CRM Elliott Wave Analysis Trading Lounge Daily Chart,

Salesforce Inc., (CRM) Daily Chart

CRM Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Intermediate wave (4)

DIRECTION: Bottom in wave (4).

DETAILS: We are reacting off TL3 at 300$, in what we labelled as wave (3) of Primary 1. We experienced a long-term correction in wave IV which appears to be complete, and we are now looking for continuation higher.

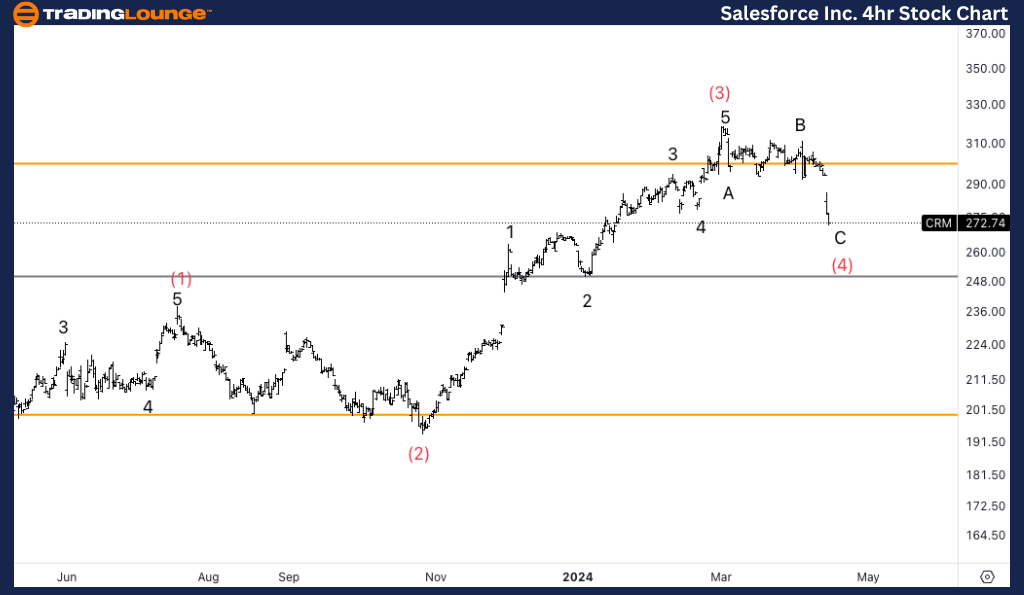

CRM Elliott Wave Analysis Trading Lounge 4Hr Chart,

Salesforce Inc., (CRM) 4H Chart

CRM Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave C of (4).

DIRECTION: Bottom in wave C.

DETAILS: We seem to have a three-wave move so far in wave (4), with a sideways wave B which because of its characteristics it gives us additional confidence we could be in a corrective structure.

Here's the latest on Salesforce Inc. (CRM) from our Elliott Wave Analysis Trading Lounge, examining both the daily and 4-hour charts.

CRM Elliott Wave Technical Analysis – Daily Chart Salesforce is currently exhibiting behavior typical of a counter-trend phase with a corrective mode and flat structure, positioned in an Intermediate wave (4). The direction is indicating a potential bottom in wave (4). We've observed a reaction off the key level, TL3 at $300, which we have identified as wave (3) of Primary 1. Following a prolonged correction in wave IV, which now appears complete, the outlook suggests a potential continuation higher.

CRM Elliott Wave Technical Analysis – 4hr Chart The 4-Hour chart further supports the daily findings but focuses on the specifics of the ongoing correction in Wave C of (4). This phase is also characterized as counter trend, corrective, and flat. The chart shows a three-wave structure for wave (4), with a sideways wave B. The nature of wave B provides additional confidence that we are indeed in a corrective structure, setting up expectations for a bottom in wave C.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Texas Instruments Inc. (TXN) Stock Analysis

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.

TradingLounge's Free Week Extravaganza!

April 14 – 21: Unlock the Doors to Trading Excellence — Absolutely FREE