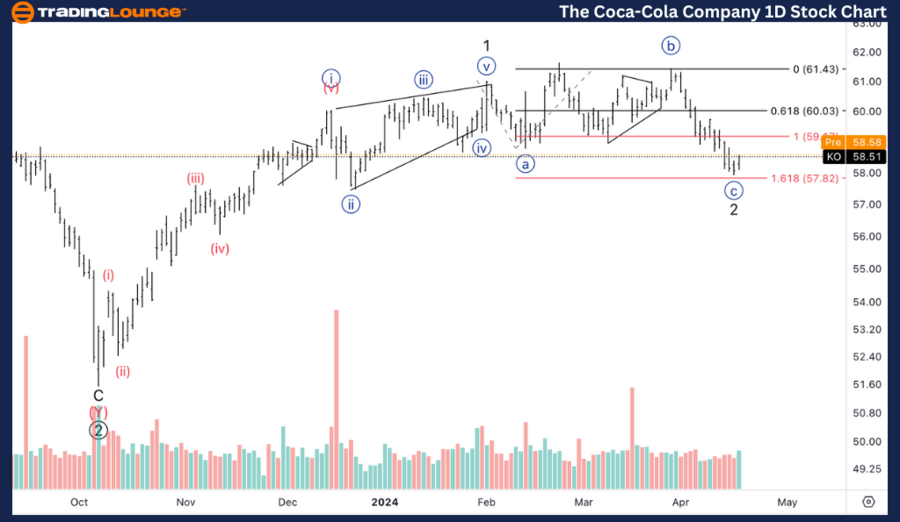

Overview of Current Elliott Wave Structure and Market Position:

Function: Counter Trend

Mode: Corrective

Structure: Flat

Current Position: Minute wave {c} of 2.

Directional Analysis: Potential Bottom in Wave {c}

Detailed Insights: During the recent trading session, a notable spike in volume was observed on the bullish side, suggesting that the corrective phase might be concluding or is close to completion. This is further underscored by the price approaching the 1.618 Fibonacci extension of wave {c} relative to wave {a}. Crucially, prices have touched the base level of the leading diagonal from wave 1, a common area for finding support.

Elliott Wave Technical Considerations for Short-Term Traders:

The Coca-Cola Company (KO) 4-Hour Chart Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Current Position: Wave (v) of {c}.

Directional Analysis: Anticipated Bottom in Wave (v)

Intraday Technical Outlook: The 4-hour chart provides a clearer view of the five-wave structure within wave {c}, which appears to have unfolded as anticipated. Analysts are now closely monitoring for a definitive sign that a bottom has been established.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The TJX Companies Inc., (TJX)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE

Investment Implications and Forward-Looking Analysis:

Both the daily and 4-hour charts of The Coca-Cola Company (KO) reveal important Elliott Wave technical patterns that suggest a nearing end to the current corrective phase, particularly in wave {c}. For investors and traders utilizing Elliott Wave analysis, these insights are crucial for making informed decisions. The observed volume spike and the technical support level hint at a potential reversal or stabilization, which could offer strategic entry points for those looking to capitalize on the impending trend shifts.