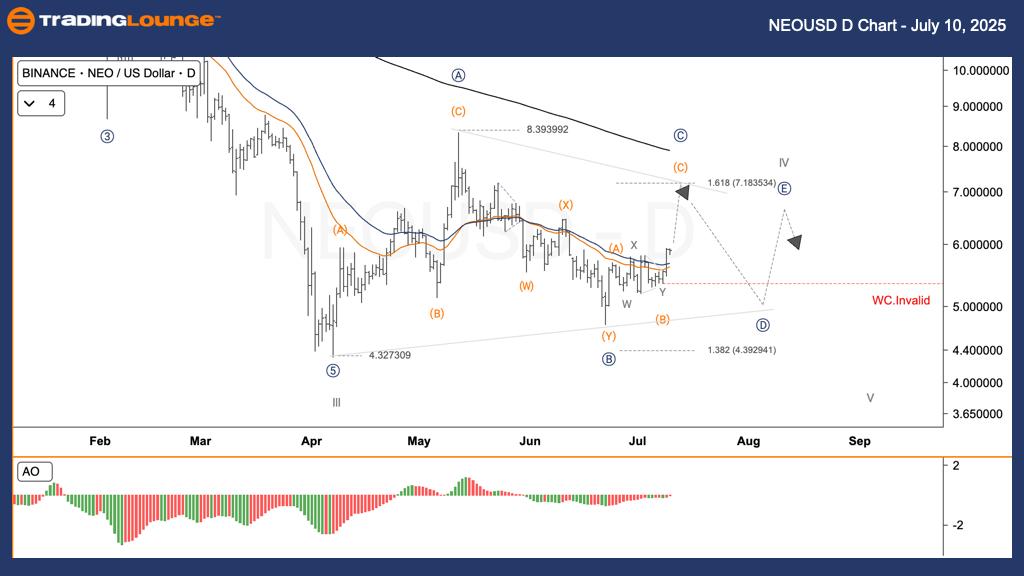

NEOUSD Elliott Wave Analysis TradingLounge Daily Chart,

NEO / U.S. Dollar (NEOUSD) Daily Chart Analysis

NEOUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Triangle Pattern

Position: Wave C

Next Direction (Higher Degree): Awaiting Confirmation

Invalidation Level: Below $5.30

NEO / U.S. Dollar (NEOUSD) Trading Strategy

NEO has developed a well-defined A-B-C-D-E triangle structure within the larger corrective wave IV, starting in early 2025. Price is consolidating, showing narrowing movement as it oscillates between converging trendlines. Recently, the asset reached the triangle’s upper resistance, suggesting a possible completion of wave E and a potential start of downward wave V.

Trading Strategies

✅ Swing Trade (For Short-Term Traders):

With wave D likely concluding, a short-term decline in price could follow, consistent with expected triangle dynamics.

🟥 Invalidation Level:

A breakdown below $5.30 would nullify the current Elliott Wave structure and require reevaluation.

NEOUSD Elliott Wave Analysis TradingLounge H4 Chart,

NEO / U.S. Dollar (NEOUSD) 4-Hour Chart Analysis

NEOUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Triangle Pattern

Position: Wave C

Next Direction (Higher Degree): Awaiting Confirmation

Invalidation Level: Below $5.30

NEO / U.S. Dollar (NEOUSD) Trading Strategy

The 4-hour timeframe highlights NEO’s steady rise within a bullish channel, forming wave C of the ongoing wave IV triangle. This climb is approaching the Fibonacci 1.618 extension level at $7.18, where a reversal into wave D may begin, in line with typical triangle progression.

Trading Strategies

✅ Swing Trade (For Short-Term Traders):

A shift from wave C to wave D may present a favourable short-selling opportunity, reflecting expected triangle movement.

🟥 Invalidation Level:

If the price falls below $5.30, the current wave count would become invalid.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: BTCUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support