Here's an Elliott Wave perspective on The TJX Companies Inc. (TJX) as of April 17, 2024, detailed through analyses on both the daily and 4-hour charts:

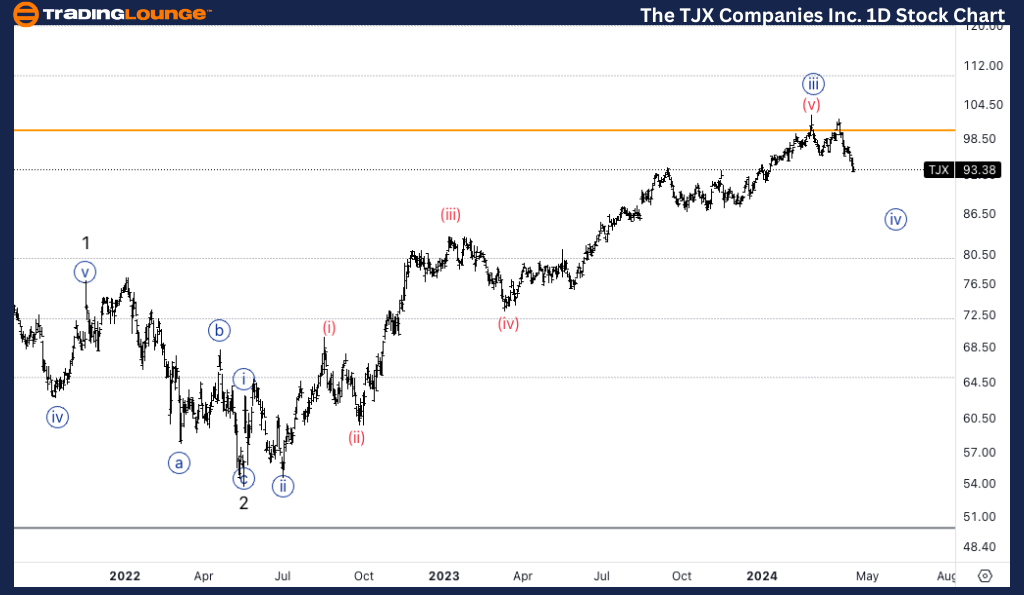

TJX Elliott Wave Analysis Trading Lounge Daily Chart,

The TJX Companies Inc., (TJX) Daily Chart

TJX Elliott Wave Technical Analysis

FUNCTION: CounterTrend

MODE: Corrective

STRUCTURE: ZigZag

POSITION: Minute wave {iv}.

DIRECTION: Bottom in wave {iv}.

DETAILS: As we seem to be unfolding in Minor wave 5, we have found resistance at TL1 at 100$, and we will not look for long trades before we will found support on 100$.

TJX Elliott Wave Technical Analysis – Daily Chart

TJX is currently positioned in a countertrend, corrective phase under a ZigZag structure, specifically in Minute wave {iv}. This indicates a potential bottom forming in wave {iv}. Currently, resistance was encountered at TL1, located at $100. The analysis suggests caution, recommending against initiating long positions until a support is clearly established at or near $100, indicating the completion of wave {iv} and a potential setup for the subsequent upward move in Minor wave 5.

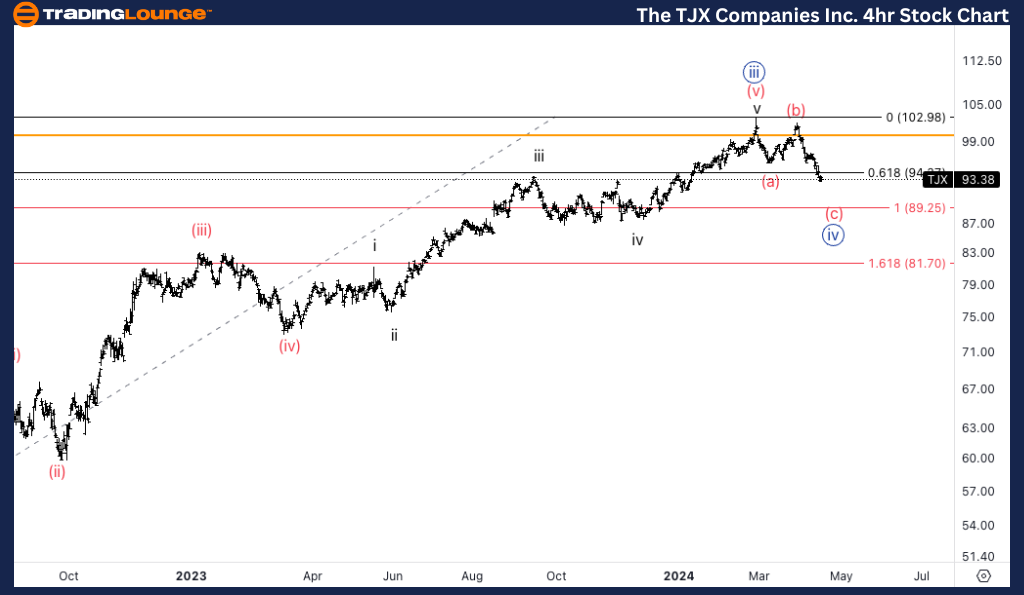

TJX Elliott Wave Analysis Trading Lounge 4H Chart,

The TJX Companies Inc., (TJX) 4H Chart

TJX Elliott Wave Technical Analysis

FUNCTION: CounterTrend

MODE: Corrective

STRUCTURE: ZigZag

POSITION: Wave (c) of {iv}.

DIRECTION: Bottom in wave (c).

DETAILS: I outlined equality of wave {ii} and {iv}, as correction of the same degree will tend towards equality, at 89$. We can clearly we demand at that level, looking to see at least a reaction.

TJX Elliott Wave Technical Analysis – 4hr Chart

On the 4-hour chart, TJX is seen in the final stages of its corrective phase, specifically in wave (c) of {iv}. This detailed view continues with the ZigZag corrective pattern, focusing on the price action towards a potential bottom. The chart notes the price target of $89, where the wave (c) could find equality with wave (ii) — a common scenario in corrections of the same degree. There's a noted demand at this level, suggesting that a reversal or significant reaction could be expected soon.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Salesforce Inc., (CRM) Stock Analysis

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE