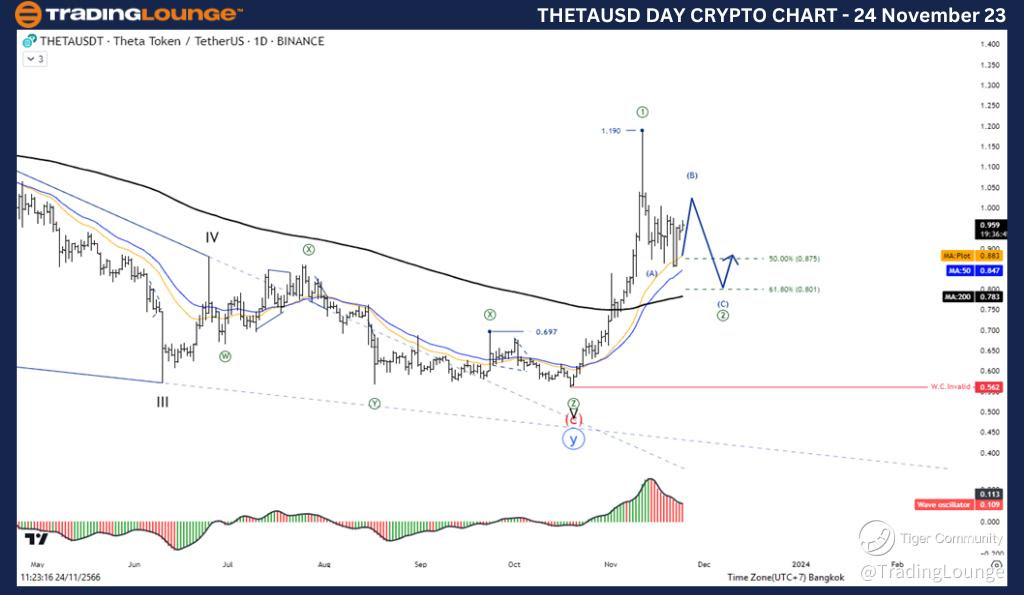

Elliott Wave Analysis TradingLounge Daily Chart, 24 November 23,

Theta Token / U.S. dollar(THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Zigzag

Position: Wave (2)

Direction Next higher Degrees: wave ((2)) of Impulse

Wave Cancel invalid Level:

Details: Retracement of wave ((2)) usually .50 or .618 x Length wave ((1))

Theta Token / U.S. dollar(THETAUSD)Trading Strategy: The rise in wave (1) appears to have ended at the 1.190 level and the price is entering a correction period in wave (2), where the retracement of wave (2) is usually at .50 or .618 x volatility. Long Wave (1) Therefore, Theta Token's trend is still up. A reversal is just a correction to continue the wave (3).

Theta Token / U.S. dollar(THETAUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, Wave Oscillators a Bullish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

Elliott Wave Analysis TradingLounge 4H Chart, 24 November 23,

Theta Token / U.S. dollar(THETAUSD)

THETAUSD Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Zigzag

Position: Wave (2)

Direction Next higher Degrees: wave ((2)) of Impulse

Wave Cancel invalid Level:

Details: Retracement of wave ((2)) usually .50 or .618 x Length wave ((1))

Theta Token / U.S. dollar(THETAUSD)Trading Strategy: The rise in wave (1) appears to have ended at the 1.190 level and the price is entering a correction period in wave (2), where the retracement of wave (2) is usually at .50 or .618 x volatility. Long Wave (1) Therefore, Theta Token's trend is still up. A reversal is just a correction to continue the wave (3).

Theta Token / U.S. dollar(THETAUSD)Technical Indicators: The price is above the MA200 indicating an uptrend, Wave Oscillators a Bullish Momentum.